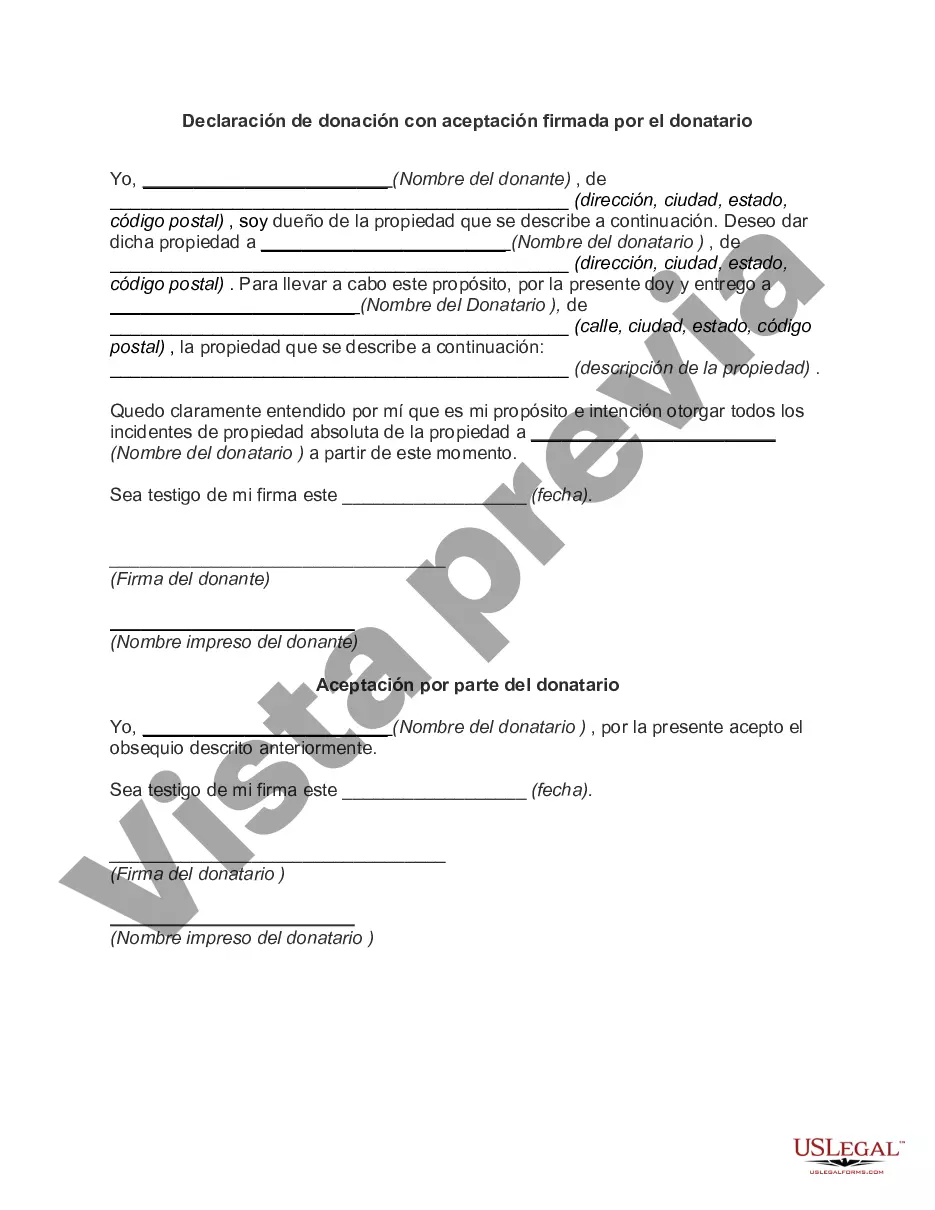

The Phoenix Arizona Declaration of Gift with Signed Acceptance by Done is a legal document that outlines the transfer of personal property from one party (donor) to another party (done) as a gift. This declaration serves as a formal confirmation of the intent and acceptance of the gift, ensuring clarity and legal validity of the transaction. The Declaration of Gift with Signed Acceptance by Done in Phoenix, Arizona follows a specific format to guarantee compliance with state laws. It includes relevant information such as the names and contact details of the donor and done, a description of the gifted property, and the date of transfer. This document is crucial for documenting and proving the voluntary nature of the gift, safeguarding the rights and responsibilities of both parties involved. The Declaration proves the donor's intention to gift the property without any expectation of payment or compensation from the done. Moreover, the signed acceptance by the done solidifies their acknowledgment and consent to receive the gift. This acceptance signifies their understanding of the responsibilities associated with the gifted property. In Phoenix, Arizona, there are no specific types of Declaration of Gift with Signed Acceptance by Done for different scenarios. However, this document can be customized based on the nature of the gift, whether it is a piece of artwork, jewelry, real estate, vehicle, or any other tangible asset. In summary, the Phoenix Arizona Declaration of Gift with Signed Acceptance by Done is a legally binding document ensuring the transparent transfer of personal property as a gift. Its purpose is to establish the donor's intent to gift and the done's acceptance, providing a clear record of the transaction while protecting the rights of both parties involved. Create your customized Declaration of Gift with Signed Acceptance by Done to suit the specifics of your gift transfer in Phoenix, Arizona.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Declaración de donación con aceptación firmada por el donatario - Declaration of Gift with Signed Acceptance by Donee

Description

How to fill out Phoenix Arizona Declaración De Donación Con Aceptación Firmada Por El Donatario?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business objective utilized in your county, including the Phoenix Declaration of Gift with Signed Acceptance by Donee.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Phoenix Declaration of Gift with Signed Acceptance by Donee will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Phoenix Declaration of Gift with Signed Acceptance by Donee:

