Mecklenburg North Carolina Notice of Disputed Account: Understanding Your Rights and Options Keywords: Mecklenburg, North Carolina, Notice of Disputed Account, rights, options, creditor, consumer, debt, dispute, credit reporting agencies, Fair Credit Reporting Act, investigation, resolution, types. Introduction: The Mecklenburg North Carolina Notice of Disputed Account is an important legal document that offers consumers in Mecklenburg County, North Carolina, protection when faced with inaccuracies or discrepancies in their accounts. This notice allows individuals to assert their rights and dispute any debts they believe to be invalid, helping to ensure fair and accurate credit reporting. In this article, we will delve into the details of Mecklenburg North Carolina Notice of Disputed Account, highlighting different types and explaining the rights, options, and process involved. Types of Mecklenburg North Carolina Notice of Disputed Account: 1. Notice of Disputed Debt: This type of notice is submitted by consumers who believe a debt claimed by a creditor is either incorrect, outdated, or not owed at all. Debtors can initiate this process to challenge debts and seek validation or rectification when faced with discrepancies. 2. Notice of Disputed Credit Report: Consumers can also encounter situations where their credit reports contain inaccuracies, such as outdated or incorrect information, unauthorized accounts, or erroneous negative entries. By submitting a Notice of Disputed Credit Report, individuals can contest these inaccuracies and ensure that their credit histories are rectified. Rights and Options for Consumers: When confronted with a Mecklenburg North Carolina Notice of Disputed Account situation, consumers possess specific rights and options that are safeguarded by both federal and state laws. Here are some vital points to consider: 1. The Fair Credit Reporting Act (FCRA): Under this federal law, consumers have the right to dispute inaccurate information on their credit reports, including the debts listed. The FCRA mandates that credit reporting agencies conduct timely investigations to resolve disputes promptly. 2. Detailed Dispute Process: Individuals should gather relevant documents and evidence to support their claims before submitting a Notice of Disputed Account. Clear and concise explanations, along with any supporting documentation, can strengthen the case during the investigation process. 3. Credit Reporting Agency Investigation: Upon receiving the Notice of Disputed Account, credit reporting agencies are obligated to investigate the claim within 30 days. They must contact the creditor responsible for the reported debt and review all relevant information to determine its validity. 4. Resolving Disputes: Once the investigation is complete, the credit reporting agency must inform the consumer of the results. If the dispute is resolved in favor of the consumer, the agency is required to rectify the inaccuracies, update the credit report, and inform other credit bureaus about the changes. Conclusion: The Mecklenburg North Carolina Notice of Disputed Account empowers consumers in the county to challenge and rectify inaccurate debts or credit report entries. By understanding their rights and options and adhering to the appropriate process, individuals can take an active role in securing fair and accurate credit reporting. If you believe a debt or credit report entry is inaccurate, it is crucial to take prompt action and submit a Notice of Disputed Account to protect your financial well-being and reputation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Aviso de cuenta en disputa - Notice of Disputed Account

Description

How to fill out Mecklenburg North Carolina Aviso De Cuenta En Disputa?

Drafting papers for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Mecklenburg Notice of Disputed Account without professional help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Mecklenburg Notice of Disputed Account on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Mecklenburg Notice of Disputed Account:

