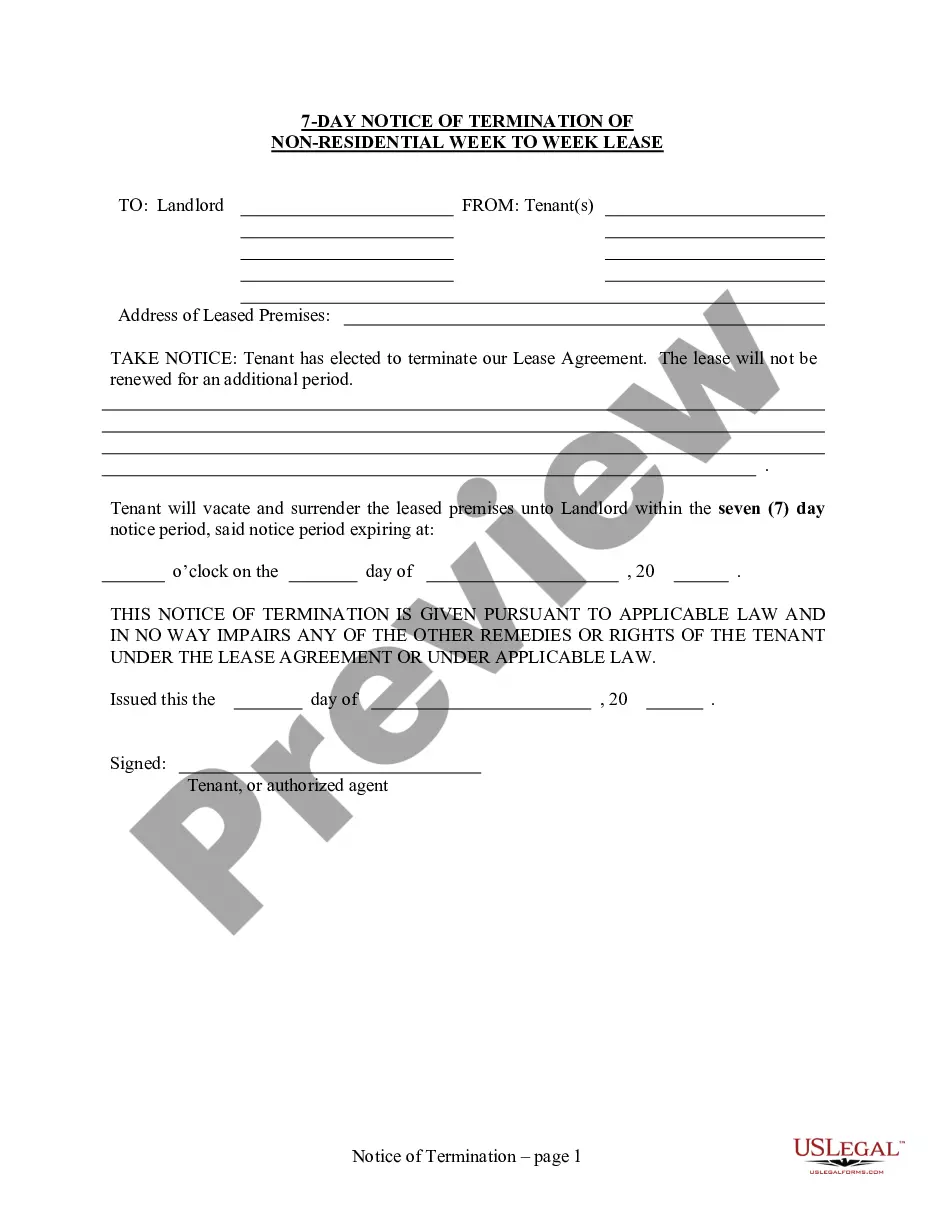

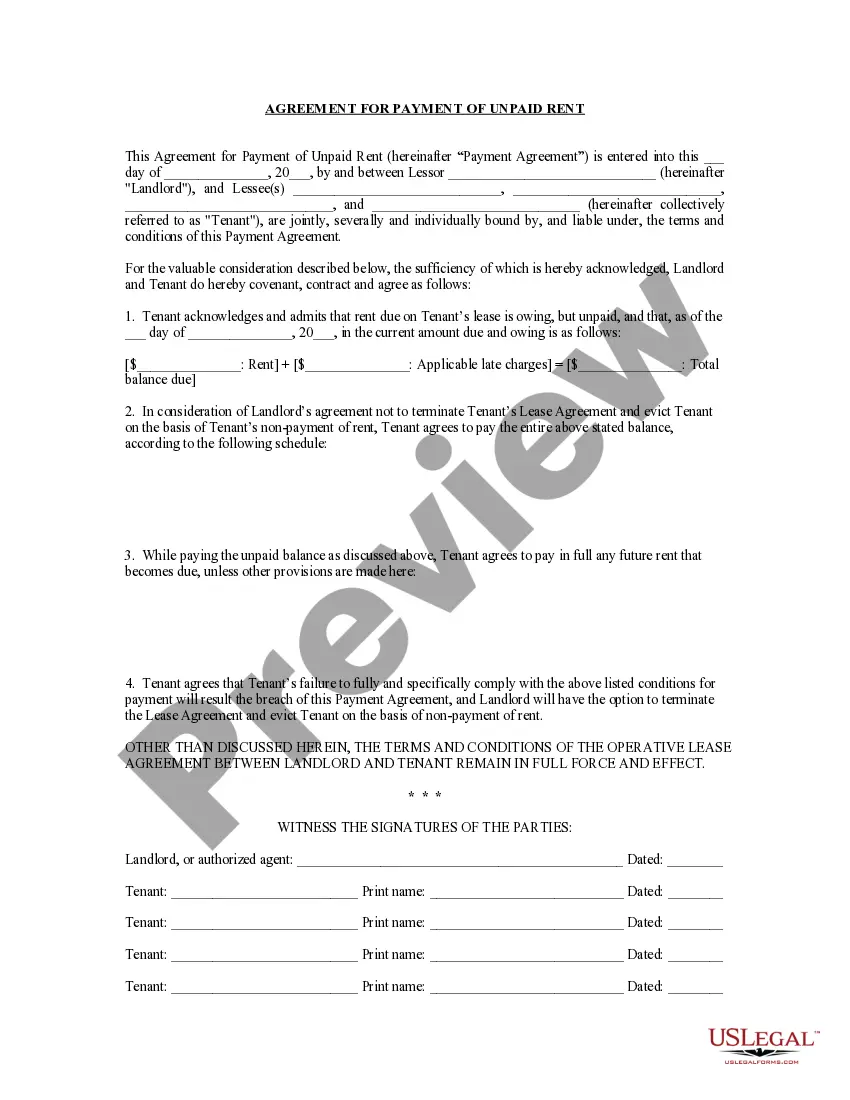

Nassau New York Credit Information Request is a formal process through which individuals or organizations can obtain credit-related information specific to Nassau County, located in the state of New York. This type of request is commonly used by potential lenders, employers, landlords, or other entities who require detailed insight into an individual's credit history and financial background in Nassau County. The Nassau County government, alongside numerous credit reporting agencies and private companies, facilitate these credit information requests to ensure transparency and accuracy in evaluating an individual's creditworthiness. Some different types of Nassau New York Credit Information Requests include: 1. Personal Credit Information Request: This type of request involves an individual seeking their own credit report for various purposes such as monitoring creditworthiness, identifying any errors or discrepancies, or preparing for significant financial decisions like buying a house or applying for a loan. 2. Business Credit Information Request: Businesses operating in Nassau County can also initiate credit information requests to evaluate the creditworthiness of potential partners, suppliers, or clients before entering into any financial agreements. This helps businesses assess the risk involved in extending credit or conducting business transactions with other entities. 3. Landlord Credit Information Request: Landlords or property management companies in Nassau County often require credit information from potential tenants to evaluate their financial stability and ability to pay rent on time. This type of request assists in minimizing risks associated with renting properties and ensuring the financial stability of the tenant. 4. Employment Credit Information Request: Certain employers, particularly those in financial institutions or positions of trust, may request credit information as part of their pre-employment screening process. This request aims to assess an applicant's financial responsibility and overall integrity, especially when the role involves handling financial matters or sensitive information. 5. Lender Credit Information Request: Financial institutions, such as banks or credit unions, need comprehensive credit information when assessing loan applications or extending credit to individuals residing in Nassau County. This request assists lenders in determining an applicant's creditworthiness, repayment history, and debt-to-income ratio to make informed lending decisions. To initiate a Nassau New York Credit Information Request, individuals or organizations usually need to provide relevant details such as name, address, Social Security number, and possibly additional identifying information. It is essential to follow the required protocols and meet any necessary eligibility criteria when making these requests to ensure compliance with existing regulations and protect personal information privacy.

