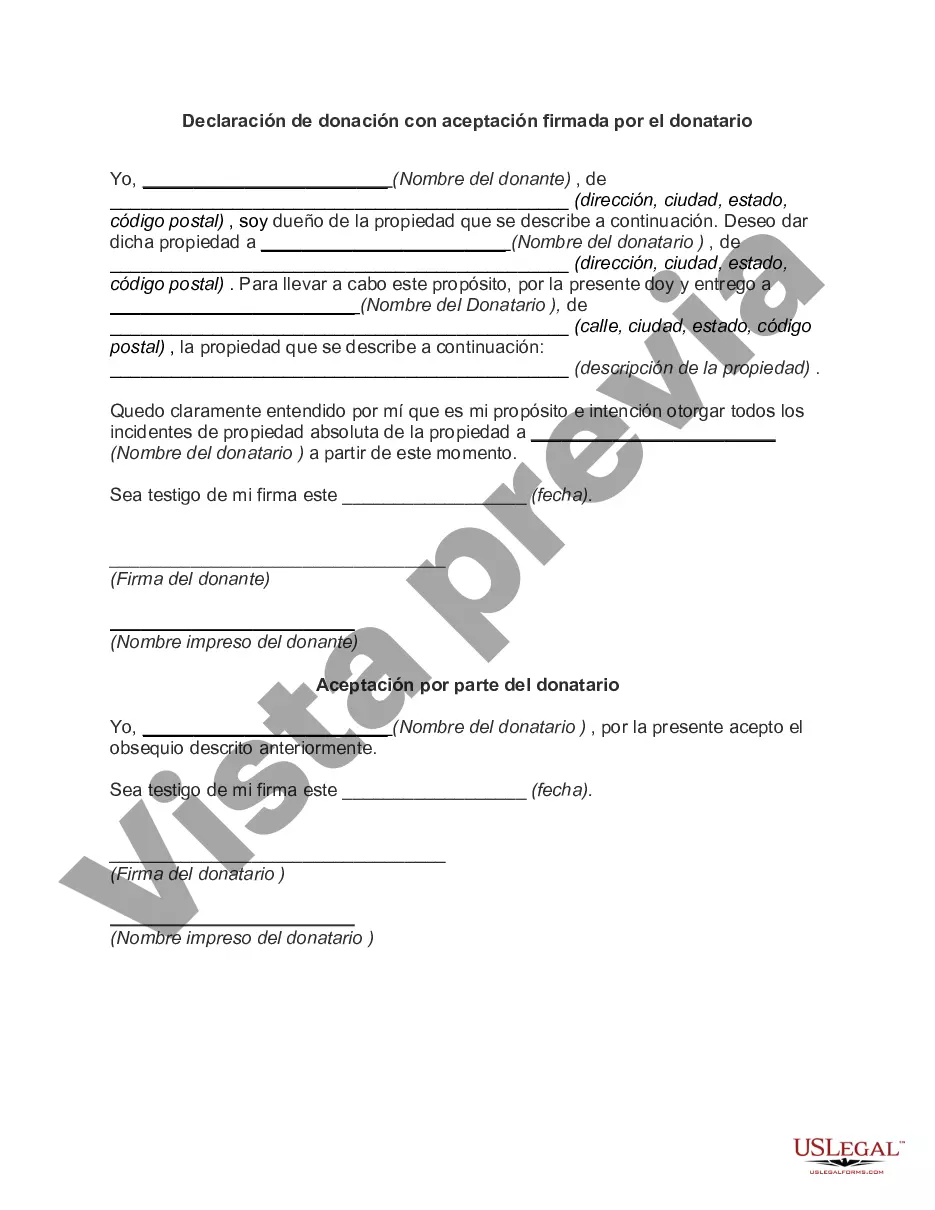

The Santa Clara California Declaration of Gift with Signed Acceptance by Done is a legal document that formalizes the transfer of a gift from a donor to a recipient in Santa Clara, California. This document serves as proof of the donor's intention to gift, and the recipient's acknowledgment and acceptance of the gift. It outlines the specific terms and conditions of the gift, ensuring transparency and preventing any future disputes or misunderstandings. Keywords: Santa Clara California, Declaration of Gift, Signed Acceptance, Done, legal document, transfer, proof, intention to gift, acknowledgment, acceptance, terms and conditions, transparency, disputes, misunderstandings. Different types of Santa Clara California Declaration of Gift with Signed Acceptance by Done: 1. Cash Gift Declaration: This type of declaration specifies the transfer of a monetary gift from the donor to the recipient. It includes the exact amount of cash being gifted, the date of transfer, and any conditions or restrictions associated with the gift. 2. Property Gift Declaration: In this type of declaration, a physical or immovable property (e.g., real estate, vehicles) is being gifted by the donor to the recipient. It outlines the description and details of the property, along with any liabilities, taxes, or encumbrances associated with it. 3. Personal Asset Gift Declaration: This declaration pertains to the transfer of personal assets, such as jewelry, artwork, collectibles, or heirlooms. It includes a detailed inventory of the gifted items and any necessary documents or certificates of authenticity. 4. Financial Securities Gift Declaration: If the gift involves stocks, bonds, or other financial securities, this type of declaration is used. It specifies the quantity and type of securities being gifted, along with any applicable transfer procedures or fees. 5. Inheritance Gift Declaration: This type of declaration is used when the gift is being received as part of an inheritance. It outlines the source of the inheritance, the assets or funds being transferred, and any legal obligations or tax implications. It is important to consult a legal professional or attorney specializing in gift transfers to ensure the accurate drafting and execution of the Santa Clara California Declaration of Gift with Signed Acceptance by Done that aligns with state and local laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Declaración de donación con aceptación firmada por el donatario - Declaration of Gift with Signed Acceptance by Donee

