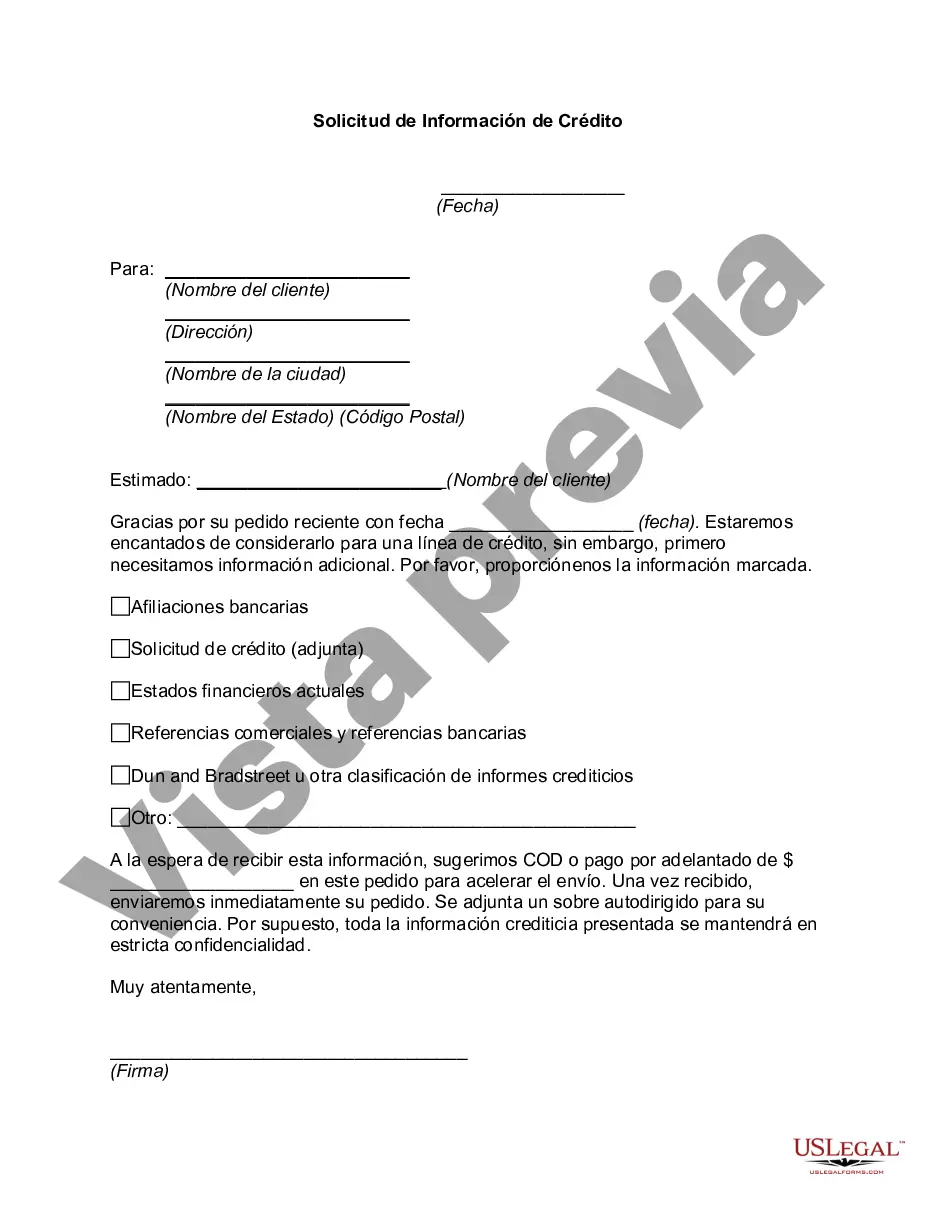

Bexar Texas Credit Information Request is a process through which individuals or businesses in Bexar County, Texas can obtain their credit-related information from various sources. This request is crucial for those seeking to understand and evaluate their creditworthiness, track their financial history, or detect any potential errors or inaccuracies in their credit reports. The Bexar Texas Credit Information Request involves submitting a formal application to authorized credit reporting agencies, financial institutions, and other relevant entities to access the desired credit information. Individuals must provide specific details, such as their full name, address, social security number, and sometimes proof of identification, to ensure appropriate and secure access to their credit records. Keywords: Bexar Texas, Credit Information Request, creditworthiness, financial history, credit reports, authorized credit reporting agencies, financial institutions, errors, inaccuracies, application, credit records, secure access. Different types of Bexar Texas Credit Information Requests can include: 1. Bexar Texas Personal Credit Information Request: This type of request is made by individuals seeking their personal credit information for personal financial management, loan applications, mortgage approvals, or monitoring their credit score. 2. Bexar Texas Business Credit Information Request: Businesses in Bexar County may require their credit information to evaluate their creditworthiness, secure business loans, establish business credit, or assess potential partners/clients' financial stability. 3. Bexar Texas Credit Information Dispute Request: In the case of identifying errors or inaccuracies in credit reports, individuals can submit a dispute request to rectify any discrepancies such as mistaken late payments, incorrect balances, or fraudulent activities. 4. Bexar Texas Credit Information Monitoring Request: This type of request is made by individuals who want to ensure constant monitoring of their credit activities, alerting them to any new accounts, credit inquiries, or other changes that might affect their credit profile. 5. Bexar Texas Credit Information Freeze Request: Individuals may opt for a credit freeze request to restrict access to their credit information, preventing unauthorized individuals from opening new accounts or loans in their name without explicit consent. Keywords: Bexar Texas, Personal Credit Information Request, Business Credit Information Request, Credit Information Dispute Request, Credit Information Monitoring Request, Credit Information Freeze Request.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Bexar Texas Solicitud De Información De Crédito?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Bexar Credit Information Request meeting all local requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. Aside from the Bexar Credit Information Request, here you can find any specific document to run your business or personal affairs, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Bexar Credit Information Request:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Bexar Credit Information Request.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!