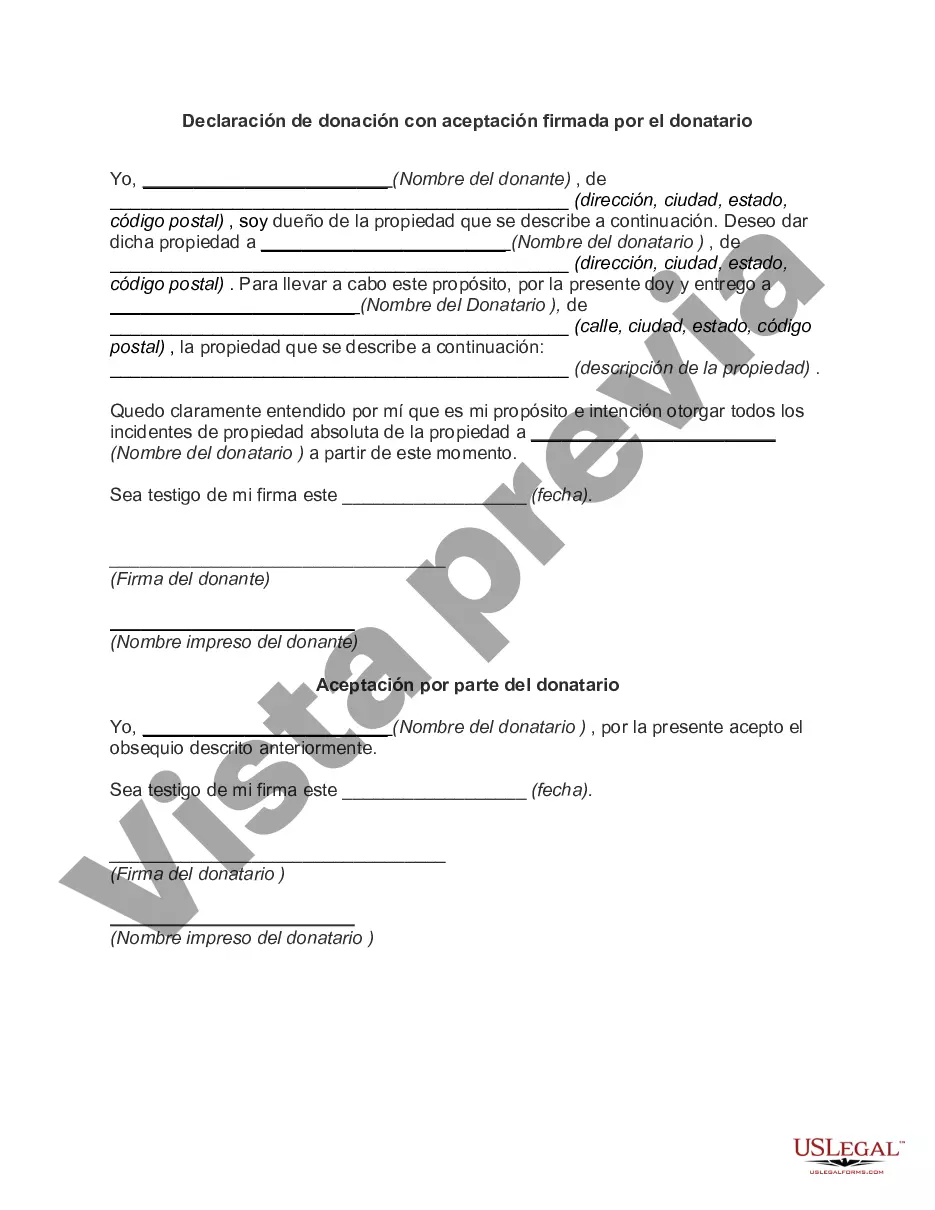

Oakland Michigan Declaración de donación con aceptación firmada por el donatario - Declaration of Gift with Signed Acceptance by Donee

Description

How to fill out Declaración De Donación Con Aceptación Firmada Por El Donatario?

Whether you plan to launch your enterprise, enter into an agreement, request an ID amendment, or address familial legal matters, you must gather particular documentation complying with your local statutes and regulations.

Finding the appropriate documents may require significant time and effort unless you utilize the US Legal Forms library.

The platform offers users over 85,000 expertly drafted and confirmed legal papers for any personal or business situation. All documents are categorized by state and region of use, making it quick and straightforward to select a copy like the Oakland Declaration of Gift with Signed Acceptance by Donee.

Documents offered in our library can be reused. With an active subscription, you can access all of your previously purchased documents anytime in the My documents section of your profile. Stop wasting time on an endless quest for current official documentation. Join the US Legal Forms platform and maintain your paperwork in order with the most extensive online form collection!

- Ensure the form aligns with your personal requirements and state legal standards.

- Review the form description and inspect the Preview if available on the page.

- Use the search feature to enter your state above to find another template.

- Click Buy Now to acquire the document once you locate the correct one.

- Choose the subscription plan that best fits your needs to proceed.

- Log in to your profile and settle the payment using a credit card or PayPal.

- Download the Oakland Declaration of Gift with Signed Acceptance by Donee in your preferred file format.

- Print the document or complete and sign it digitally through an online editor to save time.

Form popularity

FAQ

Consejos para crear un buen formulario de donacion Disena un formulario atractivo, por ejemplo, un formulario en varios pasos como este ejemplo. Debemos ponerselo facil a los donantes potenciales. La sencillez en el diseno es muy importante, ya que un formulario muy largo y complicado puede frenar la donacion.

«Certificacion dirigida al donante, firmada por el representante legal de la entidad donataria, contador publico o revisor fiscal cuando hubiere lugar a ello, en donde conste: la fecha de la donacion, tipo de entidad, clase de bien donado, valor, la manera en que se efectuo la donacion y la destinacion de la misma, la

Para declarar una donacion en el IRPF es necesario presentar el modelo 651, y puedes hacerlo tanto de forma virtual a traves de la sede electronica de la Agencia Tributaria o de tu Comunidad Autonoma, o de forma fisica en las oficinas de tu propia comunidad.

Escritura publica en la que se recoge una donacion privada.

¿Como hacer un contrato de donacion? Titulo. Declaraciones del donante y donatario. Clausulas y estipulaciones en donde deberan de estar (aceptacion y registro de la donacion, obligaciones de las partes, modificaciones, vigencia, responsabilidad civil y saneamiento por eviccion) Las firmas de los involucrados.

Contrato de donacion que celebran por una parte a quien en adelante se le conocera como el donante y por otra parte a quien en lo sucesivo se le denominara el donatario que se sujetan bajo las declaraciones y clausulas siguientes: DECLARACIONES.

- Donante: Quien otorga una donacion o dispensa una liberalidad a favor de otro. Se le conoce tambien como el donador. - Donatario: Persona a quien se hace una donacion, quien recibe y acepta.

La donacion es un contrato a traves del cual se transfiere de manera gratuita un bien a otra persona que acepta dicha transferencia. Las partes en este acuerdo se denominan donante y donatario, siendo el primero el que transfiere el bien y el segundo el que lo recibe.

Uno de los mas sonados es que cualquier donacion inferior a 3.00020ac no se tiene que declarar o no se considera donacion y, por tanto, no debe pagarse el Impuesto de Sucesiones y Donaciones.

Para declarar una donacion en el IRPF es necesario presentar el modelo 651, y puedes hacerlo tanto de forma virtual a traves de la sede electronica de la Agencia Tributaria o de tu Comunidad Autonoma, o de forma fisica en las oficinas de tu propia comunidad.