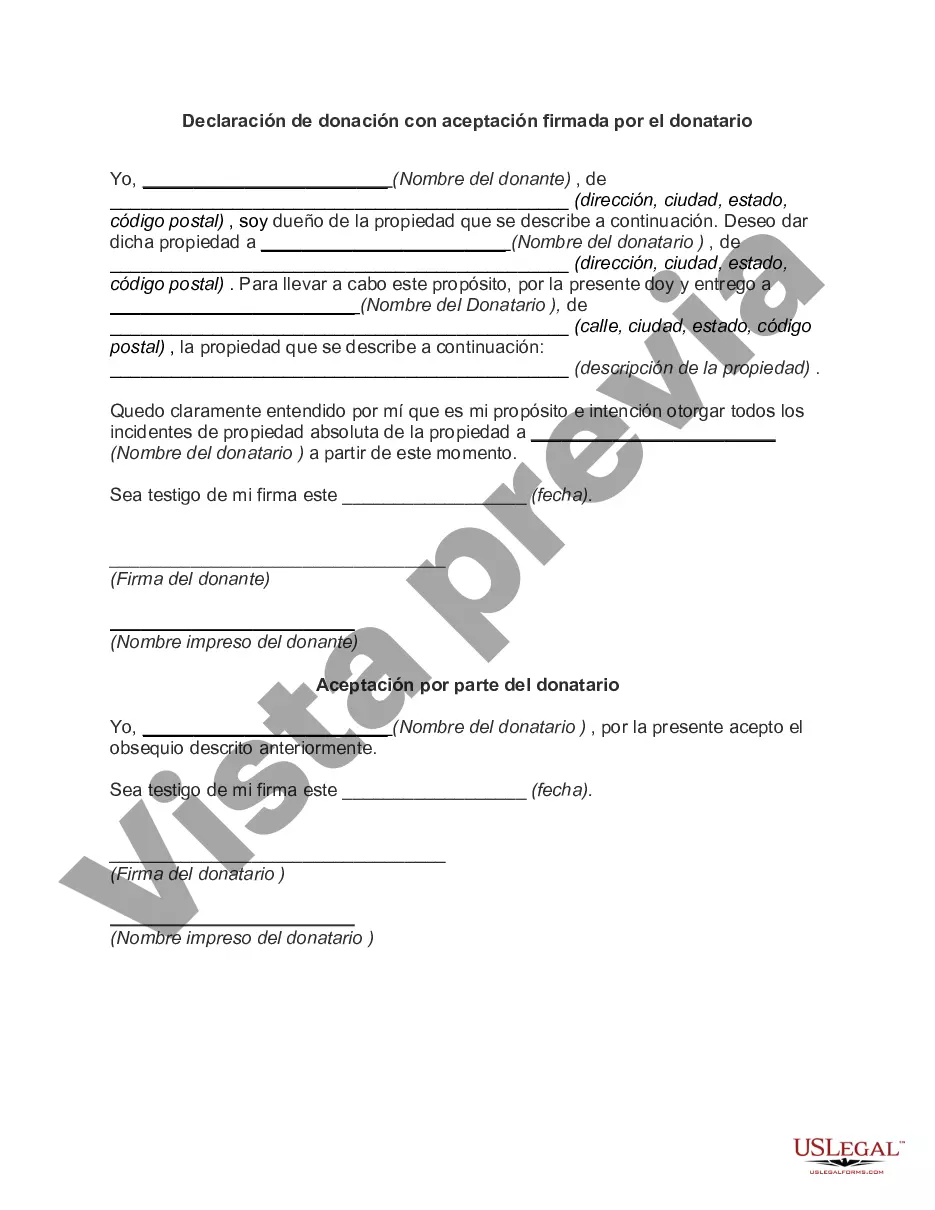

The Philadelphia Pennsylvania Declaration of Gift with Signed Acceptance by Done is a legal document that formalizes the transfer of ownership of property or assets from one party, known as the donor, to another party, known as the done. This declaration of gift is commonly used in the city of Philadelphia, Pennsylvania, to ensure a clear and enforceable transfer of property rights. Key Elements of the Philadelphia Pennsylvania Declaration of Gift with Signed Acceptance by Done: 1. Gift description: The document should include a detailed description of the gift being transferred, such as real estate, personal belongings, monetary funds, or other assets. This description should be accurate and specific to avoid any ambiguity. 2. Donor information: The name, address, and contact details of the donor, who is relinquishing ownership of the gift, must be included. This information ensures that the donor is properly identified and can be contacted if required. 3. Done information: The name, address, and contact details of the done, who will be receiving the gift, should be stated. This information helps establish the done as the rightful recipient of the gift. 4. Acceptance of the gift: The document should include a section where the done acknowledges and accepts the gift. The done's signature is required to validate the acceptance and ensure their intent to receive the gift. 5. Terms and conditions: The declaration may outline any specific terms or conditions related to the gift, such as any restrictions, limitations, or obligations attached to the transferred property. These terms are essential for both the donor and done to be aware of their rights and responsibilities. 6. Witnesses and notary: It is advisable to have witnesses present during the signing of the declaration to attest to the authenticity of the document. Additionally, some jurisdictions may require notarization to add an extra layer of legality and authenticity. Types of Philadelphia Pennsylvania Declaration of Gift with Signed Acceptance by Done: 1. Real Estate Gift Declaration: Specifically designed for the transfer of real property, this document is used when the donor wishes to gift a