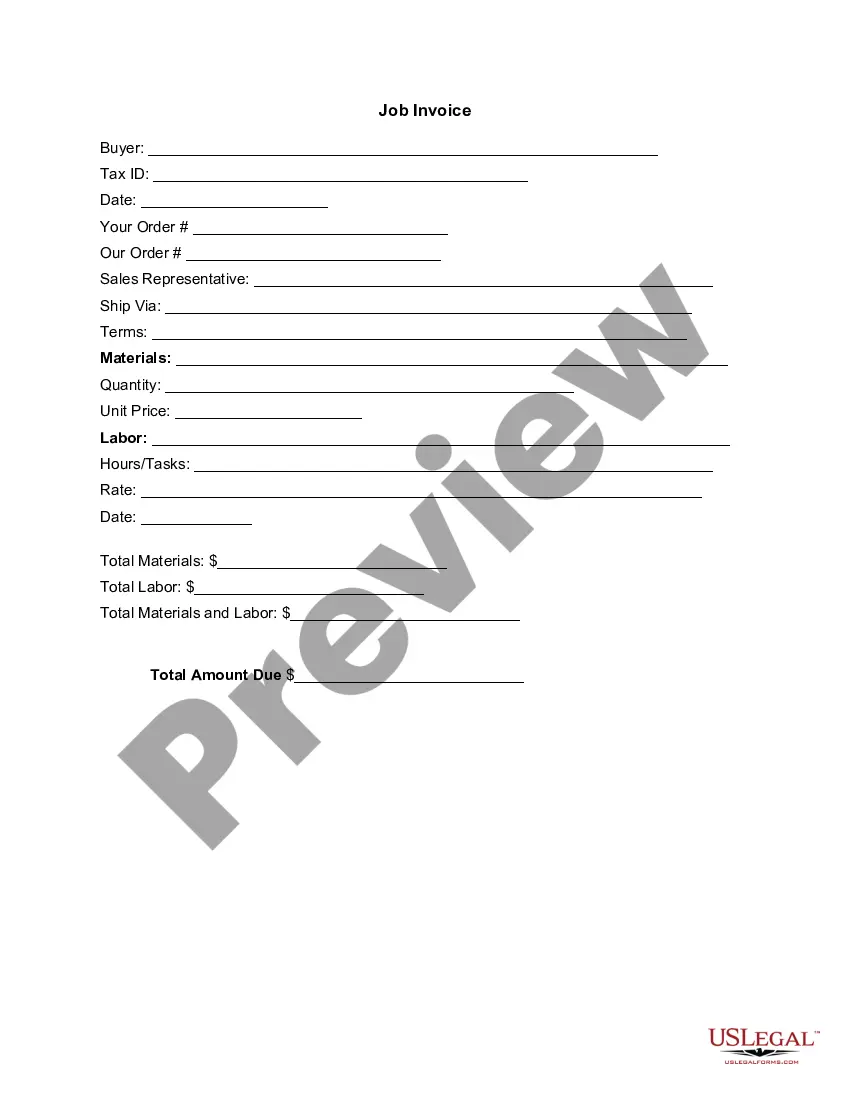

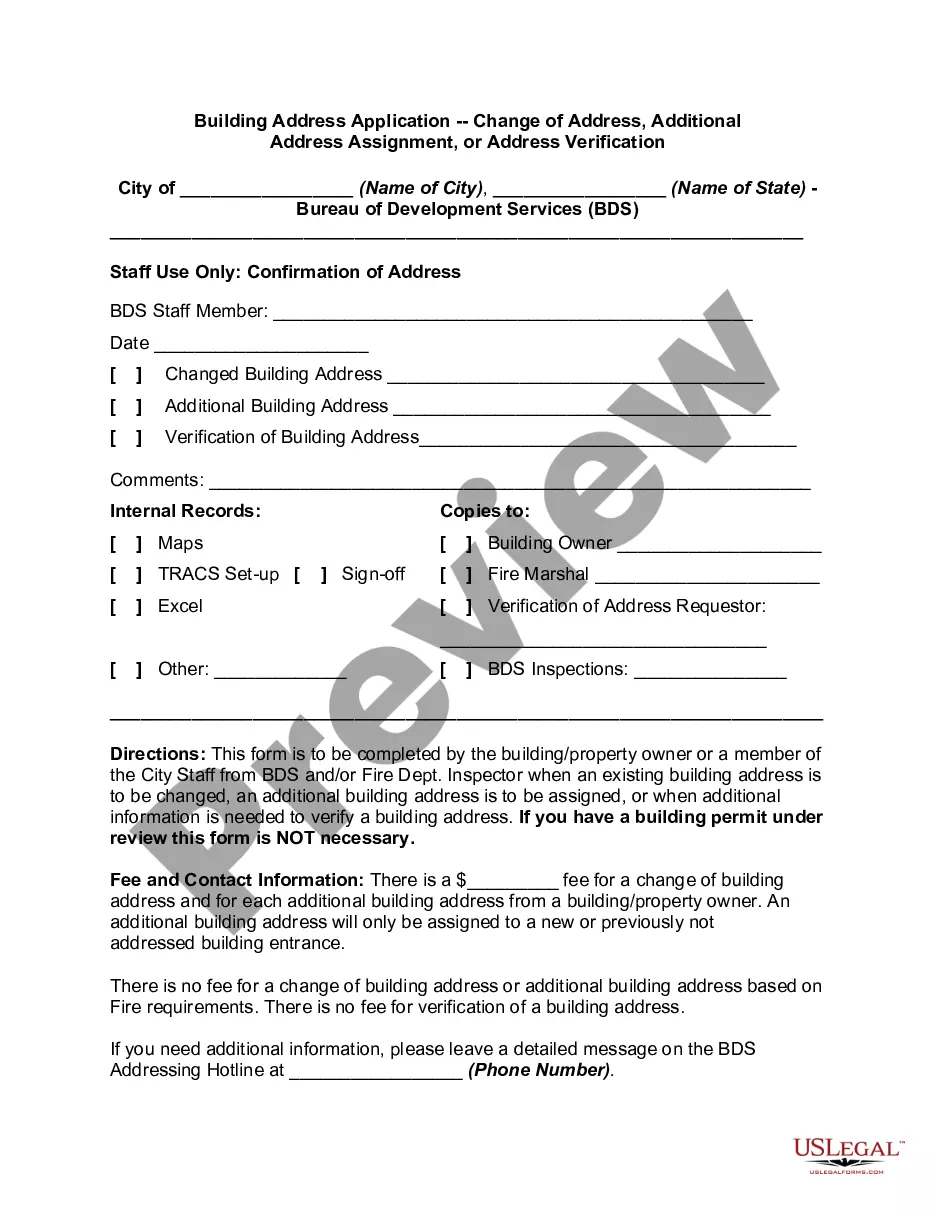

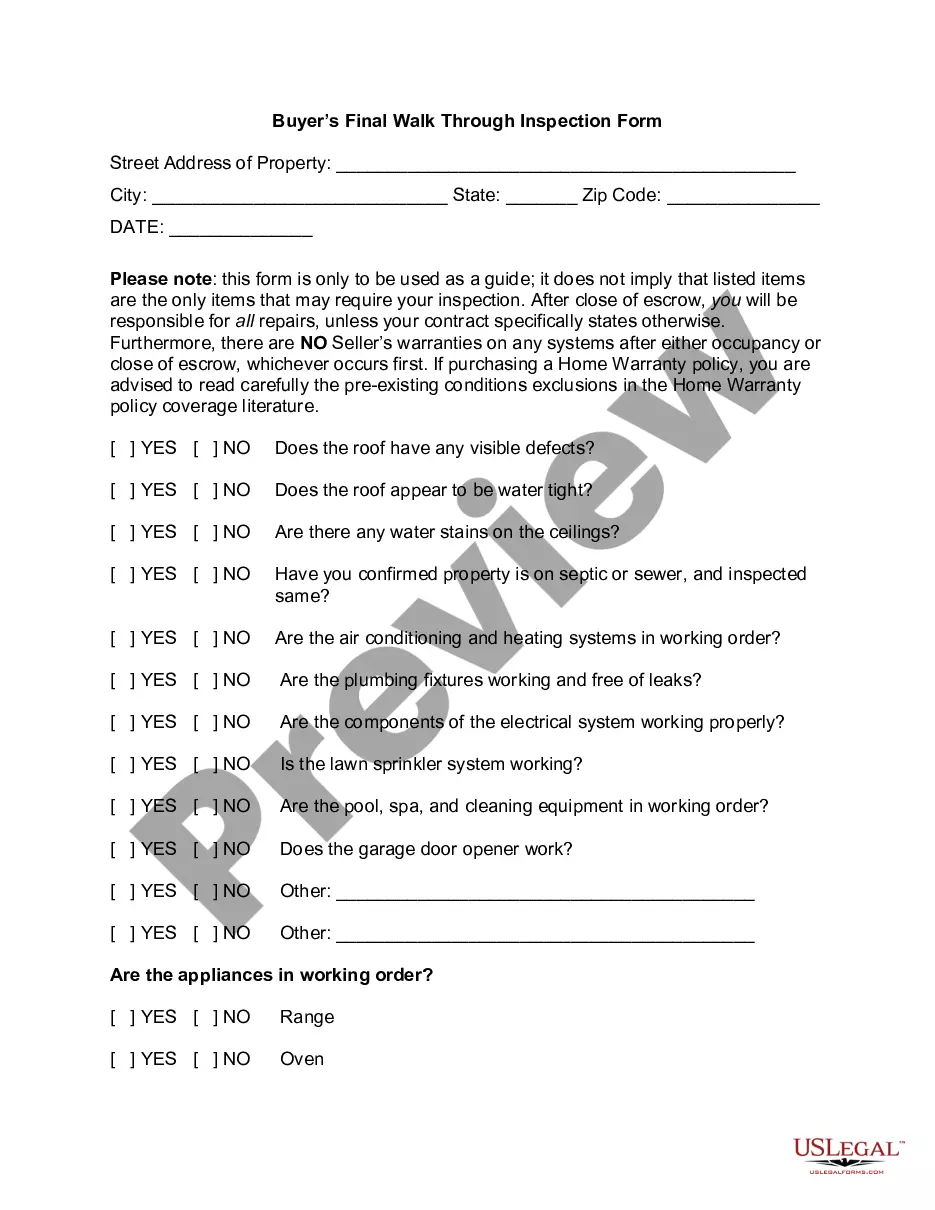

- Look through the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a few clicks!