A buy-sell agreement with life insurance is a legal contract designed to facilitate a smooth transition of ownership in a professional partnership following the death of one of the partners. In San Antonio, Texas, this agreement is a commonly utilized tool among professionals such as physicians, attorneys, accountants, and other business partners. The purpose of this agreement is to establish a predetermined mechanism for the purchase and sale of the deceased partner's interest in the partnership, ensuring a financial arrangement that benefits both the surviving partner(s) and the deceased partner's estate. By incorporating life insurance as a funding mechanism, the surviving partner(s) can use the insurance proceeds to buy out the deceased partner's share of the business. There are different types of San Antonio Texas buy-sell agreements with life insurance to fund the purchase of a deceased partner's interest: 1. Cross-Purchase Agreement: In this type of agreement, each partner agrees to purchase the other partner's interest in the event of death. The partners take out life insurance policies on each other, with the proceeds used to buy the deceased partner's share from their estate. 2. Entity Redemption Agreement: In this arrangement, the partnership itself purchases life insurance policies on each partner. In the event of a partner's death, the partnership uses the insurance proceeds to buy and retire the deceased partner's interest. 3. Wait-and-See Agreement: This agreement combines elements of the cross-purchase and entity redemption strategies. Partners initially agree on a wait-and-see approach, allowing the surviving partner(s) to decide whether they want to buy the deceased partner's interest personally or have the partnership redeem it. 4. One-Way Agreement: This agreement applies when there is only one surviving partner remaining in the partnership. The life insurance proceeds are used solely by the surviving partner to buy the deceased partner's interest. The San Antonio Texas buy-sell agreement with life insurance to fund the purchase of a deceased partner's interest in a professional partnership provides financial security and peace of mind to both partners and their families. It ensures a smooth transition of ownership and protects the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Acuerdo de compra-venta con seguro de vida para financiar la compra del interés del socio fallecido en una sociedad profesional - Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership

Description

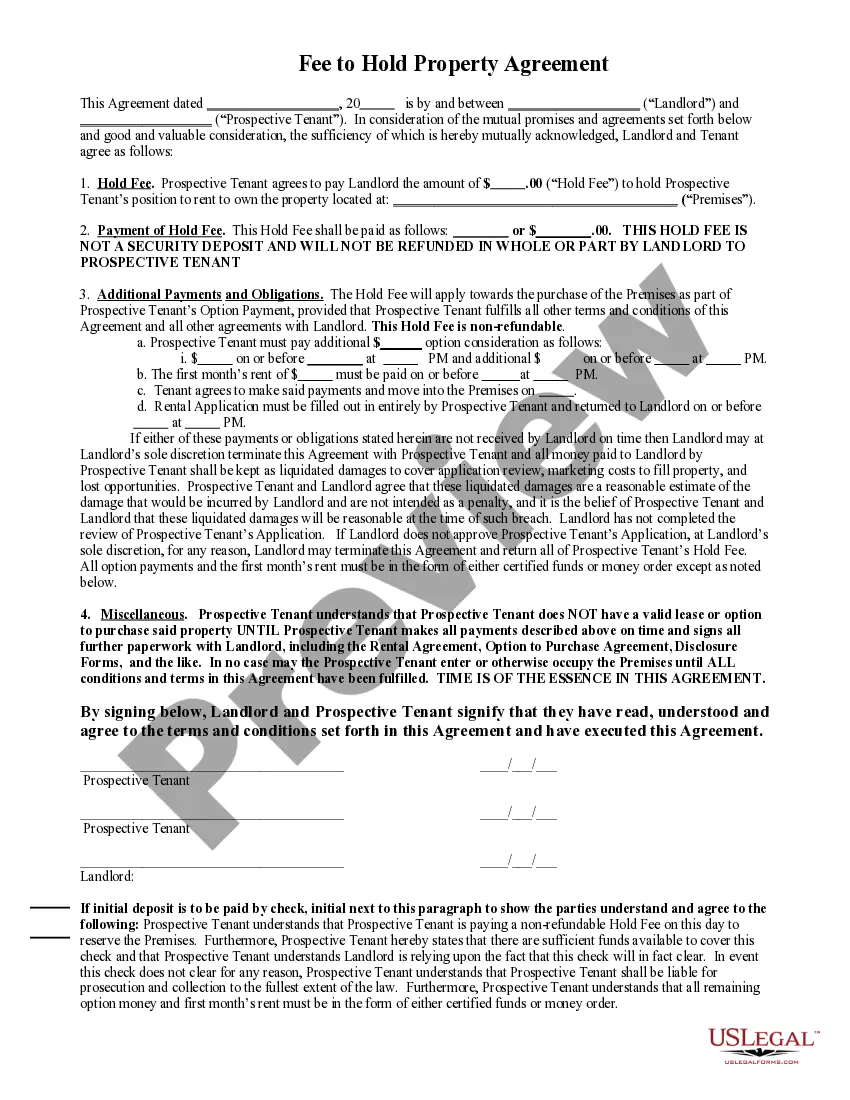

How to fill out San Antonio Texas Acuerdo De Compra-venta Con Seguro De Vida Para Financiar La Compra Del Interés Del Socio Fallecido En Una Sociedad Profesional?

How much time does it usually take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a San Antonio Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership suiting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Aside from the San Antonio Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you get your San Antonio Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Antonio Buy-Sell Agreement with Life Insurance to Fund Purchase of Deceased Partner's Interest in a Professional Partnership.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!