Hennepin Minnesota Credit Information Request is a formal process allowing individuals or entities to access their credit report and related information in Hennepin County, Minnesota. This request is pertinent for individuals seeking to review their credit status, monitor any changes, identify potential errors or inaccuracies in their credit report, or verify the legitimacy of credit activities. The Hennepin County Credit Information Request provides valuable insights into an individual's financial history and creditworthiness. By obtaining their credit report, individuals can gain a comprehensive view of their credit accounts, payment history, loans, credit inquiries, and other pertinent details. This information is crucial for potential lenders, employers, or landlords who make decisions based on a person's creditworthiness. Moreover, Hennepin County offers multiple types of Credit Information Requests tailored to specific needs: 1. Personal Credit Information Request: This type allows individuals to access and review their personal credit reports, giving them a thorough understanding of their own financial standing. It enables users to ensure the accuracy of information, address any mistakes or discrepancies, and take appropriate actions to improve their credit profile. 2. Background Check Credit Information Request: This type is often required by employers or landlords when conducting background checks on prospective employees or tenants. It provides insights into an individual's credit history, offering employers and landlords an additional perspective on the applicant's financial responsibility and reliability. 3. Fraudulent Activity Credit Information Request: In cases where individuals suspect or have fallen victim to identity theft or fraudulent credit activity, this type of request is vital. It allows affected individuals to monitor their credit reports closely, identify any unauthorized accounts or activities, and take necessary measures to mitigate the impact of fraud. 4. Dispute Resolution Credit Information Request: When individuals identify errors, inaccuracies, or fraudulent activities on their credit report, they can initiate a dispute resolution request. This type facilitates the investigation and correction of any incorrect information, ensuring the credit report accurately represents an individual's financial history. By engaging in any of these Hennepin Minnesota Credit Information Requests, individuals can take control of their credit health, safeguard against fraudulent activities, and maintain accurate financial records. It is a valuable tool for ensuring financial success, trustworthiness, and peace of mind in Hennepin County, Minnesota.

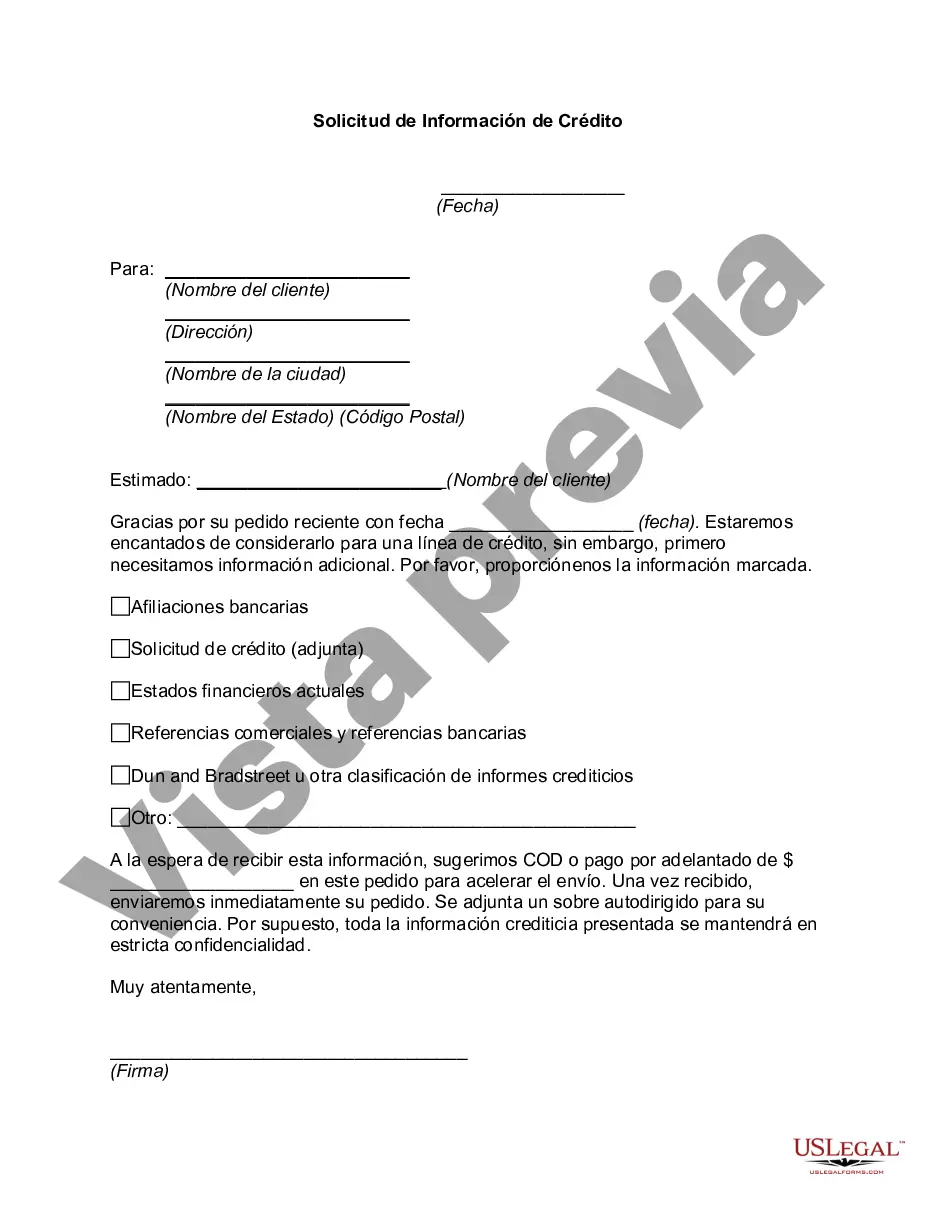

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Hennepin Minnesota Solicitud De Información De Crédito?

Preparing papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate Hennepin Credit Information Request without professional assistance.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Hennepin Credit Information Request on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Hennepin Credit Information Request:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a few clicks!