Title: Understanding the Oakland Michigan Checklist of Matters to be Considered in Drafting a Verification of an Account: A Comprehensive Guide Introduction: In Oakland, Michigan, a verification of an account is a crucial legal document used to ensure accuracy and credibility when presenting financial records. This comprehensive guide will discuss the checklist of matters to be considered while drafting a verification of an account and shed light on its importance. I. Definition and Purpose of a Verification of an Account: 1. What is a verification of an account? 2. Why is it necessary? 3. How does it help establish credibility? II. The Oakland Michigan Checklist of Matters to be Considered: Key Elements to Include: 1. Accurate Identification: — Essential personal details of the account holder — The business or financial institution involved — Dates of account transactions and activities 2. Complete Financial Records: — Including all relevant financial statements, such as bank statements, invoices, receipts, etc. — Ensure inclusion of complete transaction history to avoid discrepancies 3. Organizational Legitimacy: — Clearly establish the legal status of the organization — Provide proof of registration, if applicable — Include relevant licenses and certifications 4. Detailed Account Summary: — An overview of the account's purpose and its desired outcomes — Specify any limitations or restrictions associated with the account 5. Transaction Specifics: — Accurate recording of each financial transaction — Breakdown of transaction details including the date, amount, parties involved, and purpose 6. Supporting Documentation: — Attach evidence like receipts, contracts, and invoices — Ensure all attached documents are relevant and legitimate 7. Authorized Signatures: — Obtain signatures of all authorized individuals responsible for the account — Clearly identify their positions and roles within the organization 8. Notarization: — Consider notarizing the verification of an account to enhance its legal validity and credibility — Provide relevant notarial details, including notary public's name, seal, and date of certification III. Different Types of Verification of an Account in Oakland, Michigan: 1. Individual Personal Account Verification: — Pertains to personal financial records — Emphasizes individual savings, investments, and personal transactions 2. Business Account Verification: — Focuses on the financial records of a business or organization — Stresses income, expenses, and taxation matters 3. Legal and Estate Account Verification: — Pertains to accounts associated with legal entities, estates, trusts, or guardianship — Emphasizes compliance with legal regulations and fiduciary responsibilities Conclusion: The Oakland Michigan checklist of matters to be considered while drafting a verification of an account plays a vital role in ensuring the accuracy and credibility of financial records. By including the key elements discussed above, individuals and organizations can present a comprehensive and legally sound verification of their accounts, enhancing trust and confidence in their financial dealings.

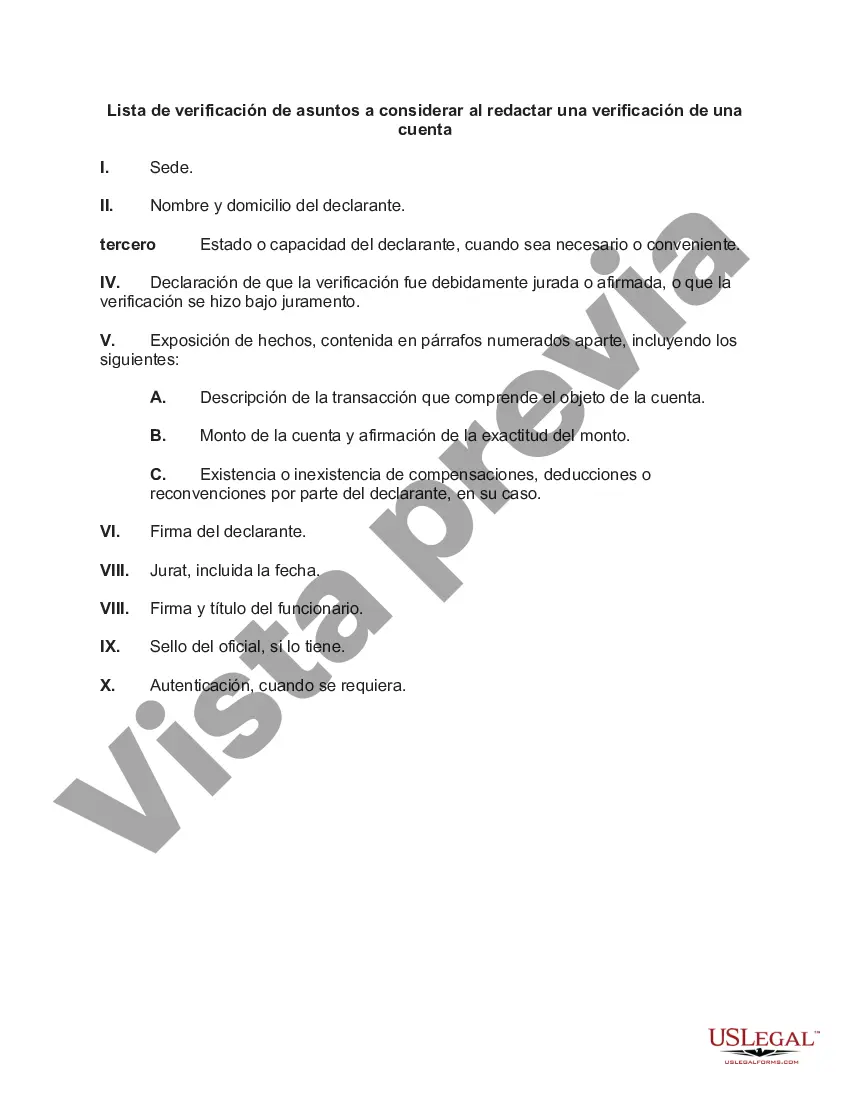

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Oakland Michigan Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business objective utilized in your county, including the Oakland Checklist of Matters to be Considered in Drafting a Verification of an Account.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Oakland Checklist of Matters to be Considered in Drafting a Verification of an Account will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Oakland Checklist of Matters to be Considered in Drafting a Verification of an Account:

- Ensure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Oakland Checklist of Matters to be Considered in Drafting a Verification of an Account on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!