house, land, or any other type of real estate to the done. 2. Financial Gift Declaration: This type of declaration is appropriate for monetary gifts, such as cash, bonds, or stocks, where the donor intends to transfer ownership to the done. 3. Gift Declaration for Personal Property: Used for non-real estate assets, this declaration encompasses gifts like jewelry, artwork, vehicles, or other valuable possessions that the donor wishes to pass on to the done. 4. Conditional Gift Declaration: If the donor wants to impose certain conditions on the gift, such as the done's attainment of a specific age or completion of a particular milestone, a conditional gift declaration may be required. This document ensures that the gift will only be transferred once the defined conditions are met. Regardless of the type, the Philadelphia Pennsylvania Declaration of Gift with Signed Acceptance by Done is a legally binding document that protects both the donor and the done, ensuring a smooth and transparent transfer of assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Declaración de donación con aceptación firmada por el donatario - Declaration of Gift with Signed Acceptance by Donee

Description

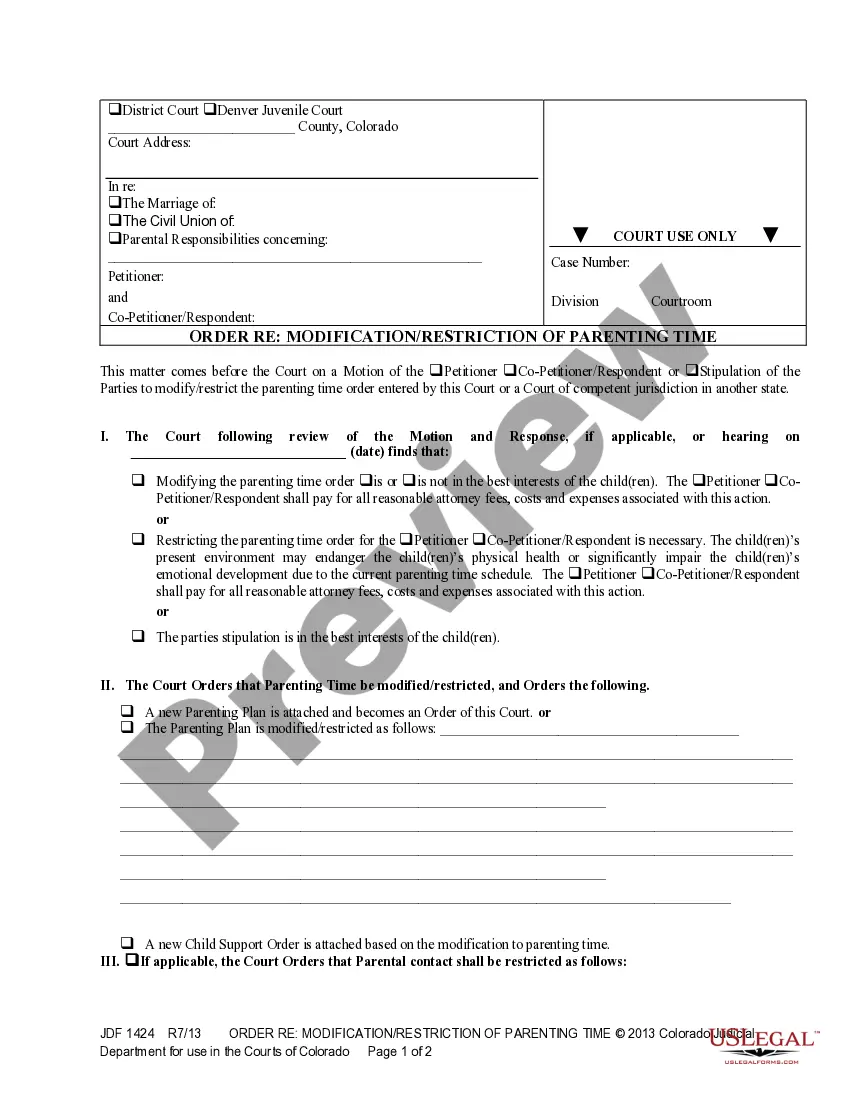

How to fill out Philadelphia Pennsylvania Declaración De Donación Con Aceptación Firmada Por El Donatario?

Draftwing documents, like Philadelphia Declaration of Gift with Signed Acceptance by Donee, to manage your legal matters is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task not really affordable. However, you can get your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for different cases and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Philadelphia Declaration of Gift with Signed Acceptance by Donee form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before getting Philadelphia Declaration of Gift with Signed Acceptance by Donee:

- Ensure that your form is specific to your state/county since the regulations for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Philadelphia Declaration of Gift with Signed Acceptance by Donee isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our website and get the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!