Fulton Georgia Credit Information Request is a formal process through which individuals or organizations can obtain credit-related information about a person or business in Fulton County, Georgia. This request is typically made to assess the creditworthiness, payment history, and financial stability of an individual or entity before extending credit, leasing property, or entering into any financial transactions. The Fulton Georgia Credit Information Request is a vital tool for lenders, landlords, employers, and other entities involved in financial decision-making processes. By accessing credit information, they can evaluate the risk associated with extending credit, tailor loan terms, set appropriate interest rates, determine eligibility for rental agreements or employment, and make well-informed financial judgments. Different types of Fulton Georgia Credit Information Requests may include: 1. Personal Credit Information Request: This type of request is often made by individuals who want to obtain their own credit report or credit score. It helps individuals assess their financial standing, identify potential inaccuracies or fraudulent activities, and make informed decisions regarding borrowing, applying for loans, or improving their creditworthiness. 2. Business Credit Information Request: This type of request is targeted towards businesses or organizations seeking credit information about other companies before entering into partnerships, collaborations, or trade agreements. It assists in evaluating the risk associated with extending credit to other businesses and helps in mitigating potential losses. 3. Landlord Credit Information Request: Landlords often use this type of request to assess the creditworthiness of potential tenants. By reviewing an applicant's credit history, landlords can determine if an individual has a good payment track record, manage their finances responsibly, and make timely rent payments. This helps landlords find reliable and financially stable tenants. 4. Employment Credit Information Request: This type of request is commonly made by employers during the hiring process to evaluate the financial responsibility and integrity of job applicants. By accessing credit information, employers can assess an applicant's financial stability, potential risks of fraud, or money mishandling, particularly for positions that involve handling finances or sensitive information. In conclusion, the Fulton Georgia Credit Information Request serves as a valuable resource for various entities in making informed financial decisions. Whether it's for personal, business, landlord, or employment purposes, this process allows individuals and organizations to obtain a comprehensive understanding of an individual or entity's credit history, facilitating well-informed financial judgments and minimizing potential risks.

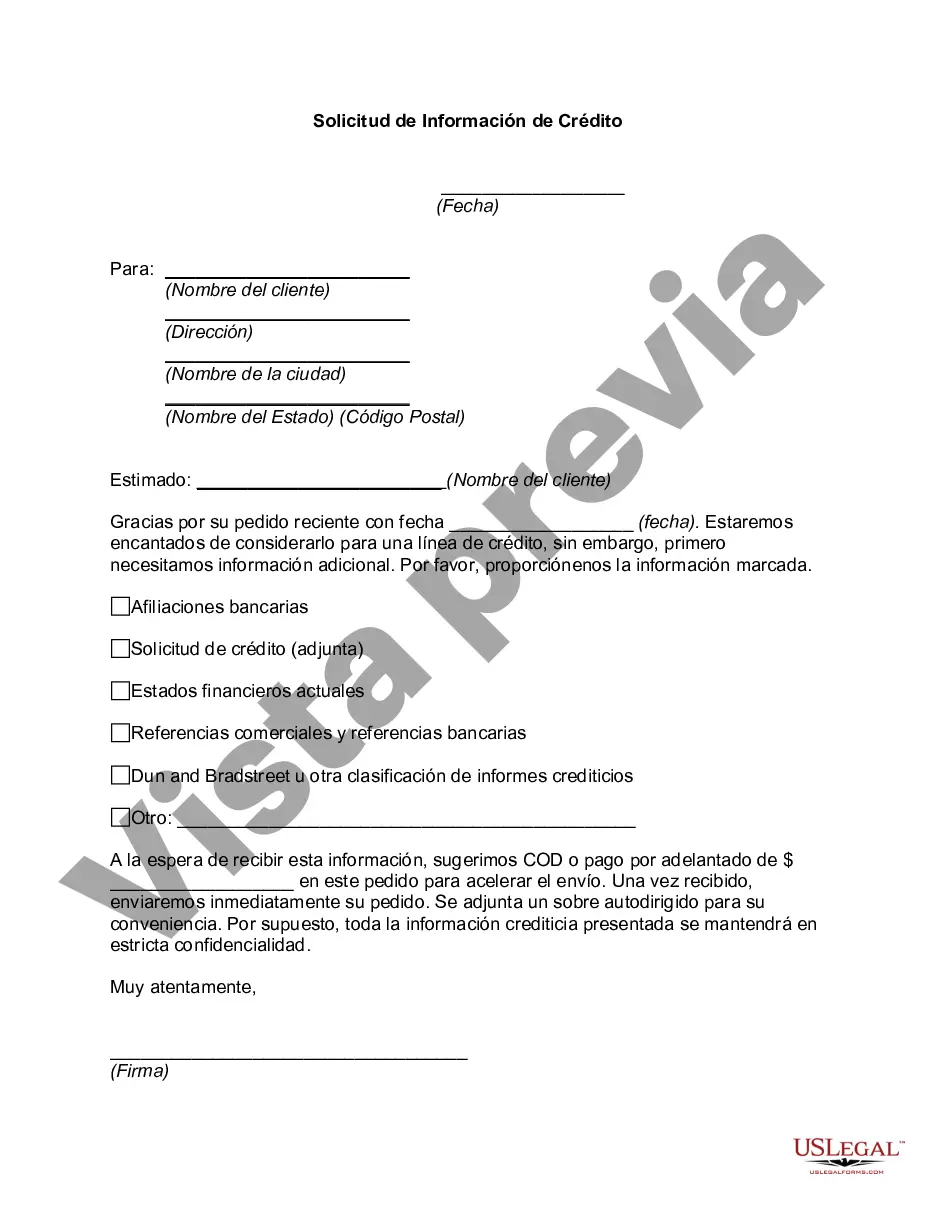

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Fulton Georgia Solicitud De Información De Crédito?

Whether you plan to open your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Fulton Credit Information Request is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the Fulton Credit Information Request. Adhere to the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Fulton Credit Information Request in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!