Description

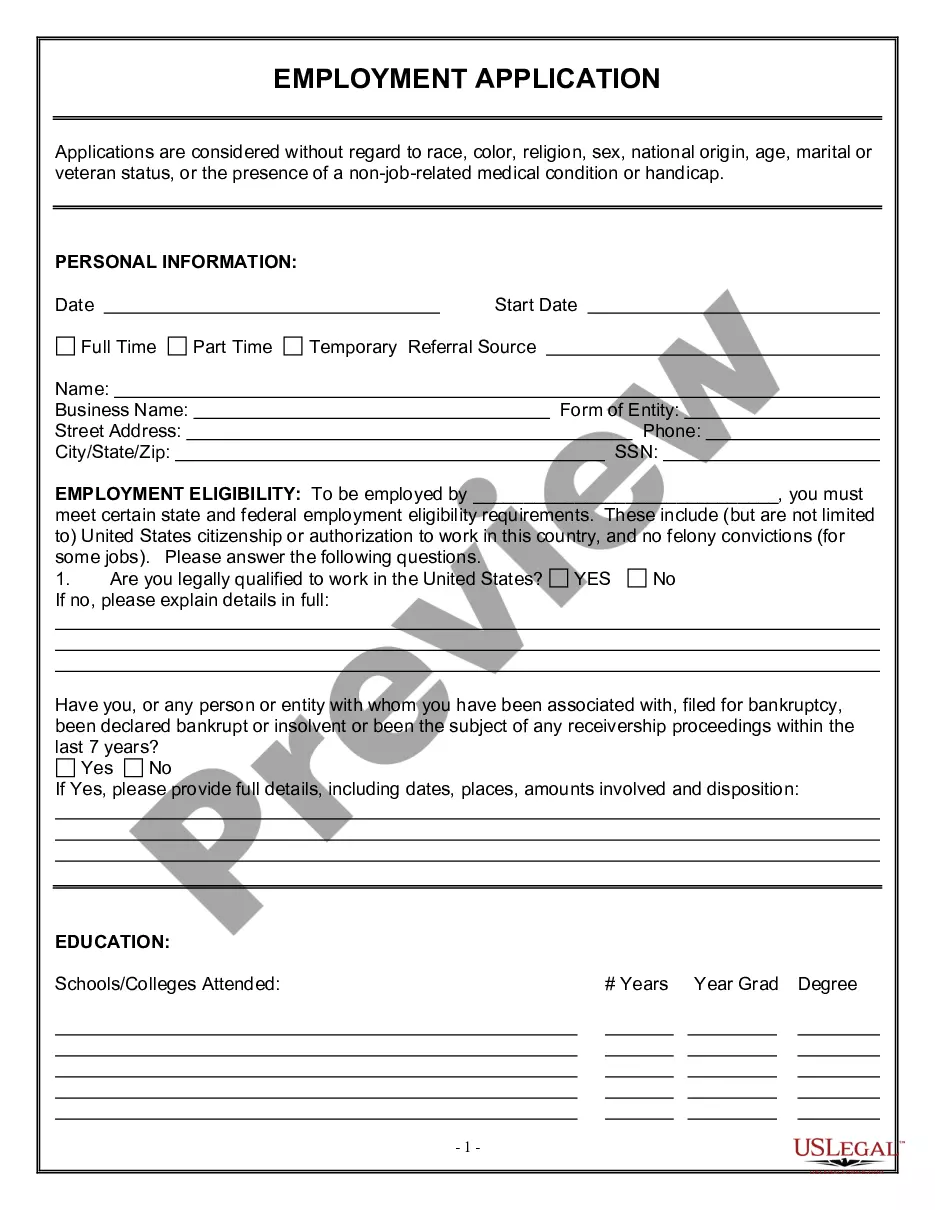

How to fill out Santa Clara California Declaración De Donación Con Aceptación Firmada Por El Donatario?

Drafting paperwork for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Santa Clara Declaration of Gift with Signed Acceptance by Donee without professional help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Santa Clara Declaration of Gift with Signed Acceptance by Donee on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Santa Clara Declaration of Gift with Signed Acceptance by Donee:

- Look through the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that meets your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!