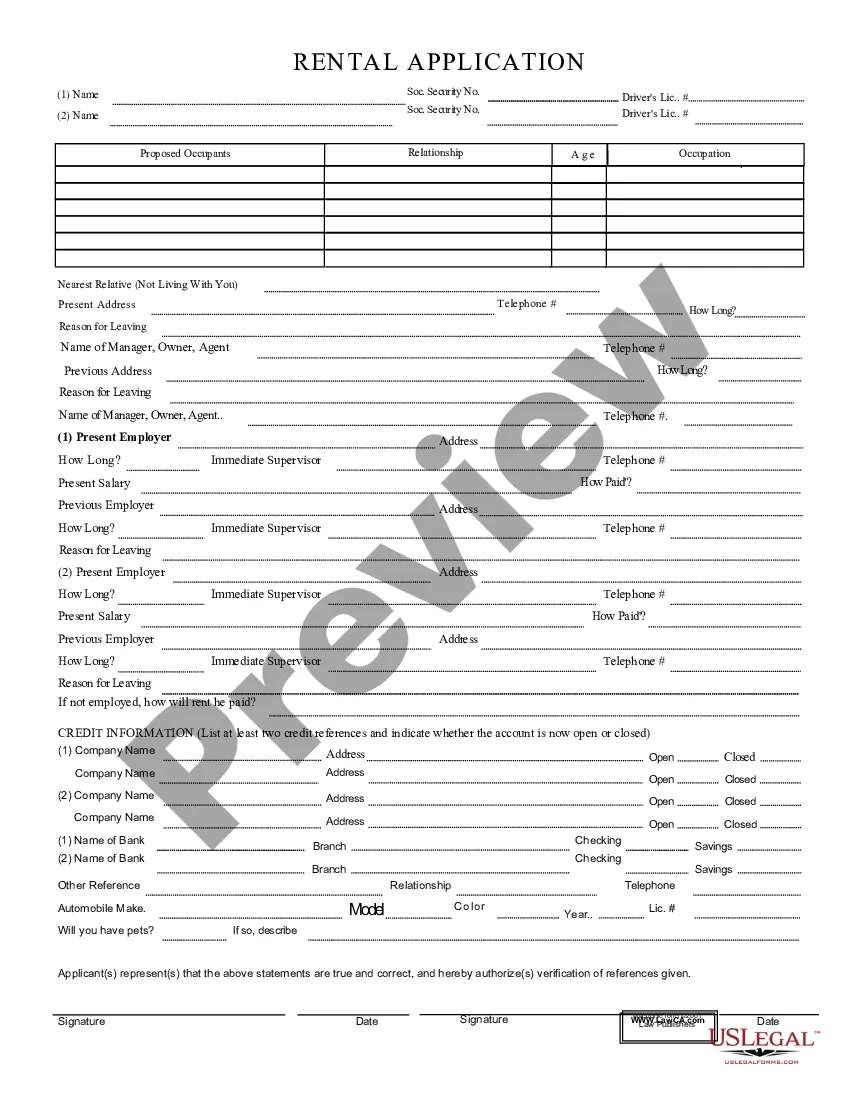

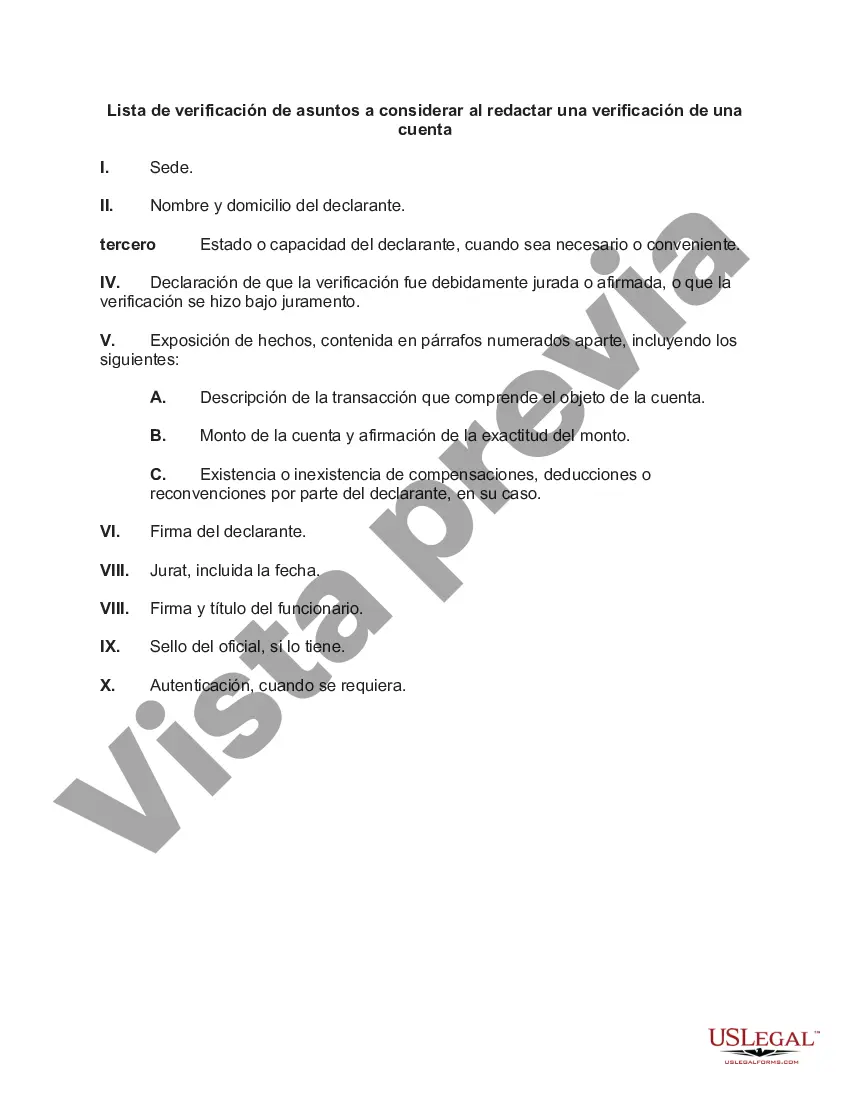

San Diego, California is a vibrant city located on the Pacific coast of southern California. Known for its stunning beaches, year-round pleasant weather, and rich cultural heritage, San Diego is a popular destination for both tourists and residents alike. When considering drafting a verification of an account in San Diego, there are several important matters to be considered. These matters include: 1. Account holder information: Start by gathering all relevant details about the account holder, such as their full name, contact information, and any relevant identification numbers. This information is crucial for accurately verifying the account. 