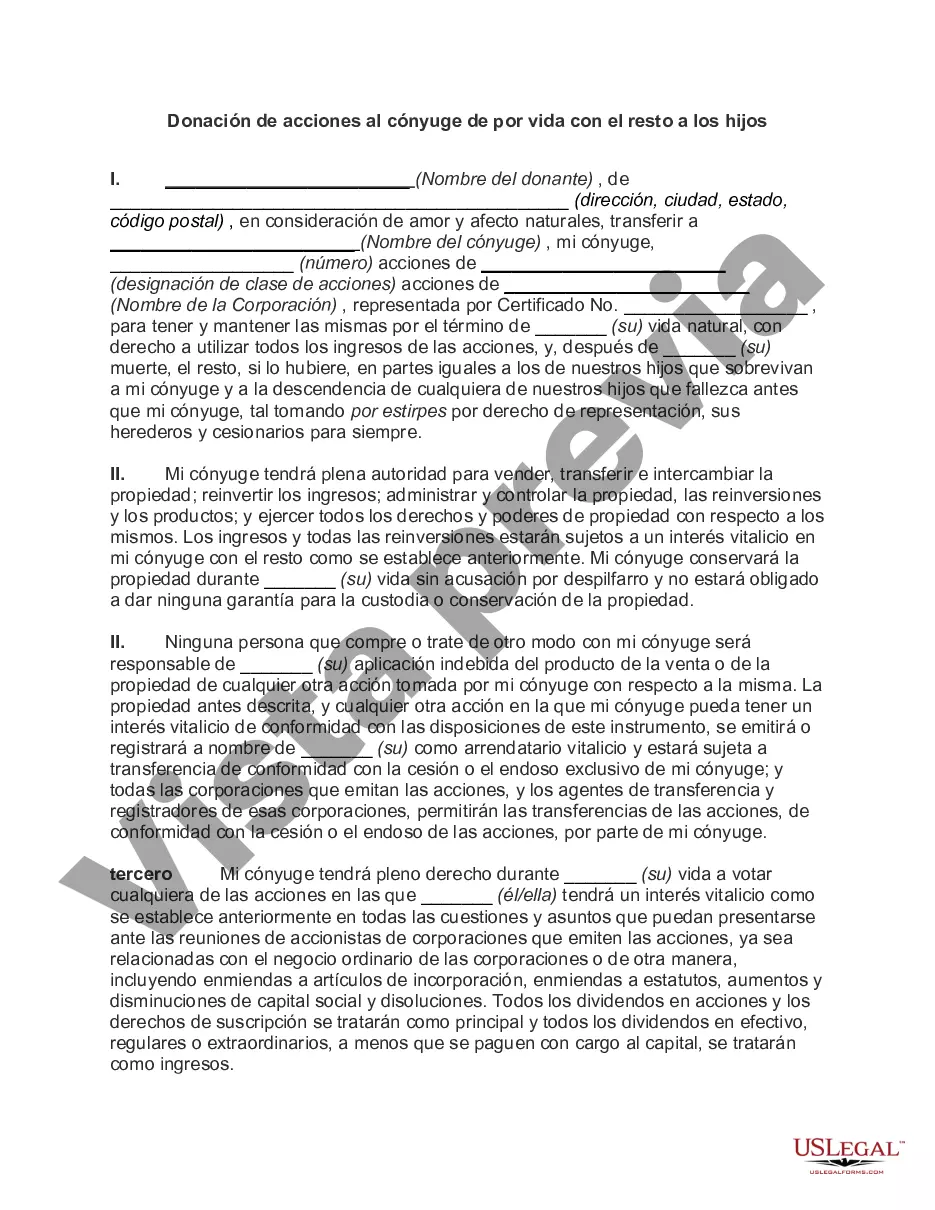

Kings New York Gift of Stock to Spouse for Life with Remainder to Children is a popular estate planning strategy that allows individuals to pass on their assets to their loved ones in a tax-efficient manner. This type of gift involves transferring ownership of stock to a spouse for their lifetime, with the remaining assets going to the couple's children upon the spouse's passing. With this strategy, both the spouse and children benefit from the gift, maximizing wealth preservation and minimizing potential tax liabilities. Investing in stocks can provide individuals with long-term growth potential and dividend income. By gifting stock to a spouse, it ensures they have access to the income generated by the stock during their lifetime. This strategy can be especially advantageous when the spouse is not familiar with investment management or is reliant on the income produced by the stock to maintain their lifestyle. One of the key benefits of this type of gift is the potential for capital gains tax savings. By transferring stock as a gift, the donor can avoid paying capital gains taxes on any appreciation in the stock's value. Instead, the spouse assumes ownership of the stock with a stepped-up basis, potentially reducing or eliminating future tax consequences of selling the stock. In addition to the primary type of Kings New York Gift of Stock to Spouse for Life with Remainder to Children, there are variations tailored to specific situations. These may include: 1. Kings New York Gift of Stock to Non-Spouse for Life with Remainder to Children: This strategy is similar to the primary type, but instead of transferring stock to a spouse, it is transferred to a non-spouse (e.g., a sibling or close friend) for their lifetime, with the remainder going to the children. 2. Kings New York Gift of Stock to Spouse for Life with Remainder to Charitable Organization: In this variation, the stock is transferred to a spouse, and upon their passing, the remainder is donated to a charitable organization. This allows individuals to support causes they care about while still providing for their spouse during their lifetime. 3. Kings New York Gift of Stock to Spouse for Life with Remainder to Trust for Children: Here, the stock is transferred to a trust established for the benefit of the children. The trust can provide the children with income and/or distributions while also providing asset protection and control over the assets. In conclusion, Kings New York Gift of Stock to Spouse for Life with Remainder to Children is a valuable estate planning strategy that provides significant benefits in terms of preserving wealth, managing tax liabilities, and ensuring financial security for both spouses and children. It can be customized to suit individual circumstances through variations such as gifts to non-spouses, charitable organizations, or trusts. By exploring this strategy, individuals can optimize their estate plans and ensure the smooth transfer of assets to their loved ones.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Donación de acciones al cónyuge de por vida con el resto a los hijos - Gift of Stock to Spouse for Life with Remainder to Children

Description

How to fill out Kings New York Donación De Acciones Al Cónyuge De Por Vida Con El Resto A Los Hijos?

Draftwing forms, like Kings Gift of Stock to Spouse for Life with Remainder to Children, to manage your legal affairs is a tough and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. However, you can take your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms crafted for different scenarios and life situations. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Kings Gift of Stock to Spouse for Life with Remainder to Children template. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before getting Kings Gift of Stock to Spouse for Life with Remainder to Children:

- Make sure that your form is compliant with your state/county since the rules for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the Kings Gift of Stock to Spouse for Life with Remainder to Children isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to start using our website and download the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!