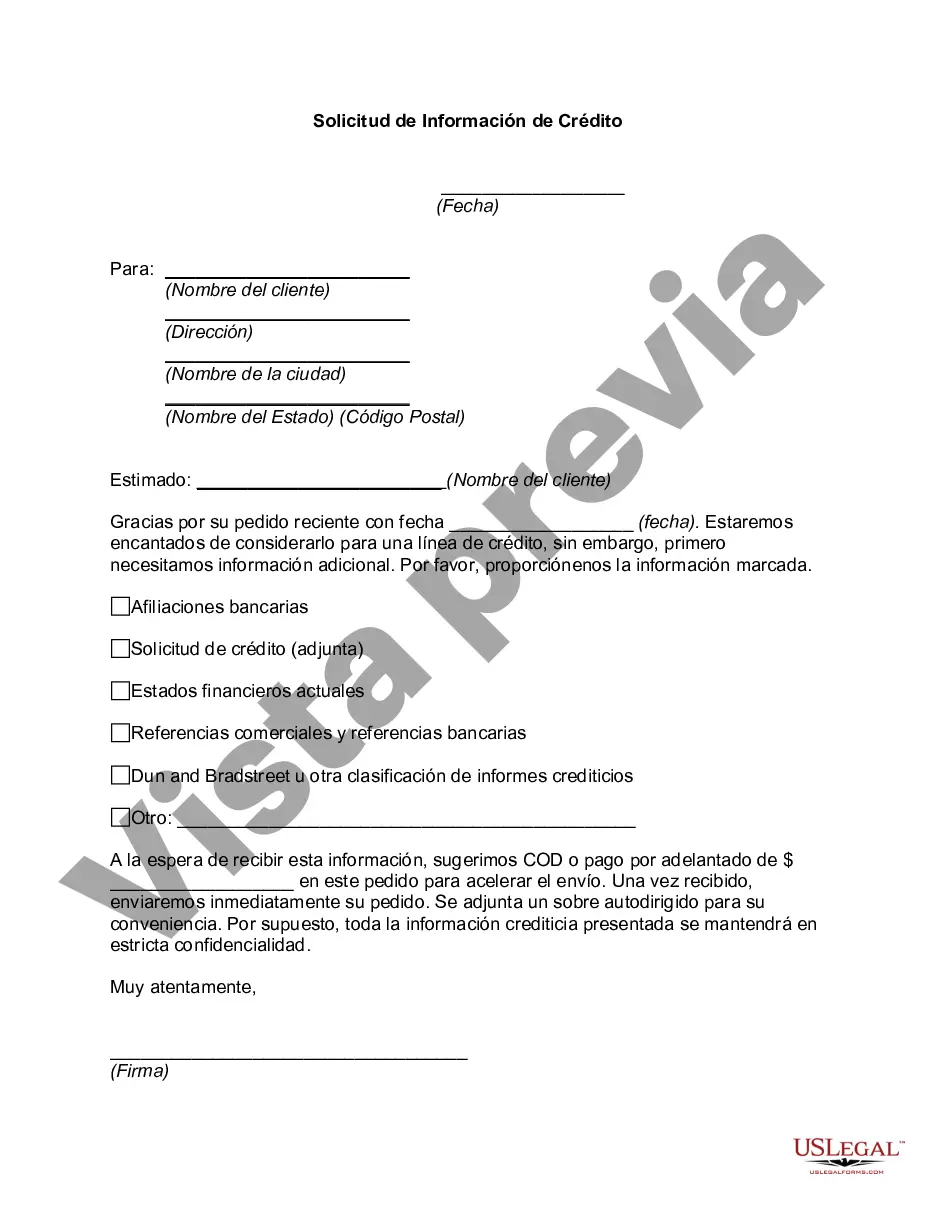

Maricopa Arizona Credit Information Request is a formal process that individuals or organizations in Maricopa, Arizona, can undertake to gather specific credit-related details. This request aims to access and gather information regarding an individual's or business entity's credit history, credit score, and financial background. The objective is to make informed decisions about creditworthiness, loan eligibility, or potential business partnerships. The Maricopa Arizona Credit Information Request is often initiated when individuals or businesses need to assess the creditworthiness of potential borrowers, tenants, or partners. Lenders, landlords, financial