2. Account details: It is essential to thoroughly document all pertinent information about the account. This includes the account number, type of account (e.g., checking, savings, credit card), and the financial institution where the account is held. 3. Verification purpose: Clearly specify the purpose for which the verification is being drafted. Whether it is for legal, financial, or administrative purposes, articulating the intended use of the verification is crucial for its validity. 4. Verification statement: Craft a concise and clear verification statement that validates the accuracy and authenticity of the account information. This statement should affirm that the account information provided is true to the best of the account holder's knowledge. 5. Signature: Obtain a signature from the account holder on the verification document. This signature ensures that the account holder acknowledges the accuracy of the provided information and authorizes its use. Different types of San Diego, California checklists of matters to be considered in drafting a verification of an account might include variations based on the following factors: 1. Account type: The checklist may vary depending on the type of account being verified, such as personal vs. business accounts or different financial institutions. 2. Legal requirements: The checklist might differ based on any specific legal regulations or requirements governing the verification process. 3. Purpose of verification: Depending on the purpose for which the verification is being drafted, such as for a loan application or bank investigation, the checklist may contain additional considerations specific to that purpose. 4. Verification format: The checklist could vary based on the preferred format of the verification document, whether it is an official letter, a digital form, or any other specified format. By addressing each of these matters carefully, a well-drafted verification of an account can be created in accordance with the specific requirements for San Diego, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out San Diego California Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

