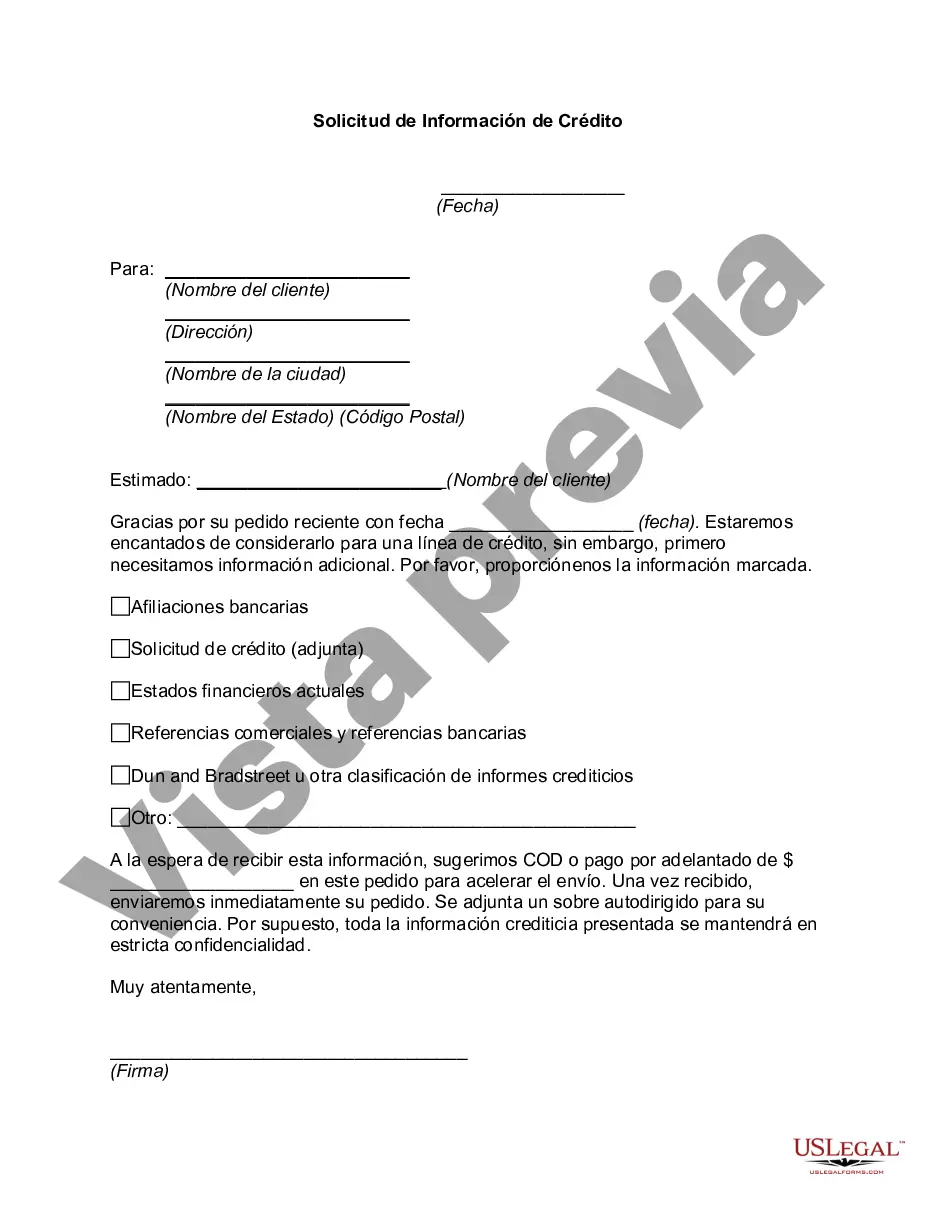

San Jose California Credit Information Request refers to the process of obtaining credit-related information in San Jose, California. This request is crucial for individuals, businesses, or organizations seeking to gather data about their credit history or creditworthiness. San Jose, being a major city in California, offers various types of credit information requests to cater to different needs. These requests could include the following: 1. Personal Credit Information Request: This type of request is made by individuals who want to access their personal credit information in San Jose, California. It allows individuals to review their credit reports, credit scores, and other relevant credit-related data. Personal credit information is essential for assessing one's financial standing, making major purchases, or applying for loans. 2. Business Credit Information Request: Businesses in San Jose, California, can request credit information specific to their company. This includes accessing their business credit reports, credit scores, and other details related to their creditworthiness. Such information is vital for businesses when seeking financing, establishing partnerships, or evaluating financial risks. 3. Credit Information Request for Lenders: Lenders, such as banks or financial institutions, often have specific credit information requests tailored to their requirements. These requests may involve obtaining credit reports, credit scores, payment history, and other relevant data of potential borrowers in San Jose, California. Lenders use this information to determine the creditworthiness of applicants and make informed lending decisions. 4. Credit Information Request for Landlords: Landlords in San Jose, California, may have a credit information request process in place when screening potential tenants. This request allows landlords to assess an individual's credit history, including rental payment records, outstanding debts, and any negative credit events. This information helps landlords make informed decisions about selecting reliable tenants. 5. Credit Information Request for Employment Screening: Some employers in San Jose, California, may require credit information requests as part of their pre-employment screening process. This type of request involves accessing an applicant's credit reports, which can provide insights into their financial responsibility and ability to manage money. Employers may consider credit information for positions involving financial responsibilities or when assessing an applicant's overall reliability. 6. Mortgage Credit Information Request: Individuals or businesses looking to secure a mortgage in San Jose, California, may need to submit a specific credit information request to lenders or mortgage brokers. This request allows lenders to evaluate the creditworthiness and repayment capacity of borrowers. The credit information provided includes credit history, credit scores, debt-to-income ratio, and other pertinent details. In conclusion, San Jose California Credit Information Request encompasses various types of requests tailored to the specific needs of individuals, businesses, lenders, landlords, employers, and mortgage applicants. These requests serve as a crucial tool in assessing creditworthiness, making informed decisions, and ensuring financial stability in San Jose, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out San Jose California Solicitud De Información De Crédito?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business objective utilized in your region, including the San Jose Credit Information Request.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the San Jose Credit Information Request will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the San Jose Credit Information Request:

- Make sure you have opened the proper page with your local form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the San Jose Credit Information Request on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!