institutions, employers, or any party requesting credit information must follow the established protocols and guidelines to ensure compliance with legal requirements and protect the privacy rights of the individuals involved. Some of the key components that might be included in a Maricopa Arizona Credit Information Request are: 1. Personal Information: This section includes the full name, current address, contact details, social security number (SSN), date of birth, and any other relevant identifying information about the subject. 2. Employment Details: In the case of a business entity, this section might require information about the company's name, address, nature of operations, and ownership details. For individuals, it may include employment history, occupation, and income details. 3. Credit History: The request typically includes information about the subject's credit accounts, such as credit cards, mortgages, loans, and payment history. It may also detail any previous bankruptcies, collections, or defaults. 4. Credit Score: The credit score represents the subject's creditworthiness and might be requested to assess the individual's financial reliability. 5. Financial Information: This section might cover the subject's assets, liabilities, income, expenses, and any other financial disclosures provided voluntarily or as per legal requirements. 6. Consent and Authorization: The request should include a section where the subject grants' permission for the release of their credit information to the requesting party. This ensures compliance with privacy laws and establishes consent. Different types of Maricopa Arizona Credit Information Requests can include the following: 1. Consumer Credit Information Request: This type of request is typically used by potential lenders, landlords, or employers when evaluating an individual's creditworthiness for purposes such as applying for a loan, renting a property, or evaluating an employment candidate's financial reliability. 