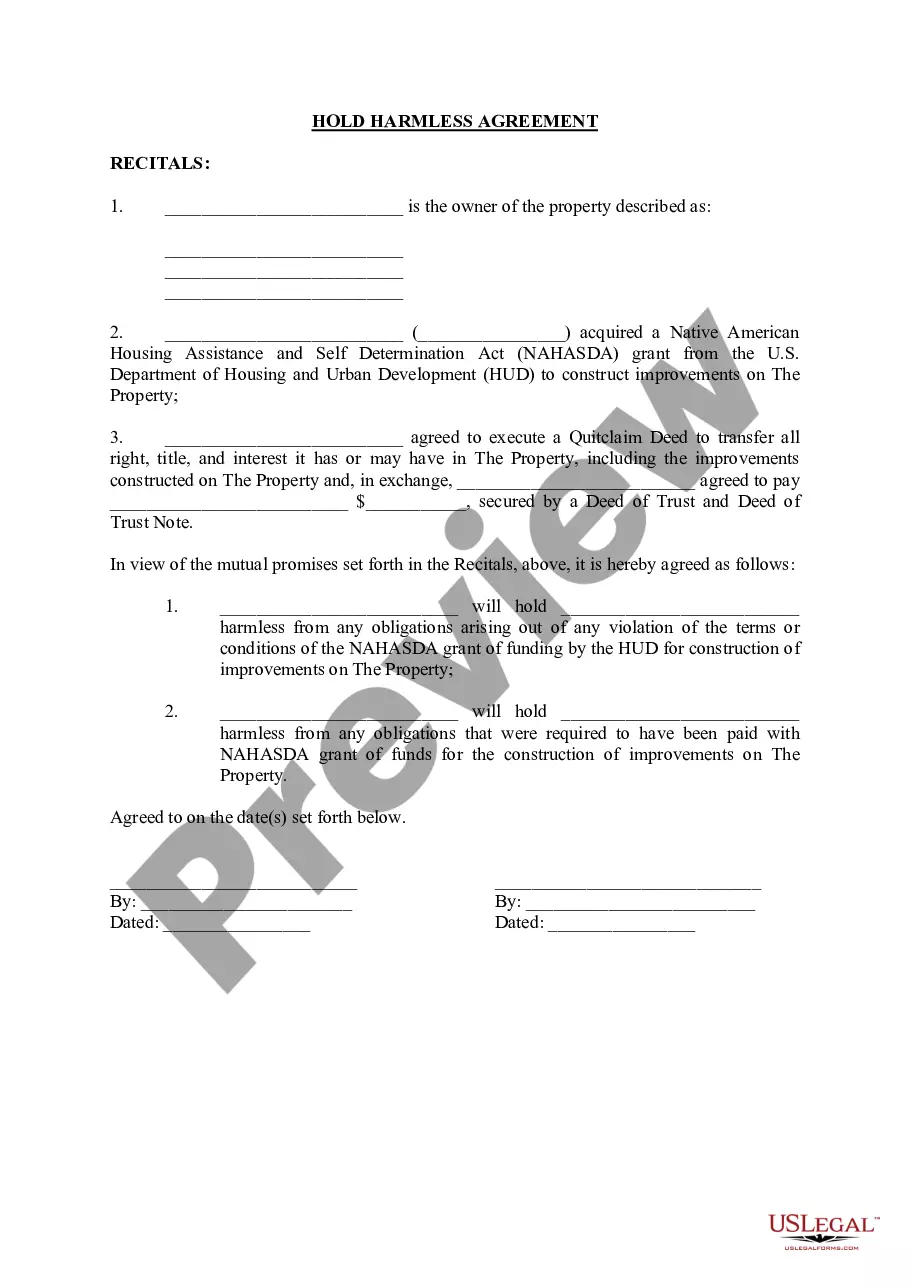

Nassau New York Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership A Nassau New York Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership is a legal contract that outlines the terms and conditions for the sale or purchase of a deceased partner's ownership interest in a professional partnership. This agreement is commonly used by professionals such as doctors, lawyers, architects, and accountants who operate as partners in a business. The primary purpose of the Buy-Sell Agreement is to ensure a smooth transition of ownership in the event of a partner's death. The inclusion of life insurance in the agreement ensures that funds are readily available to facilitate the purchase of the deceased partner's interest in the remaining partners. This arrangement provides financial security and stability to the partnership and mitigates the risk of potential disputes or disruptions that may arise due to the absence of a partner. There are different types of Nassau New York Buy-Sell Agreements with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership, including: 1. Cross-Purchase Agreement: In this type of agreement, each partner individually purchases life insurance policies on the lives of the other partners. If a partner passes away, the surviving partners can use the insurance proceeds to buy the deceased partner's interest from their heirs or beneficiaries. 2. Entity Purchase Agreement: Also known as a stock redemption agreement, this agreement involves the professional partnership entity itself purchasing life insurance policies on the lives of each partner. In the event of a partner's death, the partnership uses the insurance proceeds to buy the deceased partner's interest from their heirs or beneficiaries. 3. Wait-and-See Agreement: This hybrid agreement combines elements of both cross-purchase and entity purchase agreements. Initially, the partners individually purchase life insurance policies on each other's lives. However, in the event of a partner's death, the surviving partners have the flexibility to choose whether they want to exercise their option to purchase the deceased partner's interest individually or allow the partnership to buy it. Regardless of the type of agreement, the Nassau New York Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership offers several benefits. It ensures a smooth transfer of ownership, protects the interests of all partners, provides financial security to the deceased partner's family, and maintains the stability and continuity of the professional partnership. Consulting an experienced attorney specializing in partnership agreements and life insurance is crucial to ensure that the agreement aligns with the specific needs and circumstances of the professional partnership in Nassau New York.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Acuerdo de compra-venta con seguro de vida para financiar la compra del interés del socio fallecido en una sociedad profesional - Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership

Description

How to fill out Nassau New York Acuerdo De Compra-venta Con Seguro De Vida Para Financiar La Compra Del Interés Del Socio Fallecido En Una Sociedad Profesional?

Draftwing paperwork, like Nassau Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership, to manage your legal matters is a difficult and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task not really affordable. However, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents created for various scenarios and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Nassau Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before getting Nassau Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership:

- Make sure that your form is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Nassau Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our website and download the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!