Philadelphia Pennsylvania Credit Information Request is a process that allows individuals or organizations to obtain relevant information related to their credit history and financial standing within the state of Pennsylvania, specifically in the city of Philadelphia. This request includes accessing various details such as credit scores, credit reports, loan history, repayment patterns, and other financial data. In Philadelphia, there are a few different types of Credit Information Requests available to meet specific needs: 1. Personal Credit Information Request: This type of request is designed for individuals who wish to obtain their personal credit information. By submitting the necessary paperwork and identification, individuals can access their credit reports, which provide a comprehensive overview of their credit score, outstanding loans, payment history, and other relevant financial details necessary for making informed financial decisions. 2. Business Credit Information Request: Philadelphia's Credit Information Request system also caters to businesses operating within the city. This type of request enables businesses to access their credit information, helping them evaluate their financial standing, maintain good creditworthiness, and make sound financial decisions. Companies can review their credit ratings, payment histories, and outstanding debts to improve their financial health. 3. Rental Credit Information Request: This category of credit information request specifically deals with rental history records. Prospective landlords or property managers can seek credit information of potential tenants to evaluate their reliability and determine their ability to fulfill rental obligations. This type of request helps landlords make informed decisions when selecting tenants, minimizing the risk of default or non-payment. 4. Mortgage Credit Information Request: This type of request focuses on credit information related to mortgages. Potential homebuyers in Philadelphia can access their credit information to gauge their eligibility for mortgage loans, determine interest rates, and negotiate loan terms. This request includes reviewing credit scores, credit history, and any outstanding debts, ensuring individuals are well-prepared to navigate the mortgage application process. Philadelphia Pennsylvania Credit Information Requests are essential for various purposes, such as securing loans, renting properties, establishing creditworthiness, and making informed financial decisions. By availing these different types of credit information requests, individuals and businesses can gain insights into their financial health, enabling them to take necessary steps to improve their credit standing and achieve their financial goals.

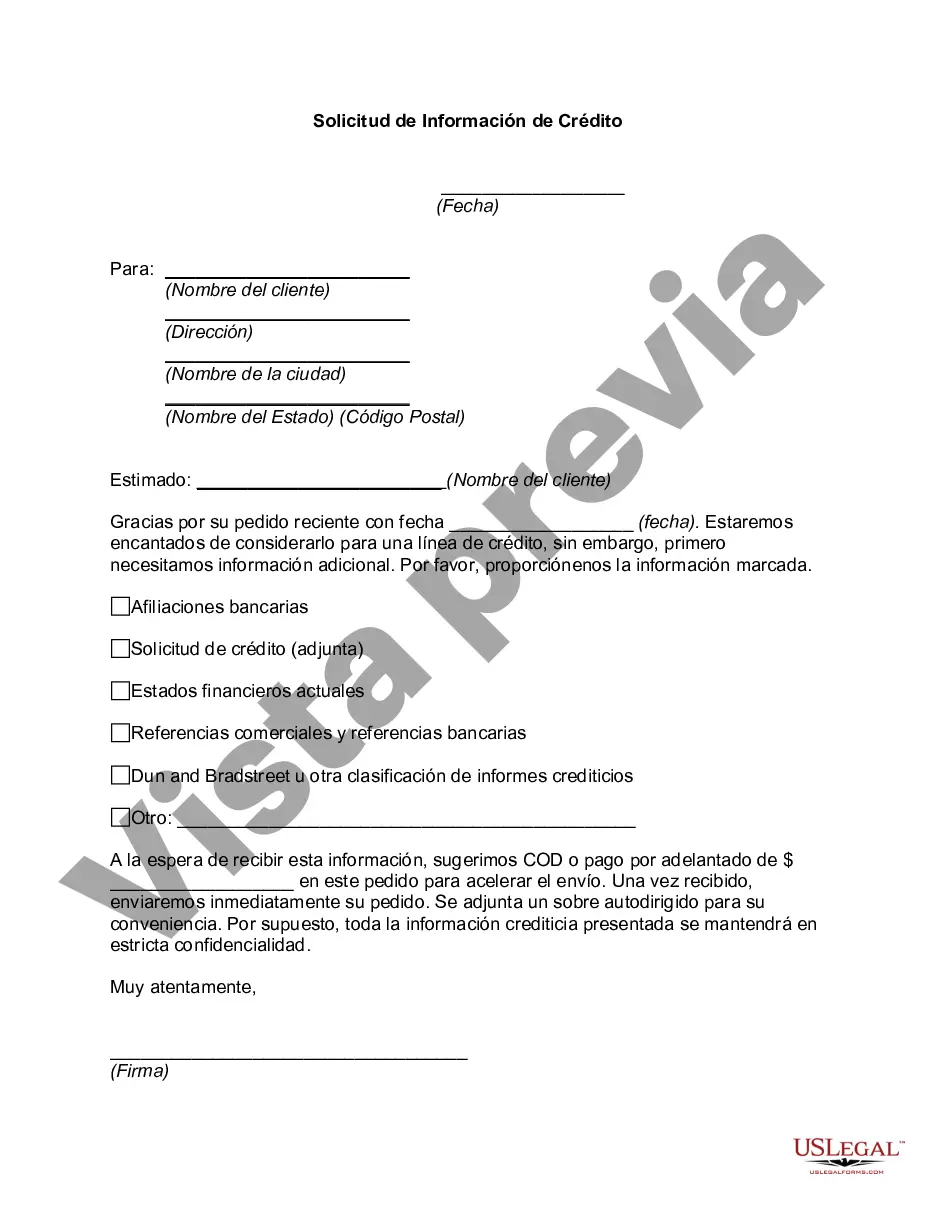

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Philadelphia Pennsylvania Solicitud De Información De Crédito?

If you need to get a trustworthy legal form provider to obtain the Philadelphia Credit Information Request, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to find and execute various papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to search or browse Philadelphia Credit Information Request, either by a keyword or by the state/county the form is created for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Philadelphia Credit Information Request template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and select a subscription plan. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less expensive and more reasonably priced. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Philadelphia Credit Information Request - all from the convenience of your home.

Join US Legal Forms now!