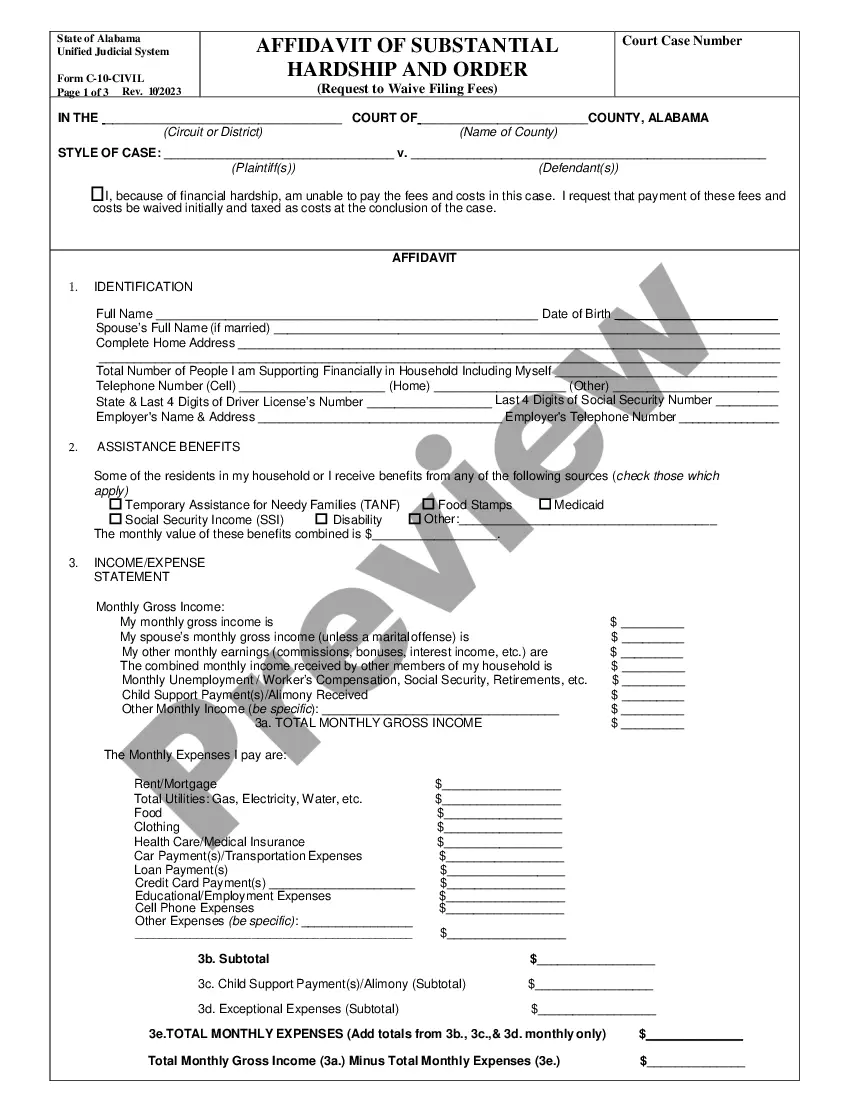

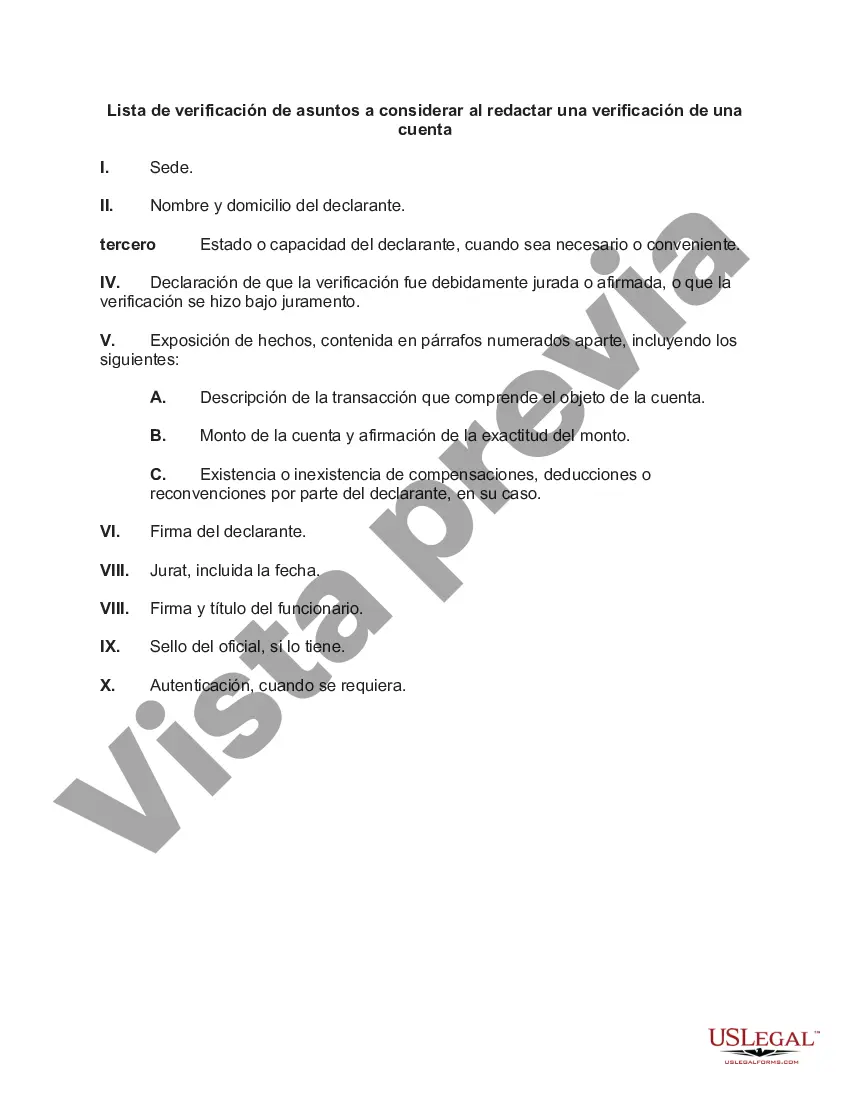

Wake North Carolina is a bustling city known for its rich history, vibrant culture, and scenic beauty. As a resident or potential visitor, it is essential to familiarize yourself with the Wake North Carolina Checklist of Matters to be Considered in Drafting a Verification of an Account. This checklist ensures that accurate and reliable information is provided when verifying an account, whether it pertains to financial, legal, or personal matters. 1. Personal Information: Begin drafting a verification of an account by including the personal details of the account holder, such as their full name, address, contact information, and any other relevant identification details. 2. Account Details: Clearly state the account number, account type (e.g., checking, savings), and the name of the financial institution or service provider associated with the account. 3. Balance Verification: Include the current balance of the account, ensuring accuracy in numerical values and currency units. This information aids in providing a complete overview of the account's financial standing. 4. Account Transactions: Detail recent transactions conducted within the account. This section serves as a comprehensive record of deposits, withdrawals, transfers, and any other relevant activities occurring within the account. 5. Account Holder's Signature: To authenticate the verification process, the account holder must sign the document. Include a space for the signature, as well as the date of signing. Types of Wake North Carolina Checklist of Matters to be Considered in Drafting a Verification of an Account can include: 1. Financial Verification: This type of verification primarily focuses on providing accurate information related to a financial account, such as a bank account, credit card account, or investment account. It ensures that the account holder's financial details are accurately represented. 2. Legal Verification: A legal verification of an account includes drafting a document that verifies information related to court-appointed accounts, trust accounts, or any account involved in a legal proceeding. This type of verification typically requires additional documentation and compliance with specific legal requirements. 3. Personal Verification: A personal verification of an account ensures accuracy in personal details such as name, address, and contact information. This type of verification may be required when applying for specific services, subscriptions, or memberships. In conclusion, when drafting a verification of an account in Wake North Carolina, the checklist of matters to be considered ensures that accurate and reliable information is provided. By carefully including personal information, account details, balance verification, account transactions, and the account holder's signature, one can create a comprehensive and trustworthy verification document. Whether it is a financial, legal, or personal verification, adhering to this checklist is crucial in meeting the necessary requirements for verification processes in Wake North Carolina.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Wake North Carolina Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Wake Checklist of Matters to be Considered in Drafting a Verification of an Account, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the recent version of the Wake Checklist of Matters to be Considered in Drafting a Verification of an Account, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Wake Checklist of Matters to be Considered in Drafting a Verification of an Account:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Wake Checklist of Matters to be Considered in Drafting a Verification of an Account and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!