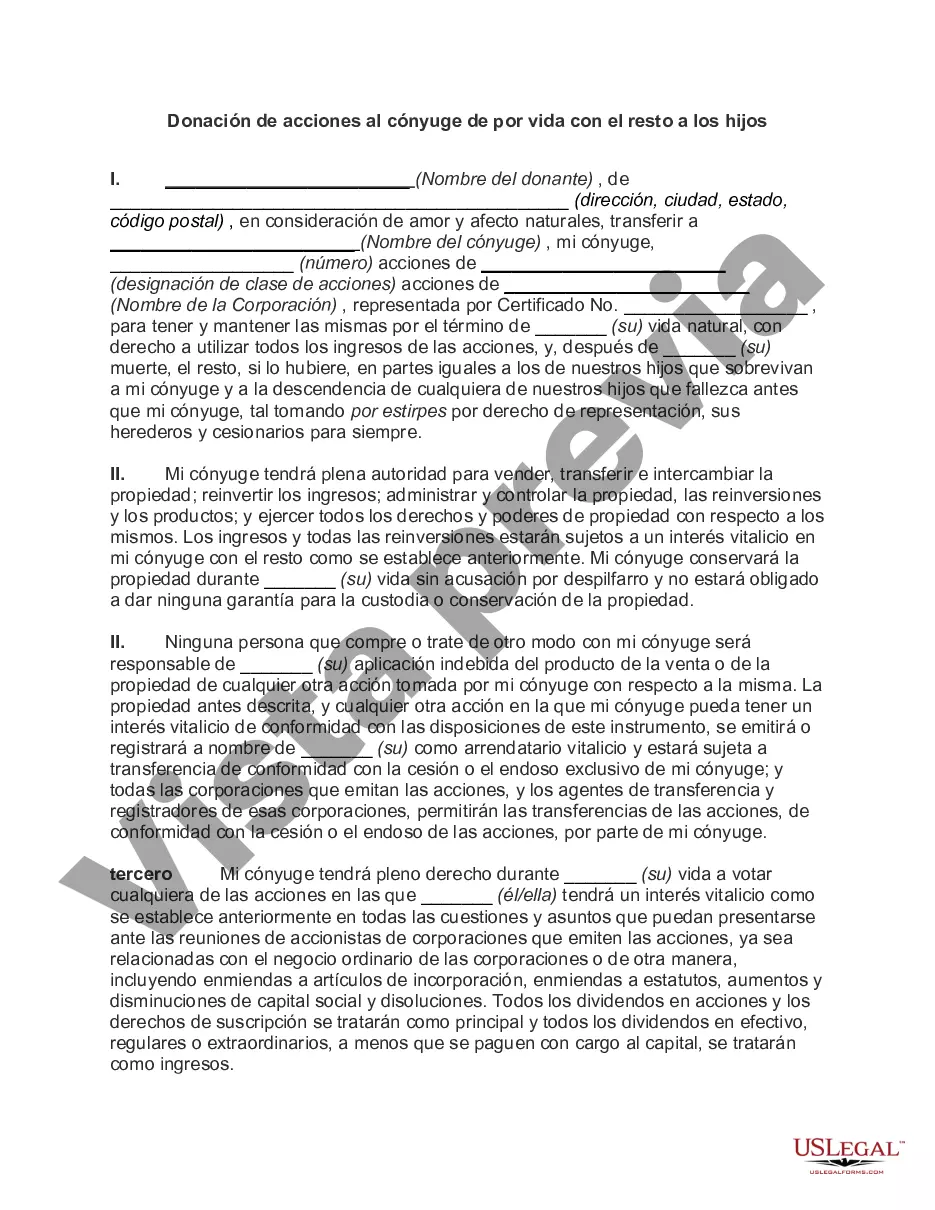

Chicago, Illinois Gift of Stock to Spouse for Life with Remainder to Children is a powerful estate planning strategy that allows individuals to transfer ownership of their stocks specifically located in Chicago, Illinois, to their spouse for their lifetime while ensuring that the remaining shares are ultimately passed on to their children. With this gift, individuals can leverage the tax advantages associated with gifting stocks while ensuring that their assets are managed and protected. Chicago, Illinois offers various types of Gift of Stock to Spouse for Life with Remainder to Children strategies to accommodate individual circumstances and preferences. These strategies include: 1. Chicago, Illinois Gift of Stock to Spouse for Life with Remainder to Children — Charitable Trust: This type of gift involves creating a charitable trust to hold the stocks with the intention of supporting charitable causes. It allows individuals to provide for their spouses while supporting causes they care about in the Chicago, Illinois community. 2. Chicago, Illinois Gift of Stock to Spouse for Life with Remainder to Children — Irrevocable Trust: By establishing an irrevocable trust, individuals can transfer ownership of the stocks to their spouses during their lifetime. Upon the spouse's passing, the remaining shares are distributed to the designated children, ensuring the preservation and controlled distribution of assets. 3. Chicago, Illinois Gift of Stock to Spouse for Life with Remainder to Children Granteror Retained Annuity Trust (GRAT): A GREAT allows individuals to gift stocks to their spouses for a fixed period while retaining an annual payment (annuity) from the trust. At the end of the trust term, the remaining stocks are passed on to the children, potentially with minimal gift or estate tax consequences. 4. Chicago, Illinois Gift of Stock to Spouse for Life with Remainder to Children — QualifiePersonnelal ResidencTrustpilotRT): This type of gift involves transferring ownership of a primary residence or vacation home to the spouse for their lifetime. Upon the surviving spouse's passing, the property is ultimately transferred to the children, providing both lifetime benefits to the surviving spouse and a future inheritance to the children. 5. Chicago, Illinois Gift of Stock to Spouse for Life with Remainder to Children — Dynasty Trust: A dynasty trust allows individuals to transfer stocks to their spouses for their lifetime, with the remaining assets being held in trust for multiple generations, typically avoiding estate taxes. It provides lasting financial security for both the surviving spouse and the children, maintaining family wealth within the Chicago, Illinois community. Individuals considering a Chicago, Illinois Gift of Stock to Spouse for Life with Remainder to Children should consult with legal and financial professionals specializing in estate planning to determine the most suitable strategy based on their unique circumstances and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Donación de acciones al cónyuge de por vida con el resto a los hijos - Gift of Stock to Spouse for Life with Remainder to Children

Description

How to fill out Chicago Illinois Donación De Acciones Al Cónyuge De Por Vida Con El Resto A Los Hijos?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Chicago Gift of Stock to Spouse for Life with Remainder to Children, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any tasks related to paperwork completion simple.

Here's how you can find and download Chicago Gift of Stock to Spouse for Life with Remainder to Children.

- Go over the document's preview and description (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the related forms or start the search over to find the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Chicago Gift of Stock to Spouse for Life with Remainder to Children.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Chicago Gift of Stock to Spouse for Life with Remainder to Children, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you need to deal with an extremely challenging case, we recommend getting a lawyer to review your document before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and purchase your state-compliant documents effortlessly!