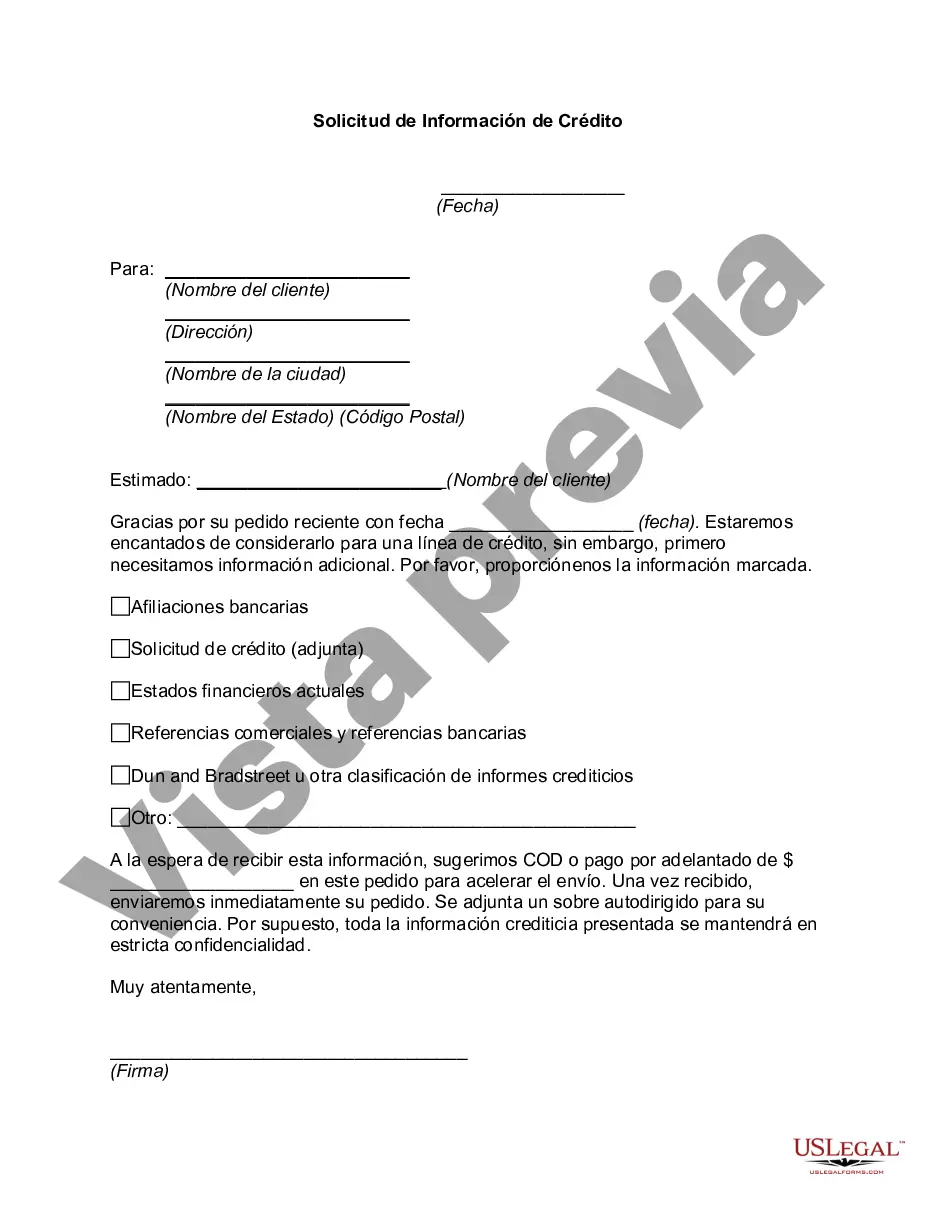

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Solicitud de Información de Crédito - Credit Information Request

Description

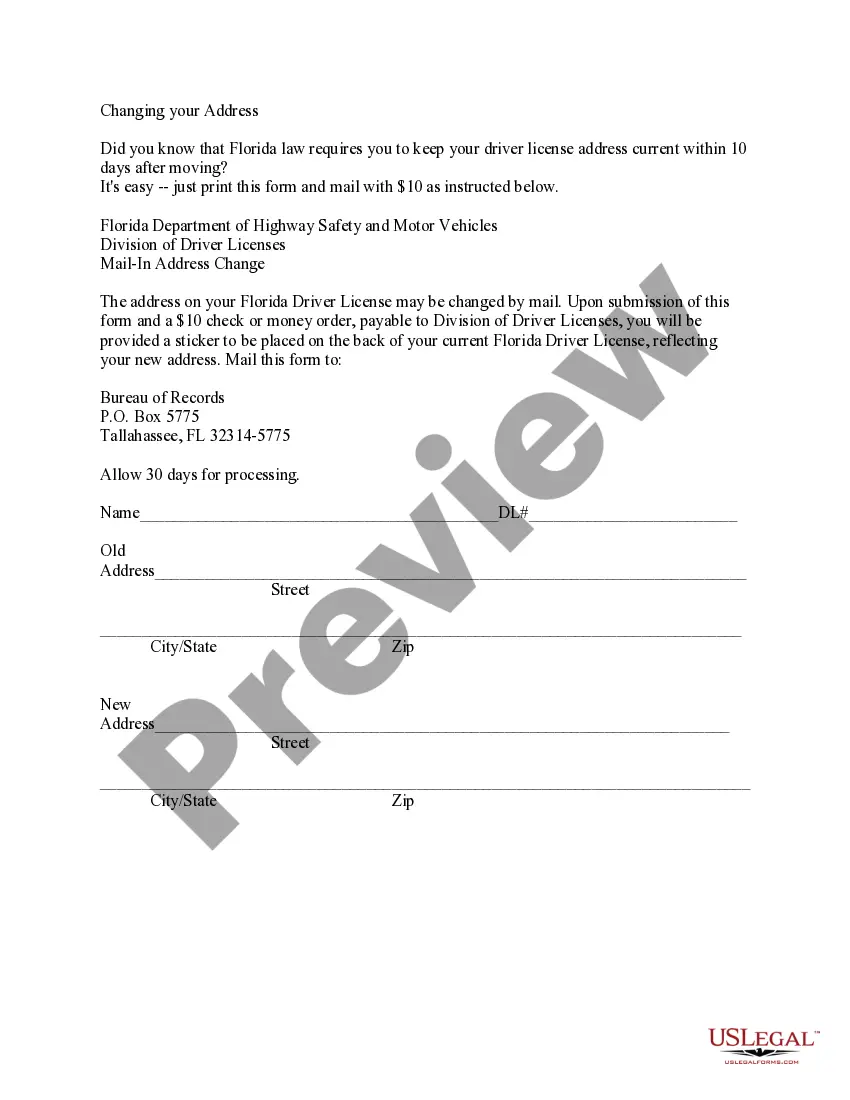

How to fill out Nassau New York Solicitud De Información De Crédito?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Nassau Credit Information Request is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several more steps to obtain the Nassau Credit Information Request. Adhere to the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Credit Information Request in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!