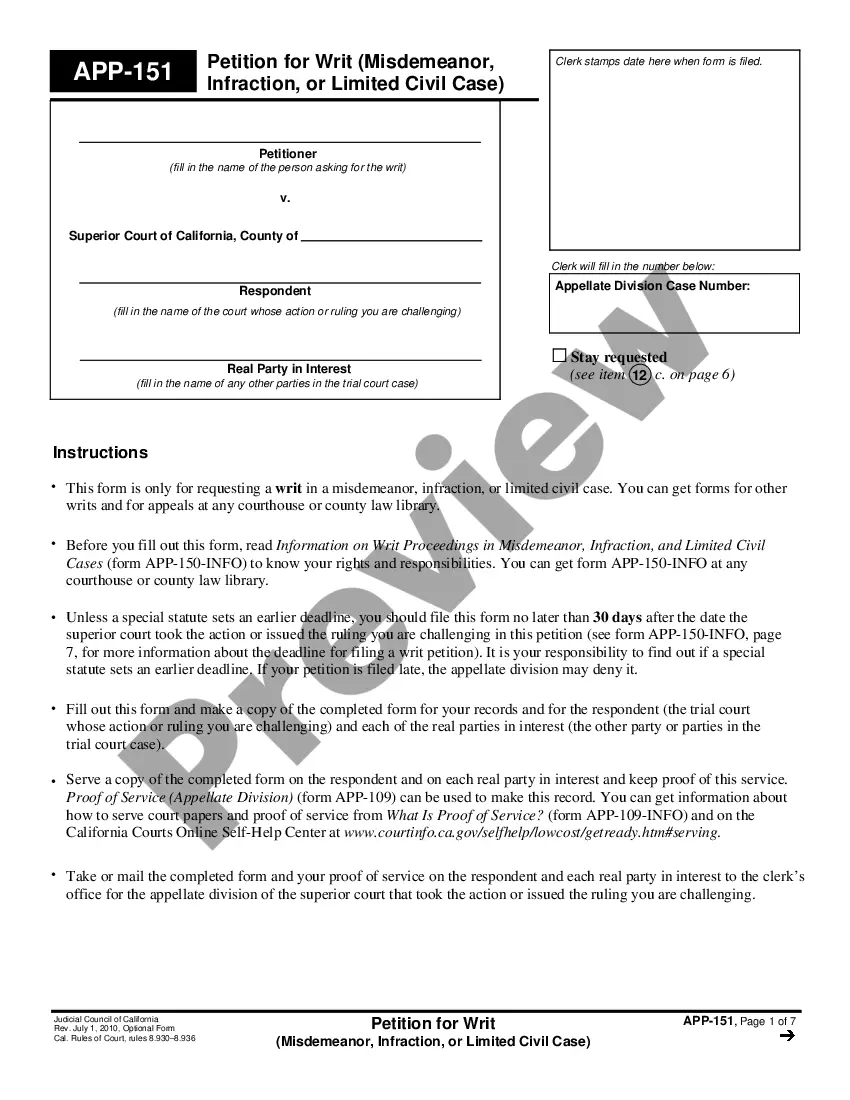

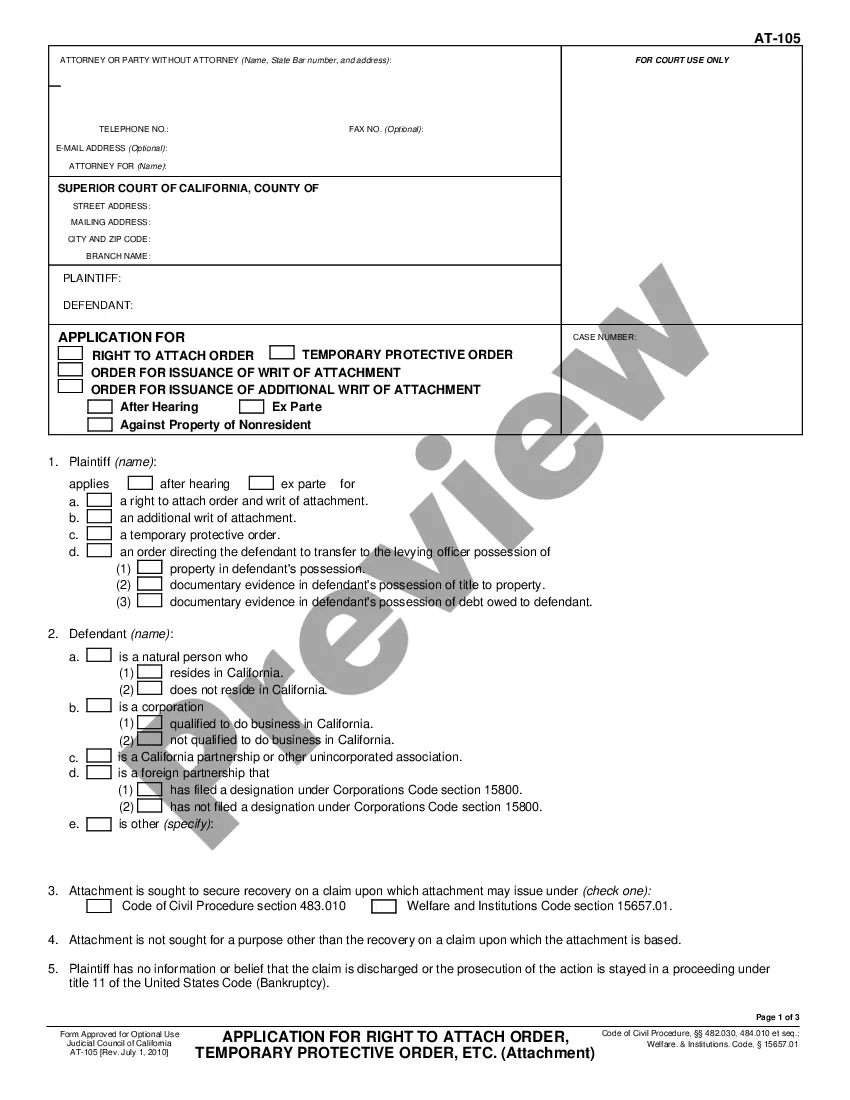

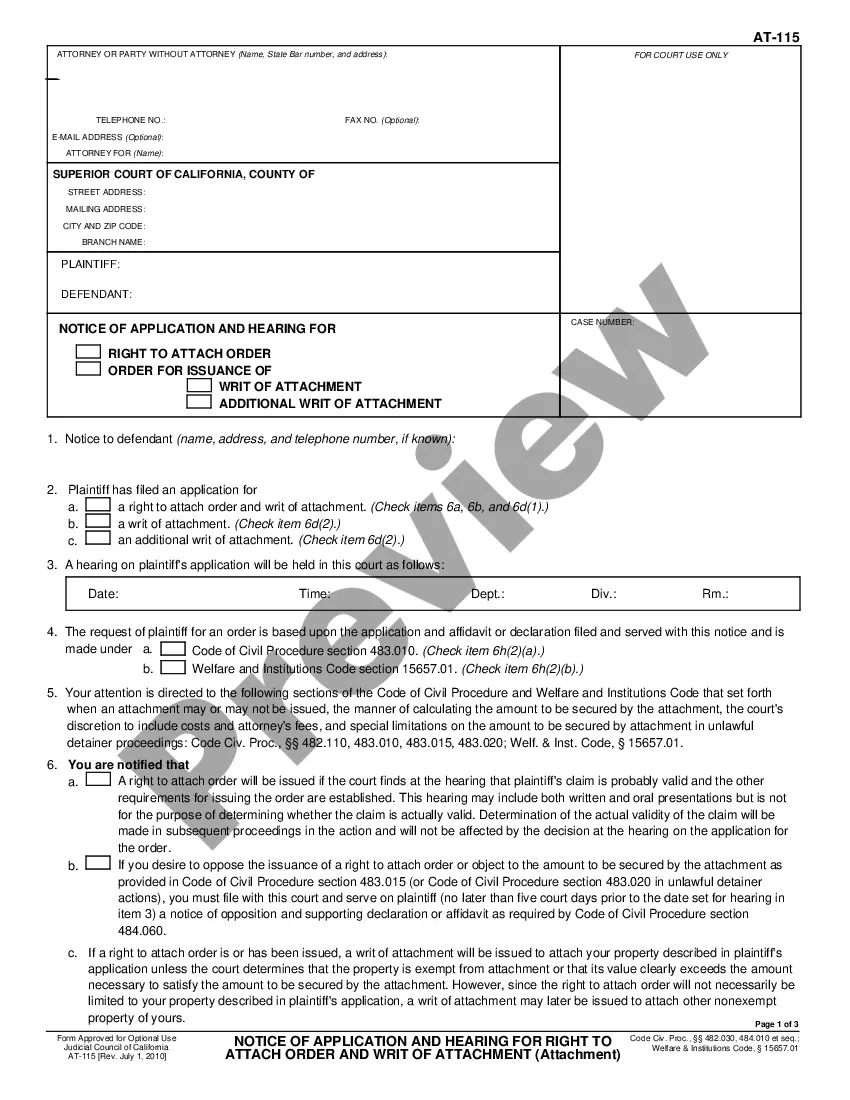

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the San Diego Checklist of Matters to be Considered in Drafting a Verification of an Account, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the San Diego Checklist of Matters to be Considered in Drafting a Verification of an Account from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Diego Checklist of Matters to be Considered in Drafting a Verification of an Account:

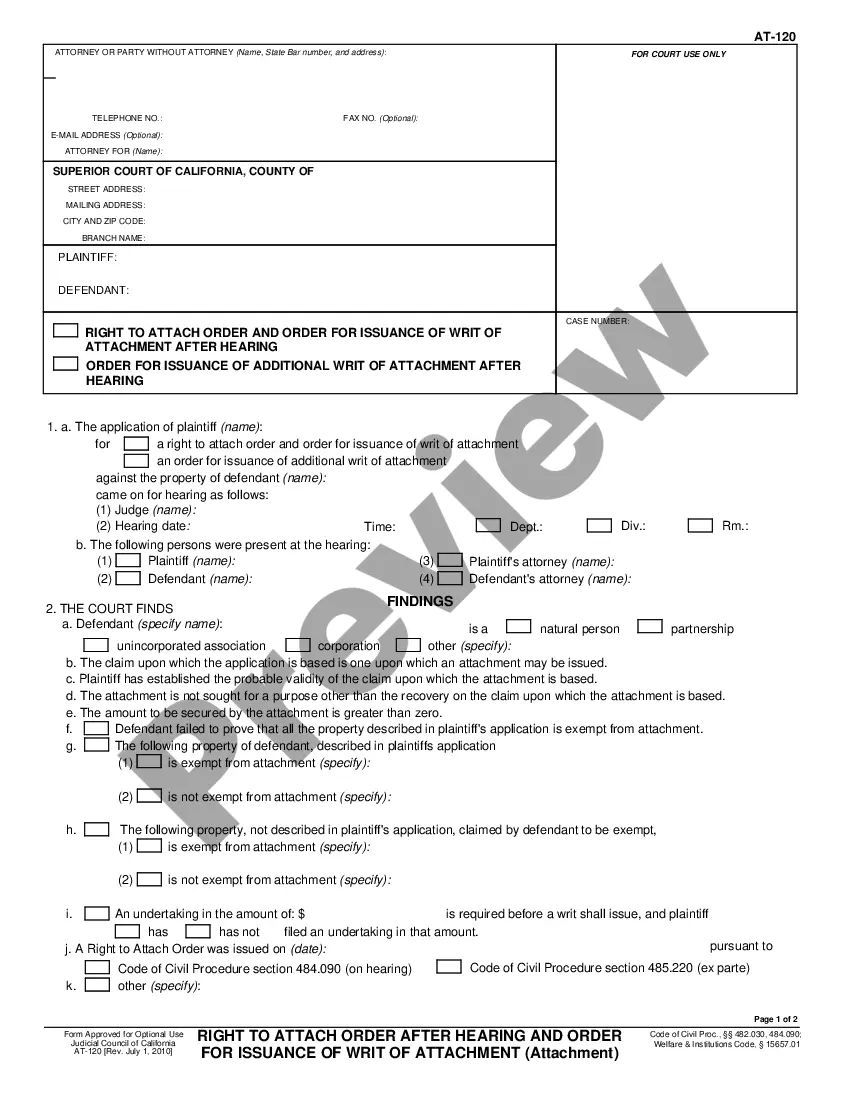

- Take a look at the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!