Allegheny Pennsylvania Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is a legal contract that outlines the terms and conditions for the purchase and sale of a deceased partner's interest within a professional partnership in the Allegheny state. In the unfortunate event of a partner's death, this agreement ensures a smooth transition of ownership by facilitating the purchase of the deceased partner's share. By integrating life insurance policies, the buy-sell agreement provides the necessary funds to complete the transaction, ensuring financial stability and continuity within the partnership. The agreement typically includes the following key elements and components: 1. Parties Involved: The agreement clarifies the identities and roles of the partners involved, including the deceased partner and the remaining partners. 2. Triggering Events: The agreement specifies the triggering events that will activate the buy-sell provision, such as the death of a partner. This provision is essential to initiate the purchase of the deceased partner's share. 3. Valuation Mechanism: Different methods can be utilized to determine the value of the partner's interest, such as a pre-determined formula, an independent appraiser, or a mutually agreed-upon method. The agreement outlines the chosen mechanism to ensure a fair and accurate valuation. 4. Funding: Life insurance plays a crucial role in funding the buy-sell agreement. The agreement details the insurance policies, their beneficiaries, and the amount of coverage needed to finance the purchase of the deceased partner's interest. 5. Purchase Terms: The agreement specifies how the purchase will be executed, including the payment terms, timeframes, and any installment options. This section ensures transparency and clarity regarding the purchase process. 6. Restrictions and Rights: The agreement may include provisions that restrict the transfer of a partner's interest to third parties without the consent of the remaining partners. It also outlines the rights and responsibilities of the partners during the transition period. Different types of Allegheny Pennsylvania Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership may vary based on the specific needs and preferences of the partnership. These variations could include different valuation methods, customized funding strategies, and unique triggering events. It is important for the partners to consult with legal and financial professionals to ensure the agreement aligns with their specific circumstances and objectives. Overall, an Allegheny Pennsylvania Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership provides a framework for a seamless transition of ownership in the event of a partner's death. By combining the benefits of life insurance and a well-structured agreement, this arrangement promotes stability, fairness, and continuity within the professional partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Acuerdo de compra-venta con seguro de vida para financiar la compra del interés del socio fallecido en una sociedad profesional - Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership

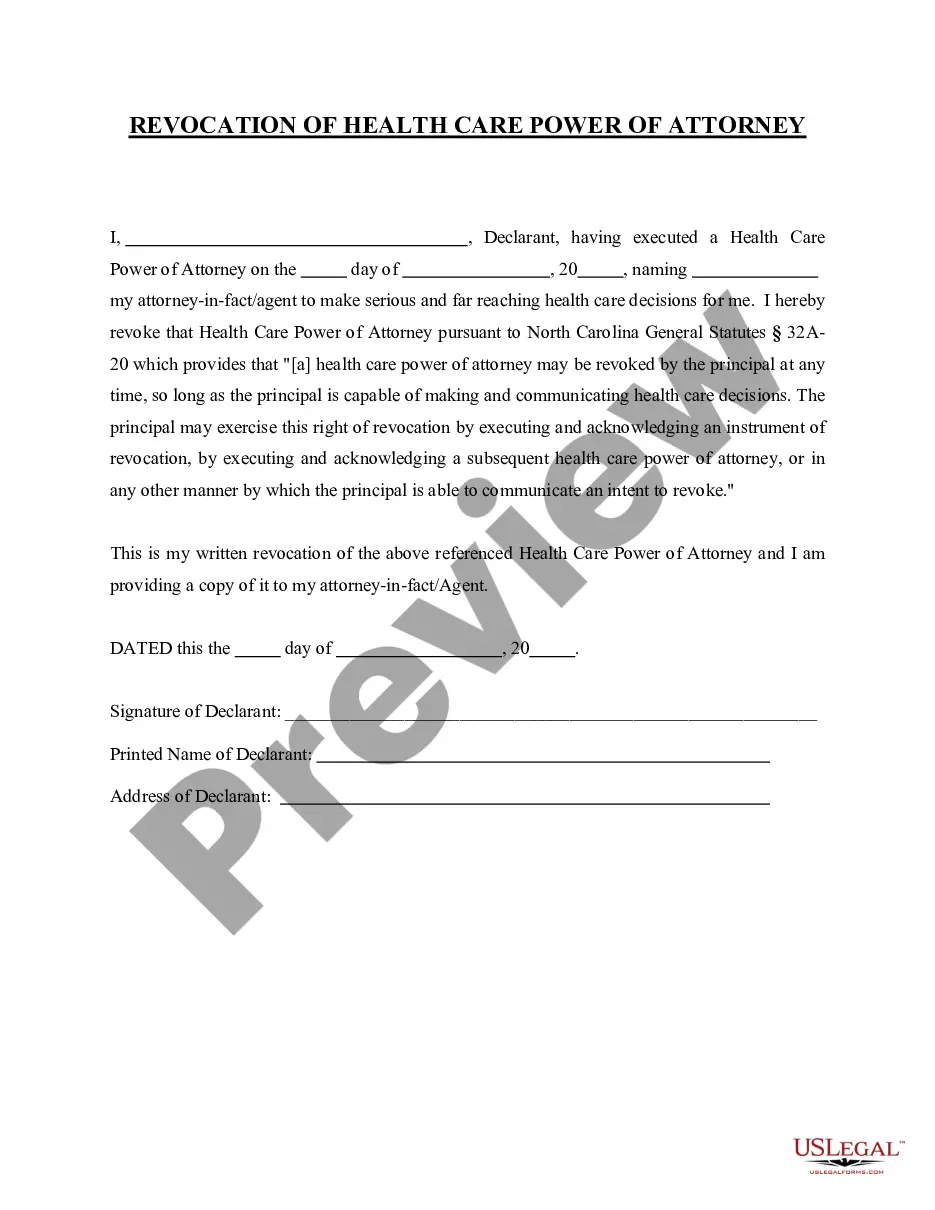

Description

How to fill out Allegheny Pennsylvania Acuerdo De Compra-venta Con Seguro De Vida Para Financiar La Compra Del Interés Del Socio Fallecido En Una Sociedad Profesional?

Draftwing paperwork, like Allegheny Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership, to take care of your legal affairs is a tough and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents crafted for different scenarios and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Allegheny Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Allegheny Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership:

- Ensure that your template is specific to your state/county since the regulations for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Allegheny Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our service and get the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is good to go. You can try and download it.

It’s an easy task to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!