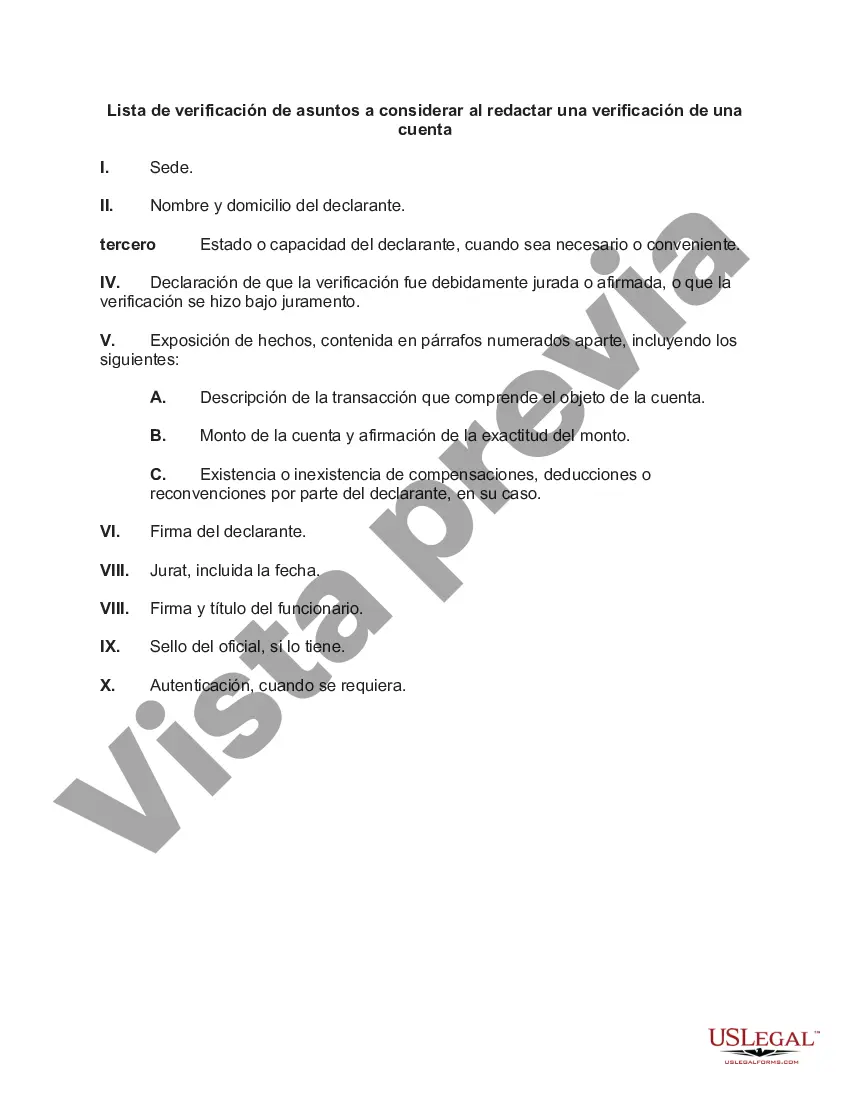

Nassau, New York is a vibrant county located on Long Island, just east of New York City. With its rich history, diverse population, and stunning natural landscapes, Nassau offers a multitude of attractions and opportunities for both residents and visitors. When it comes to drafting a verification of an account in Nassau, New York, there are several important considerations to keep in mind. A checklist of matters to be considered can help ensure accuracy, compliance, and efficiency in the verification process. Here are some key points to include in such a checklist: 1. Contact Information: Begin by providing the relevant contact information for all parties involved in the verification process. This includes the account holder's name, address, phone number, and email. 2. Statement of Account: Clearly state the purpose of the verification, which is usually to confirm the accuracy of the account balance and transaction history. Include details such as the account number, account type, and the date range for which the verification is requested. 3. Supporting Documents: Specify the documents that must be submitted along with the verification. This may include bank statements, transaction receipts, or any other relevant financial records. Ensure that all supporting documents are properly organized and labeled for ease of review. 4. Method of Verification: Determine the preferred method of verification, whether it is through an in-person visit to the financial institution, email correspondence, or any other agreed-upon method. Include instructions for scheduling appointments, if necessary. 5. Authorized Signatory: Clearly state who is authorized to provide the verification on behalf of the financial institution or representative. This individual should have the necessary authority and be able to provide their full contact information. 6. Compliance Considerations: Ensure that the verification complies with all applicable laws and regulations, such as the Federal Reserve guidelines or state-specific requirements. Include any necessary disclaimers or legal language that may be required. 7. Timeline and Deadlines: Specify a reasonable timeframe for completing the verification process. Include any applicable deadlines for submission, as well as contact details for any inquiries or follow-ups. These considerations form a general checklist for drafting a verification of an account in Nassau, New York. However, it's important to note that specific requirements may vary depending on the nature of the account, the financial institution involved, and any additional legal or regulatory factors. In conclusion, a detailed checklist for drafting a verification of an account in Nassau, New York should cover areas such as contact information, statement of account details, supporting documents, method of verification, authorized signatory, compliance considerations, and timeline. By carefully considering these matters and tailoring them to the specific context, individuals and organizations can ensure an accurate and effective verification process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Nassau New York Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

Draftwing paperwork, like Nassau Checklist of Matters to be Considered in Drafting a Verification of an Account, to take care of your legal matters is a difficult and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms created for different cases and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Nassau Checklist of Matters to be Considered in Drafting a Verification of an Account template. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Nassau Checklist of Matters to be Considered in Drafting a Verification of an Account:

- Make sure that your document is specific to your state/county since the regulations for creating legal papers may differ from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Nassau Checklist of Matters to be Considered in Drafting a Verification of an Account isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin utilizing our website and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!