Los Angeles California Credit Information Request is a process by which individuals or businesses can request access to their credit information and credit reports for the purpose of assessing and managing their financial standing. The credit information request is typically made through authorized credit reporting agencies operating in Los Angeles, California. One type of Los Angeles California Credit Information Request is the Annual Credit Report. This request allows individuals to obtain one free credit report per year from each of the major credit reporting agencies, namely Experian, Equifax, and TransUnion. This report provides a comprehensive overview of an individual's credit history, including their payment history, loan balances, credit utilization, and any delinquencies or negative marks. Another type of Los Angeles California Credit Information Request is the Credit Score Request. This request enables individuals to access their credit scores, which are numerical representations of their creditworthiness. The credit score is a crucial factor in determining an individual's ability to secure loans, mortgages, or credit cards. Different credit reporting agencies may have their own scoring models, such as FICO or Vantage Score, which assign a score based on various factors like payment history, total debt, length of credit history, and new credit applications. Furthermore, Los Angeles California Credit Information Request can also include a Credit Monitoring Request. This allows individuals to keep track of their credit activity by receiving regular alerts or notifications regarding any significant changes in their credit reports, such as new accounts opened in their name, credit inquiries, or late payments. Credit monitoring services can provide valuable protection against identity theft or fraudulent activities. Apart from these, there may be specific types of Los Angeles California Credit Information Request catered to different industries or sectors. For example, businesses may request a Business Credit Information Request, which focuses on evaluating the creditworthiness of a company rather than an individual. This type of request includes factors like payment history, business financials, trade references, and public records. In summary, Los Angeles California Credit Information Request is a process that allows individuals and businesses to obtain access to their credit information and reports. It includes various types such as Annual Credit Report, Credit Score Request, Credit Monitoring Request, and even industry-specific requests like Business Credit Information Request. Understanding and managing one's credit information is essential for making informed financial decisions and maintaining a healthy credit profile.

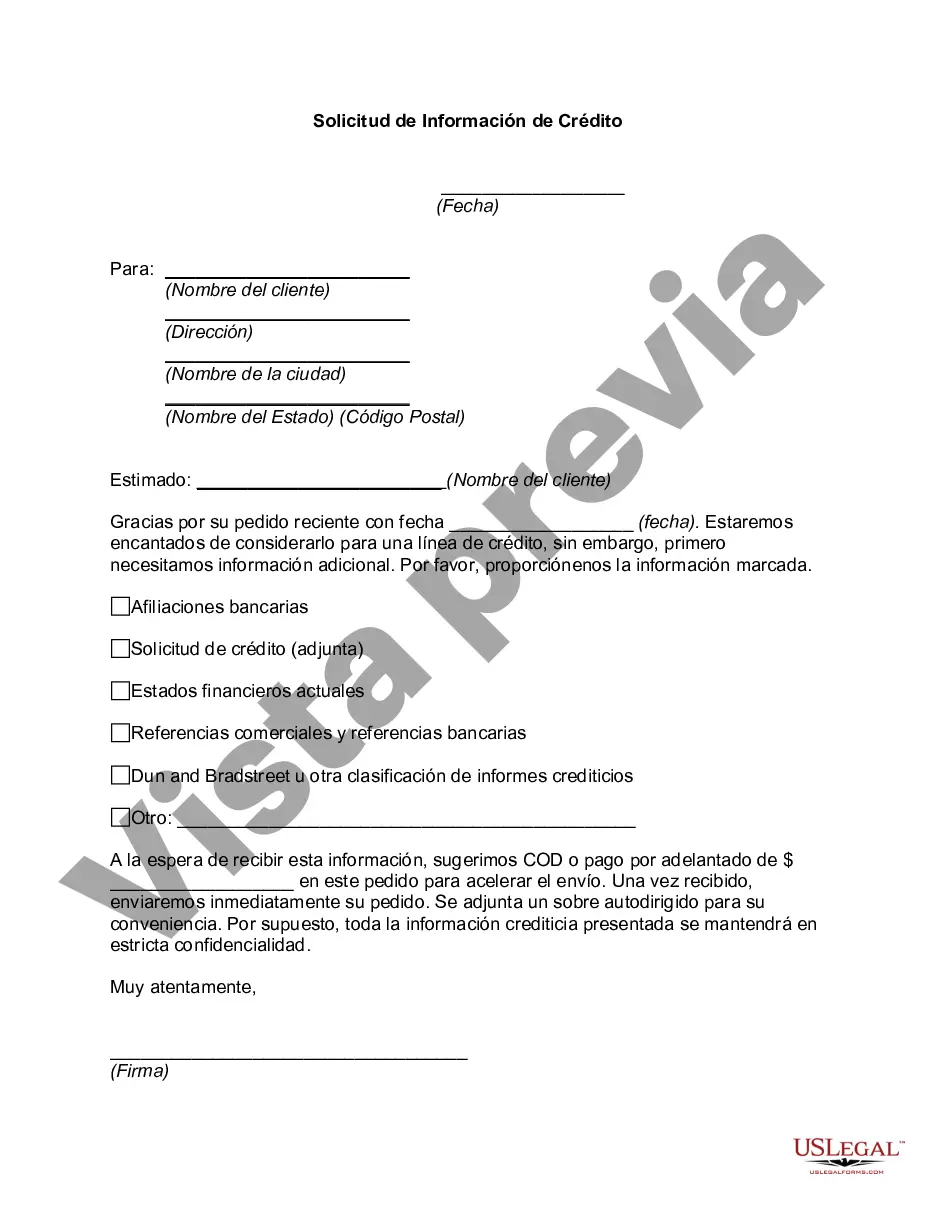

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Los Angeles California Solicitud De Información De Crédito?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Los Angeles Credit Information Request, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and guides on the website to make any tasks related to paperwork completion simple.

Here's how you can purchase and download Los Angeles Credit Information Request.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Examine the related document templates or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and buy Los Angeles Credit Information Request.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Los Angeles Credit Information Request, log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you need to deal with an extremely difficult case, we recommend getting an attorney to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-specific documents effortlessly!