Alameda California Credit Information Request is a process of obtaining credit-related data and reports for individuals or businesses located in Alameda, California. This request is typically made by individuals or organizations seeking financial services, loans, mortgages, or credit facilities. The provided information assists lenders and creditors in assessing the creditworthiness and financial stability of potential borrowers. The credit information request is crucial in making informed decisions regarding extending credit lines, setting interest rates, and determining borrowing limits. It helps lenders evaluate the risk involved in offering credit or financial services and provides insights into an applicant's credit history, debt obligations, payment behavior, and credit utilization. Alameda California Credit Information Request is often conducted through established credit reporting agencies such as Equifax, Experian, and TransUnion. These agencies compile credit reports containing detailed credit information, including the applicant's personal details, credit accounts, payment history, outstanding debts, bankruptcies, foreclosures, and public records. Different types of Alameda California Credit Information Requests may include: 1. Personal Credit Information Request: This is commonly used by individuals seeking personal loans, credit cards, or other personal credit facilities. It offers a comprehensive overview of an individual's credit history, enabling lenders to assess their eligibility for credit. 2. Business Credit Information Request: This type of request is made by businesses or organizations looking to obtain credit for operational purposes, expansion, or investments. It allows lenders and creditors to evaluate the creditworthiness of the business, including its payment track record, outstanding debts, and available credit lines. 3. Mortgage Credit Information Request: Individuals or organizations planning to purchase properties or refinance existing mortgages in Alameda, California, may request credit information relevant to mortgage lending. This request assists lenders in assessing the applicant's ability to repay the mortgage, previous mortgage payment history, and other factors that impact mortgage lending decisions. 4. Auto Loan Credit Information Request: When individuals or businesses in Alameda, California, are interested in securing auto loans, this type of request provides the necessary credit information. Lenders examine factors such as credit scores, previous auto loan repayment records, and income stability to determine loan feasibility and interest rates. In conclusion, Alameda California Credit Information Request enables lenders, financial institutions, and creditors to gain valuable insights into an individual's or business's creditworthiness, financial stability, and payment history. By obtaining credit reports from reputable agencies, such as Equifax, Experian, and TransUnion, lenders can make informed decisions regarding credit approvals, interest rates, and borrowing limits.

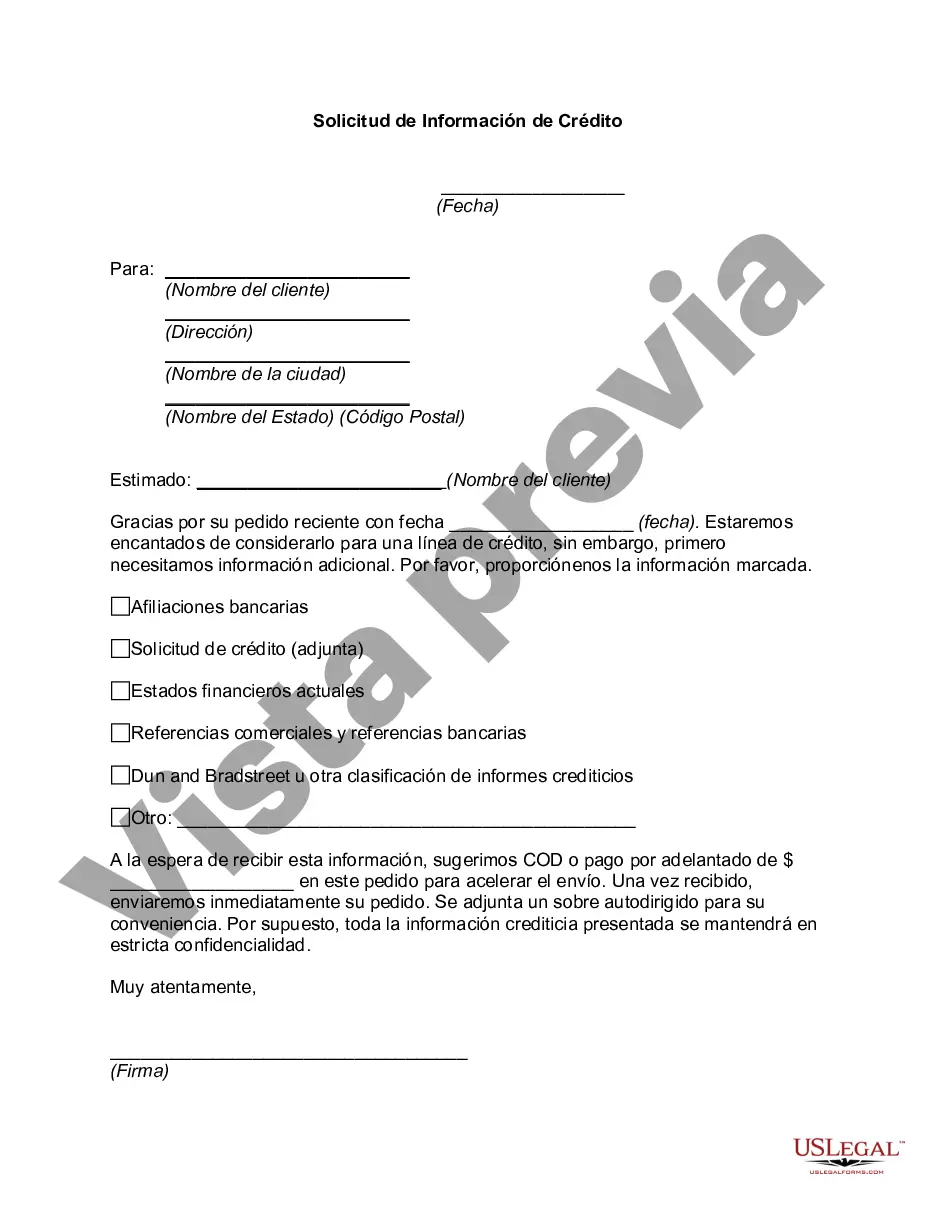

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Alameda California Solicitud De Información De Crédito?

Do you need to quickly draft a legally-binding Alameda Credit Information Request or probably any other form to handle your own or corporate affairs? You can select one of the two options: contact a legal advisor to draft a legal paper for you or create it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get neatly written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant form templates, including Alameda Credit Information Request and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, carefully verify if the Alameda Credit Information Request is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to verify what it's intended for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Alameda Credit Information Request template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the templates we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!