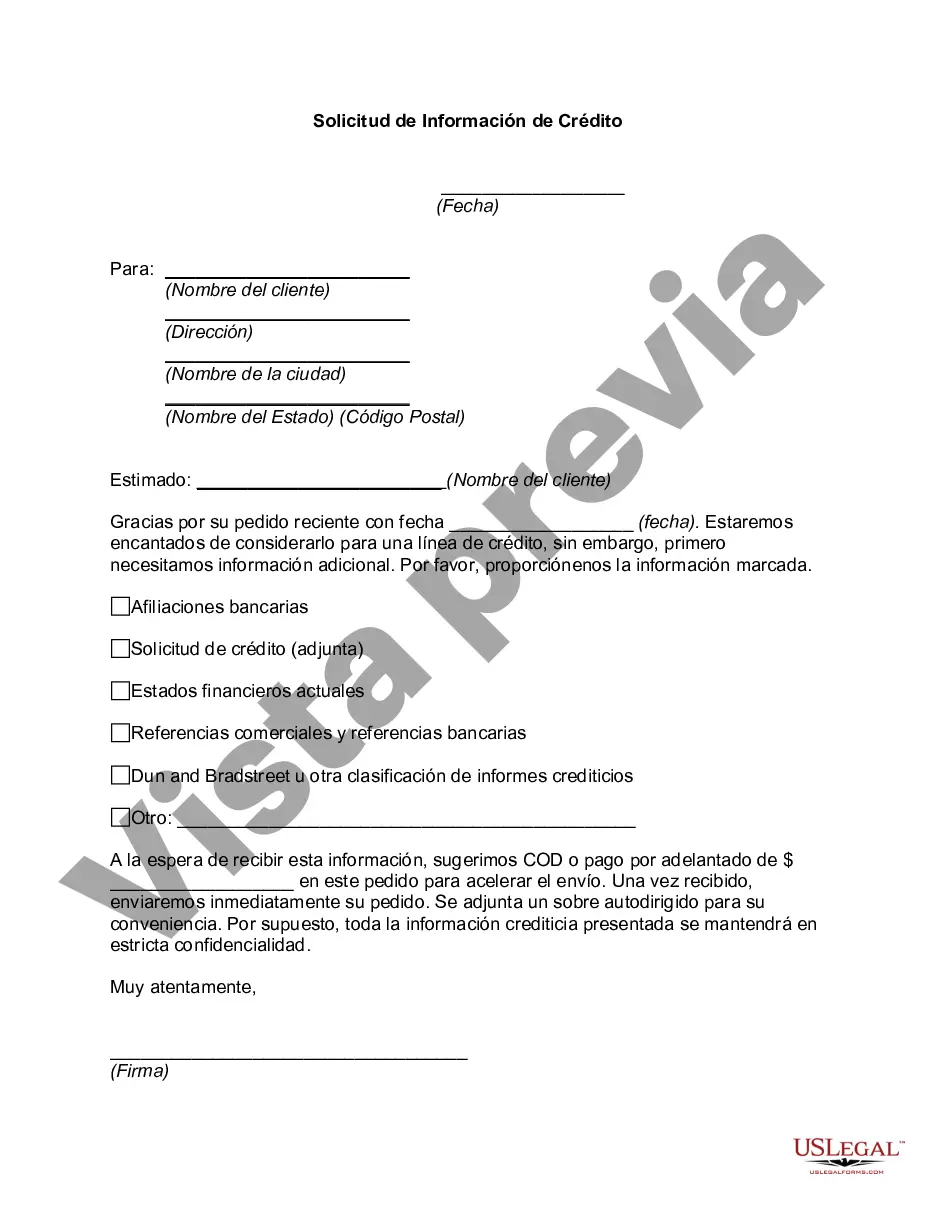

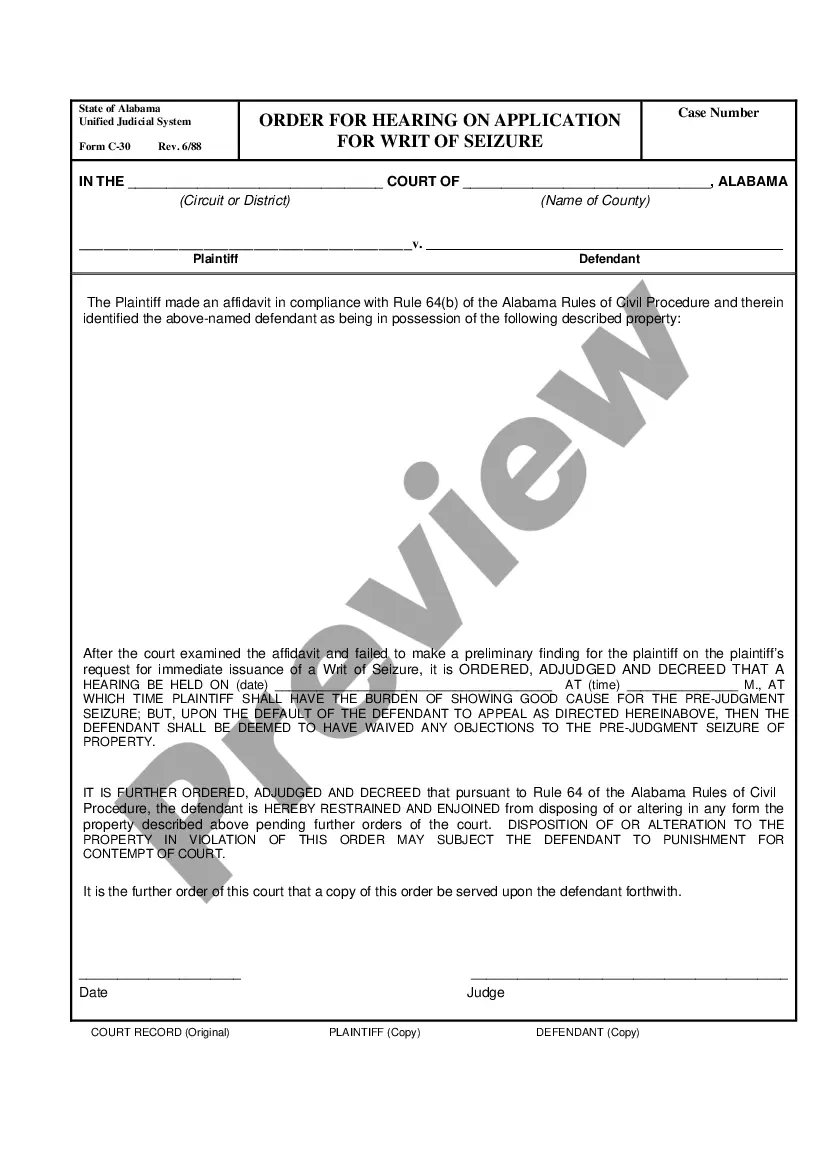

Allegheny Pennsylvania Credit Information Request is a formal process through which individuals or organizations can obtain credit-related information specific to the Allegheny County in Pennsylvania. This request aims to provide relevant credit information to interested parties for various purposes such as financial planning, credit analysis, loan application, business transactions, or even personal assessments. The Allegheny Pennsylvania Credit Information Request covers a wide range of credit-related data, including but not limited to: 1. Credit Score: This is a numerical representation of an individual or entity's creditworthiness, reflecting their ability to repay borrowed money. A higher credit score indicates a stronger financial record, improving chances of securing loans or favorable interest rates. 2. Credit History: It encompasses an individual's or business entity's past borrowing and repayment behavior. This information includes details of loans, credit card usage, payment history, defaults, bankruptcies, and other relevant credit-related activities. 3. Outstanding Balances: This section highlights any unpaid debts, outstanding loans, or credit card balances that the individual or organization may have. 4. Credit Limits: This component reveals the maximum amount that an individual or entity can borrow on credit cards or other lines of credit. 5. Late Payments: It includes information about any delayed or missed payments, which may adversely impact creditworthiness. 6. Public Records: This section discloses any legal actions, such as bankruptcies, tax liens, or judgements, which can significantly impact creditworthiness. 