- Make sure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Phoenix Declaration of Gift with Signed Acceptance by Donee on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Los formularios de donacion son la forma mas facil para recolectar lo fondos operativos que necesita para su organizacion. Explore los ejemplos de formularios de donacion de Jotform para empezar o comience con un formulario nuevo, luego personalicelo.

La opcion debera ejercerse a partir de la primera donacion que mediante el mismo se efectue en cada ano calendario, y debera manifestarse mediante el formulario F. 206/M (multinota). Donaciones hechas en especie, el monto se determina segun el valor del mercado del bien.

Consejos para crear un buen formulario de donacion Disena un formulario atractivo, por ejemplo, un formulario en varios pasos como este ejemplo. Debemos ponerselo facil a los donantes potenciales. La sencillez en el diseno es muy importante, ya que un formulario muy largo y complicado puede frenar la donacion.

¿Cuanto puede deducir el donante en su declaracion del Impuesto a las Ganancias? Se puede deducir hasta el 5 por ciento de la Ganancia Neta Imponible.

A) El Donante pueda deducir los donativos otorgados, siempre y cuando no excedan del 7% de sus ingresos (Persona Fisica) y/o utilidad fiscal (Persona Moral). b) La Donataria no considera dichos donativos como ingresos, siempre y cuando emita la factura correspondiente.

El donativo es 100% deducible, pero hay un monto maximo para esa deduccion conforme a lo siguiente: 2022 En donativos a la Federacion, entidades federativas, municipios o a sus organismos descentralizados hasta el 4% de: (i) la utilidad fiscal del ejercicio anterior en caso de ser persona moral, o (ii) los ingresos

El donatario, quien recibe el dinero, es el sujeto pasivo del Impuesto (es el obligado al pago la cuota tributaria).

La donacion es un acto de liberalidad por el cual una persona dispone gratuitamente de una cosa en favor de otra, que la acepta. La donacion no obliga al donante, ni produce efecto, sino desde la aceptacion.

Sin embargo, aunque se haga a una entidad autorizada, la donacion tambien tiene un limite: no se puede deducir mas del 5% de la ganancia neta sujeta a impuesto. Como es posible apreciar, toda esta burocracia desincentiva a la donacion.