2. Business Credit Information Request: This request is specifically designed for businesses seeking to assess the creditworthiness of other businesses or potential partners before entering into a financial or contractual arrangement. In conclusion, Maricopa Arizona Credit Information Requests are essential processes to obtain comprehensive credit-related information about individuals or businesses. These requests help decision-makers make well-informed choices when evaluating creditworthiness, loan eligibility, rental applications, or establishing business partnerships while adhering to legal requirements and respecting privacy rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Maricopa Arizona Solicitud De Información De Crédito?

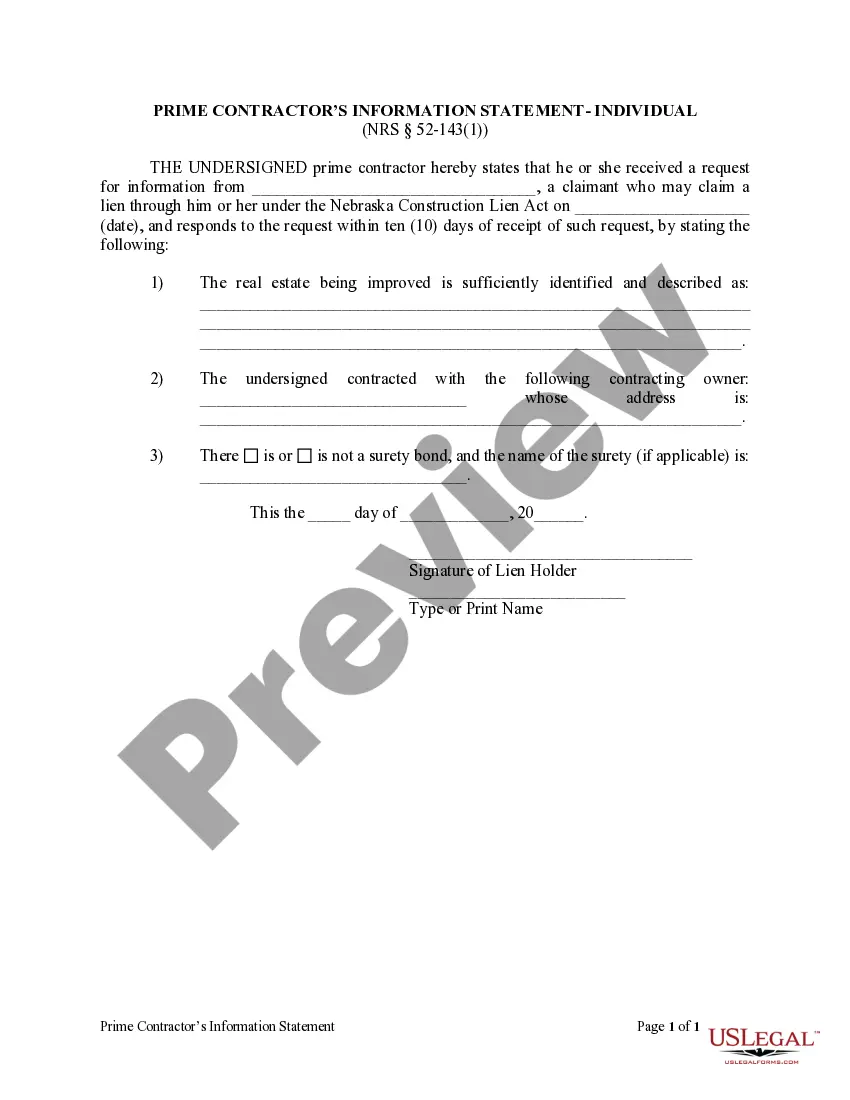

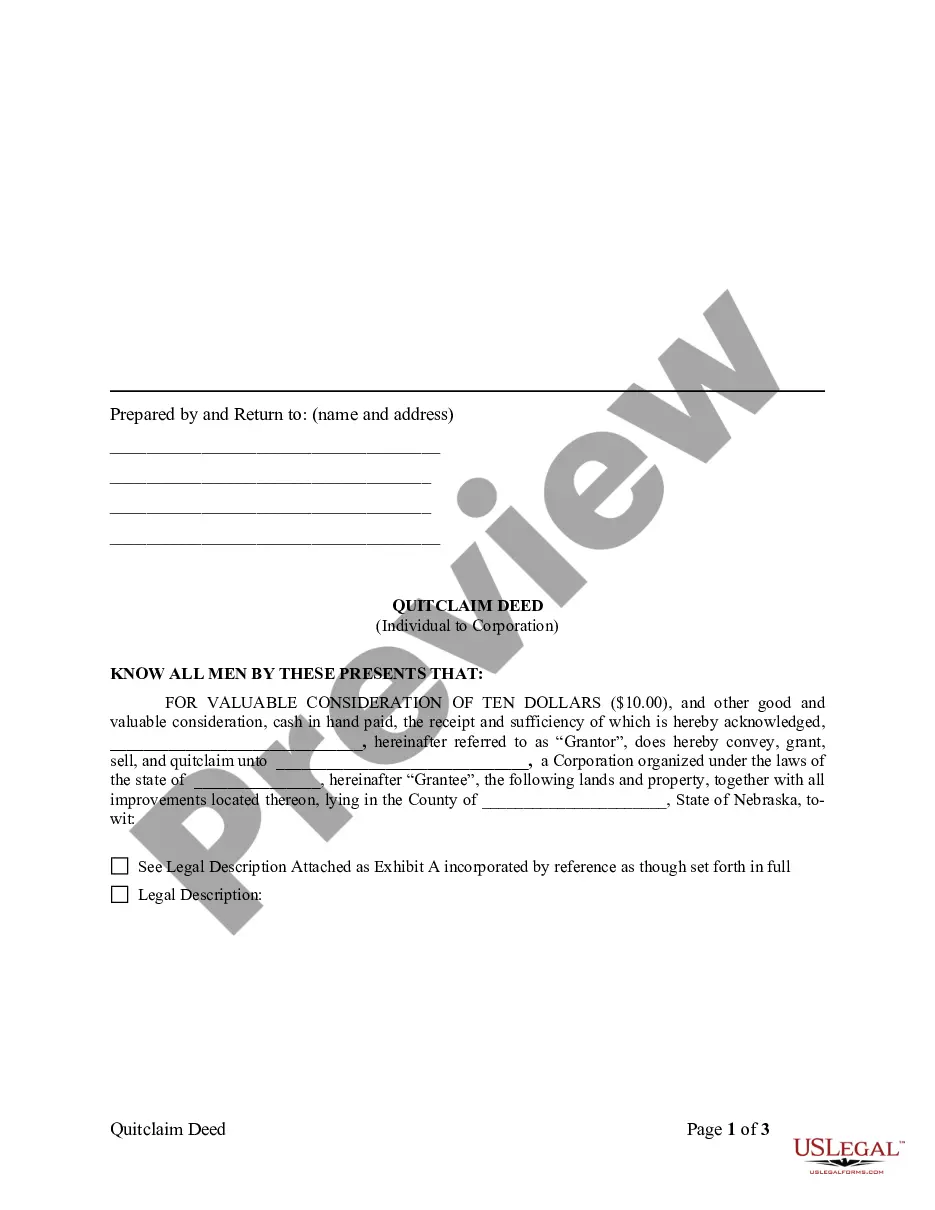

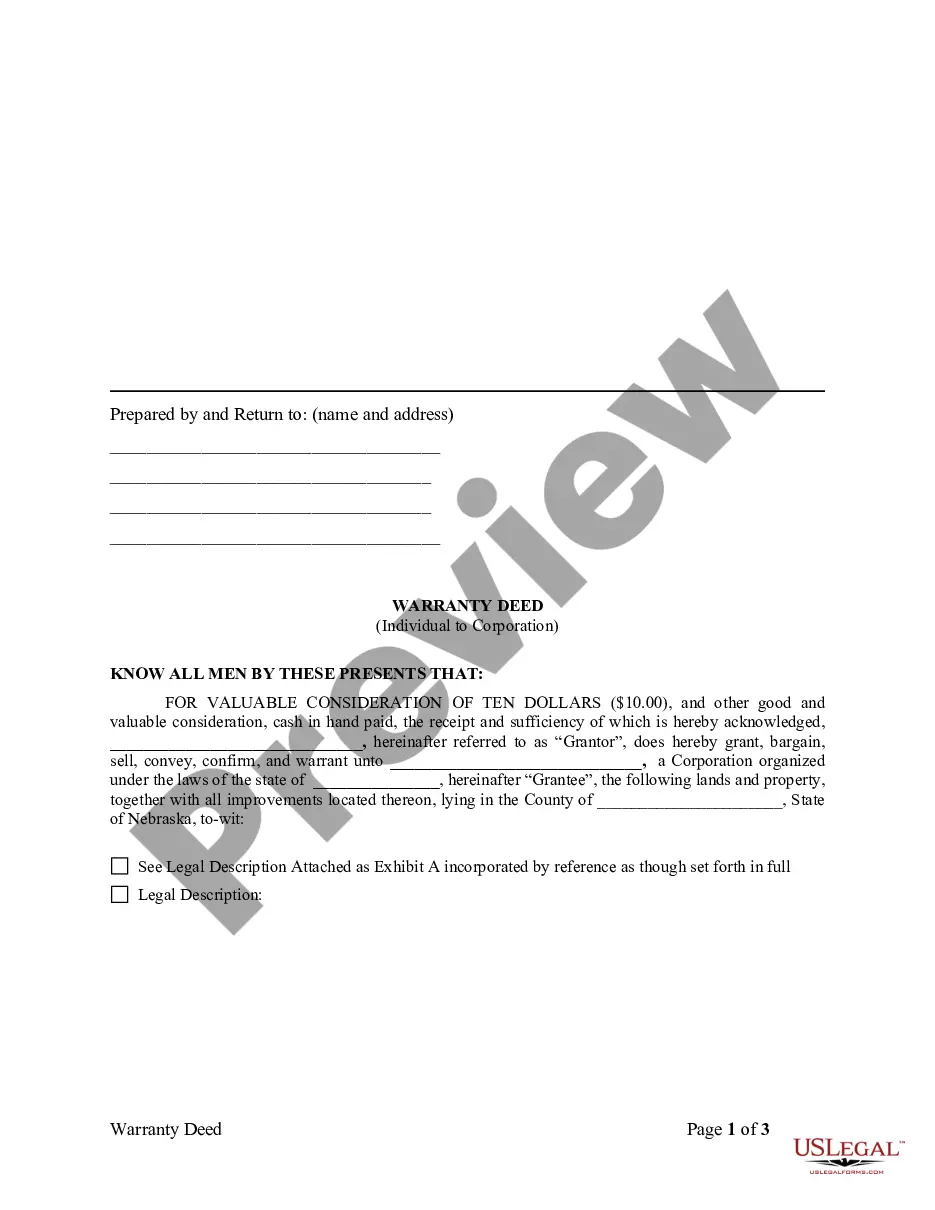

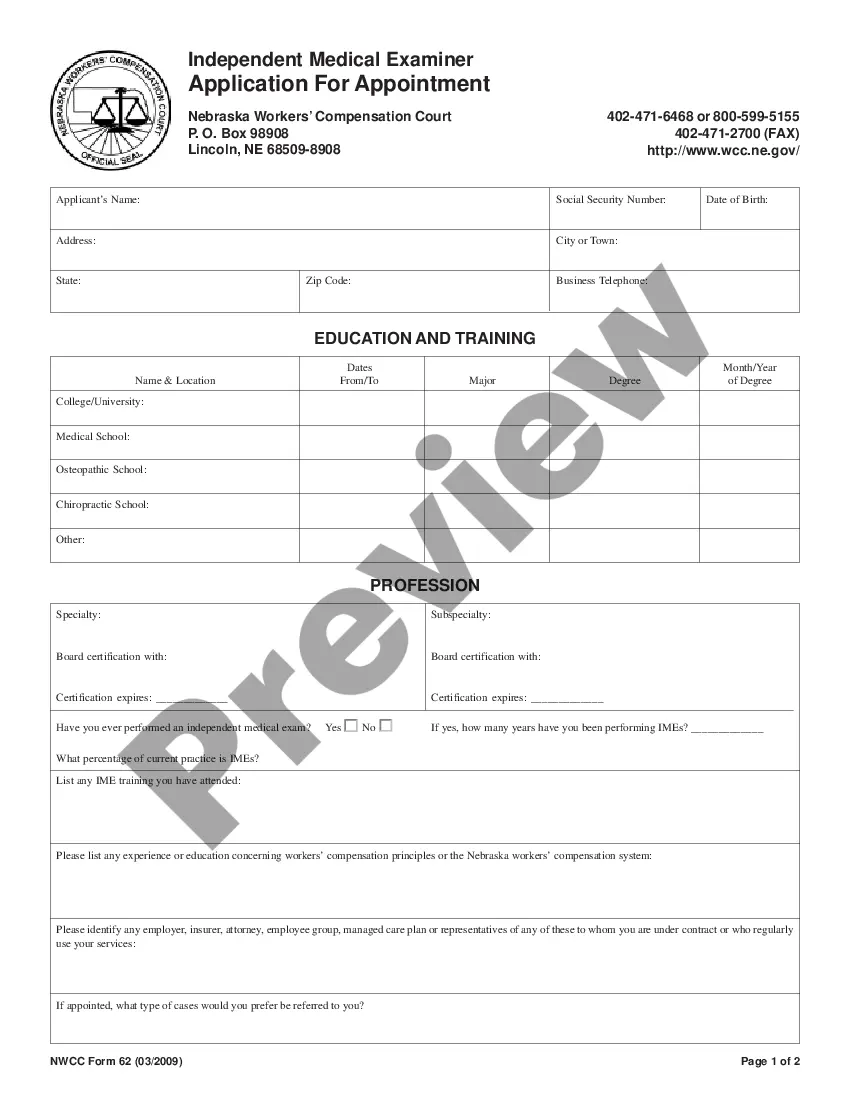

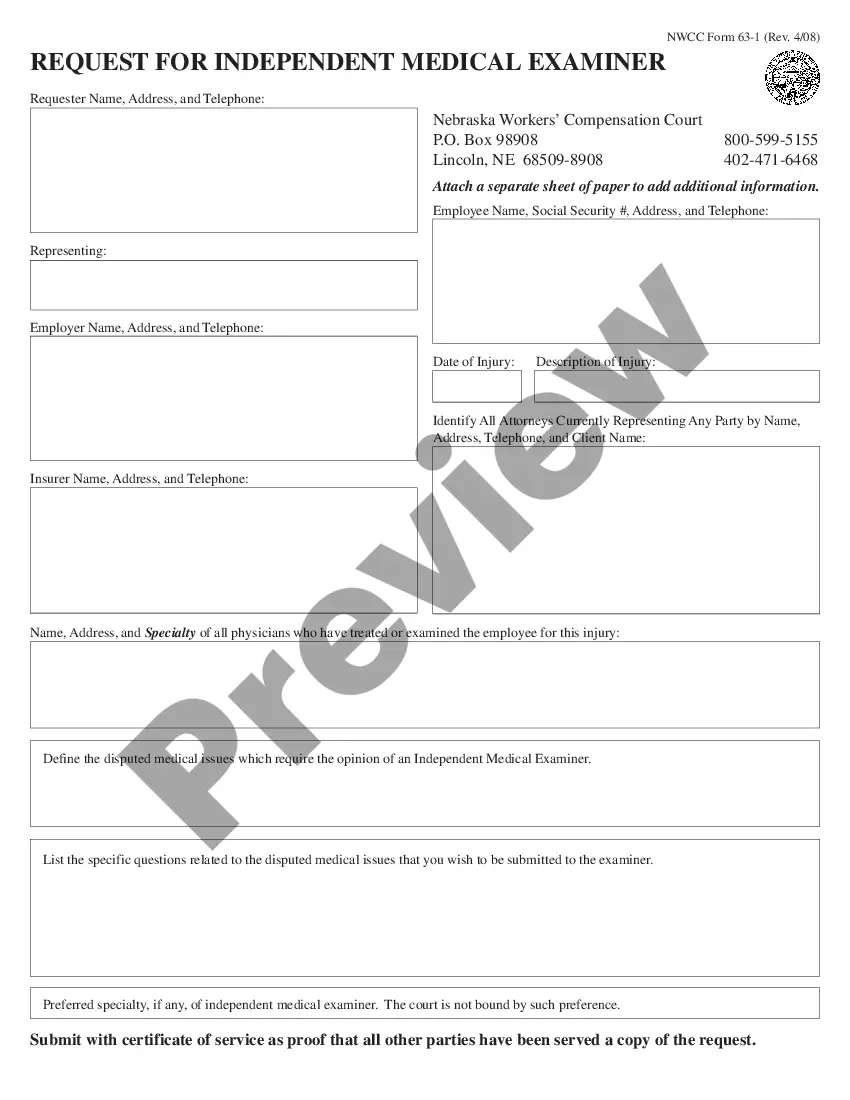

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Maricopa Credit Information Request, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Consequently, if you need the current version of the Maricopa Credit Information Request, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Credit Information Request:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Maricopa Credit Information Request and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!