7. Inquiries: This section lists entities or individuals who have recently requested the individual's or organization's credit report. Multiple inquiries within a short time may raise concerns about creditworthiness. It is important to note that there are no specific types of Allegheny Pennsylvania Credit Information Requests; instead, the term refers to the process of accessing credit information within Allegheny County, Pennsylvania. However, specific entities such as banks, financial institutions, employers, or landlords may request credit information from the Allegheny Pennsylvania credit bureaus for decision-making regarding a loan, employment, or rental agreement. To initiate an Allegheny Pennsylvania Credit Information Request, individuals or organizations need to follow the appropriate procedures set by the credit bureaus operating in the county. They may need to provide personal identification, relevant financial records, and complete the necessary forms. The request can often be made online, by mail, or in-person at designated credit bureaus or agencies operating within Allegheny County, Pennsylvania. In conclusion, an Allegheny Pennsylvania Credit Information Request is a formal process enabling individuals or entities to obtain credit-related information specific to Allegheny County. It encompasses a wide range of credit data, including credit scores, credit history, outstanding balances, credit limits, late payments, public records, and inquiries. The request allows interested parties to access this information for various purposes like financial planning, credit analysis, loan applications, and other personal or business assessments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Allegheny Pennsylvania Solicitud De Información De Crédito?

Whether you plan to start your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Allegheny Credit Information Request is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Allegheny Credit Information Request. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to obtain the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Credit Information Request in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!