Suffolk New York Credit Information Request is a process through which individuals or businesses in Suffolk County, New York, can obtain crucial credit information about themselves or other entities. This information is essential for making informed decisions related to securing loans, applying for credit cards, or engaging in any financial activities that involve assessing creditworthiness. The Suffolk New York Credit Information Request allows residents or businesses to access their credit reports, scores, and other financial information from various credit reporting agencies. By reviewing these reports, individuals can assess their financial health, identify any potential errors or discrepancies, and take necessary steps to improve their credit profiles. There are a few different types of credit information requests available in Suffolk New York: 1. Personal Credit Information Request: This type of request enables individuals to access their own credit reports, which consist of a detailed summary of their credit history, including credit accounts, payment history, and public records such as bankruptcies or liens. Suffolk New York residents can benefit from reviewing their credit reports periodically to ensure accuracy and to detect any signs of identity theft. 2. Business Credit Information Request: This type of request allows business owners in Suffolk New York to obtain their business credit reports, which provide an overview of their company's creditworthiness. Lenders and vendors often refer to these reports to assess the financial stability and reliability of a business. 3. Third-Party Credit Information Request: In certain situations, individuals or entities may need to request credit information about another person or business. This could include landlords screening potential tenants, employers assessing job applicants, or lenders evaluating loan applicants. The Suffolk New York Credit Information Request process enables authorized requesters to obtain credit information on another entity with their consent or under legal requirements. The Suffolk New York Credit Information Request process is governed by the Fair Credit Reporting Act (FCRA) and other applicable laws and regulations to protect individuals' rights to access accurate credit information. It is important to follow the proper procedure, including providing identification verification and paying any necessary fees, to obtain valid and trustworthy credit reports. In conclusion, Suffolk New York Credit Information Request is a valuable service that grants residents and businesses access to their credit information. By utilizing this service, individuals can monitor their financial health, address any credit-related issues promptly, and make informed decisions based on their creditworthiness.

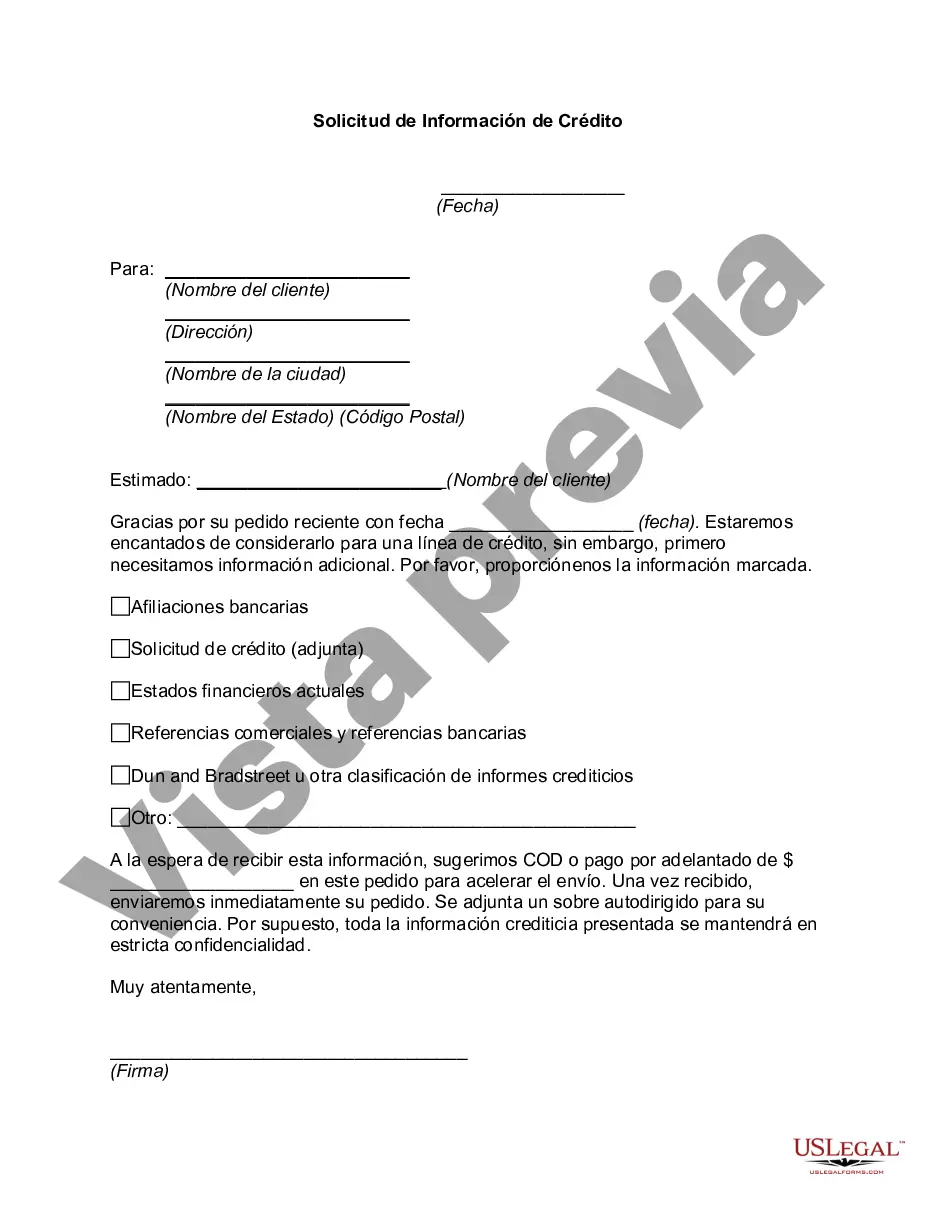

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out Suffolk New York Solicitud De Información De Crédito?

Do you need to quickly draft a legally-binding Suffolk Credit Information Request or probably any other form to take control of your personal or business affairs? You can go with two options: hire a professional to draft a valid paper for you or create it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific form templates, including Suffolk Credit Information Request and form packages. We provide templates for a myriad of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- First and foremost, carefully verify if the Suffolk Credit Information Request is tailored to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's intended for.

- Start the searching process again if the template isn’t what you were seeking by using the search bar in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Suffolk Credit Information Request template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our services. Moreover, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!