Salt Lake Utah Gift of Stock to Spouse for Life with Remainder to Children is a legal option for individuals who wish to transfer ownership of their stocks to their spouse during their lifetime, while ensuring their children receive the remaining stock after the spouse's passing. This type of gift provides financial security for both the spouse and the children, allowing for the gradual distribution of assets over time. In Salt Lake Utah, there are different types of Gift of Stock to Spouse for Life with Remainder to Children, including: 1. Outright Gift: This type of gift involves directly transferring the ownership of stocks to the spouse, who gains full control and ownership rights. After the spouse's death, the remaining stocks are then passed on to the children. 2. Life Estate: With a life estate gift, the spouse is granted the right to receive income or dividends generated by the stocks during their lifetime. However, they do not have direct ownership of the stocks themselves. After the spouse's death, the stocks are transferred to the children. 3. Charitable Remainder Trust (CRT): This option involves creating a trust where the spouse receives income from the stocks during their lifetime. Upon their death, the remaining stocks are distributed to the designated charitable organization, with any remaining assets going to the children. Keywords: Salt Lake Utah, gift of stock, spouse, remainder, children, legal option, transfer ownership, financial security, stocks, gradual distribution, outright gift, life estate, income, dividends, charitable remainder trust, trust, charitable organization, assets.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Donación de acciones al cónyuge de por vida con el resto a los hijos - Gift of Stock to Spouse for Life with Remainder to Children

Description

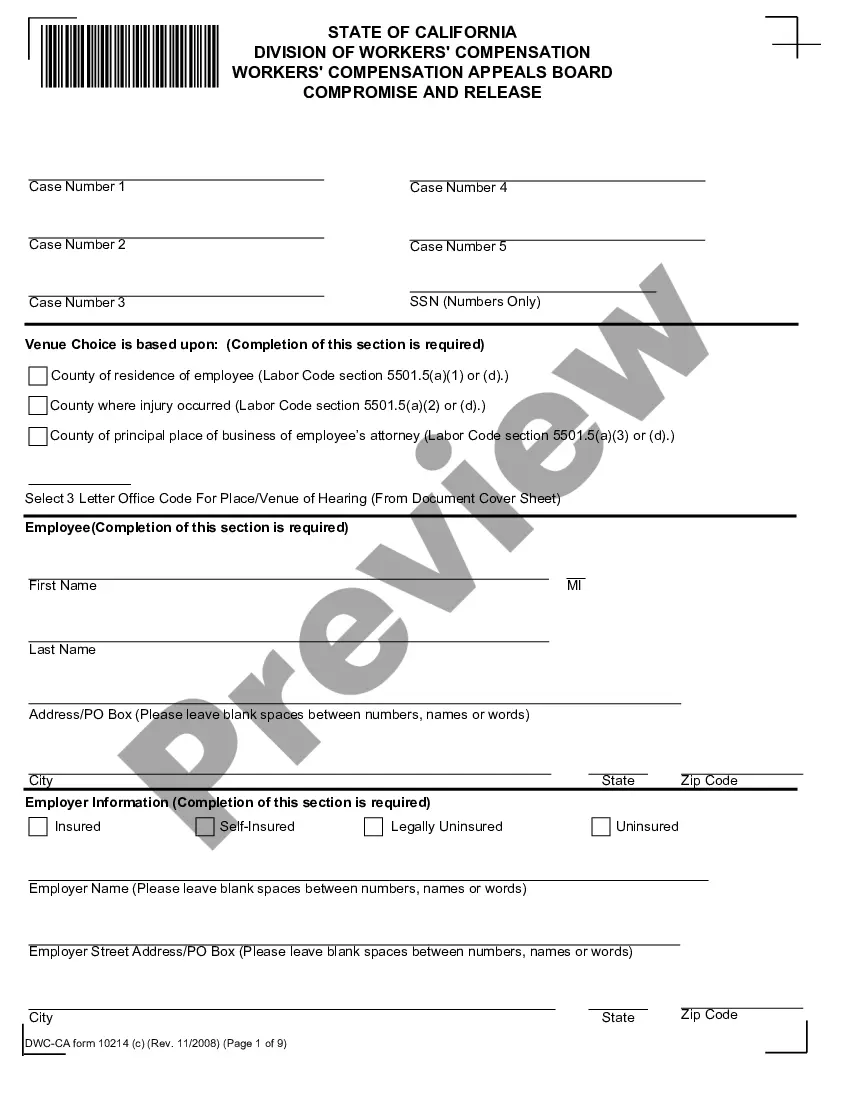

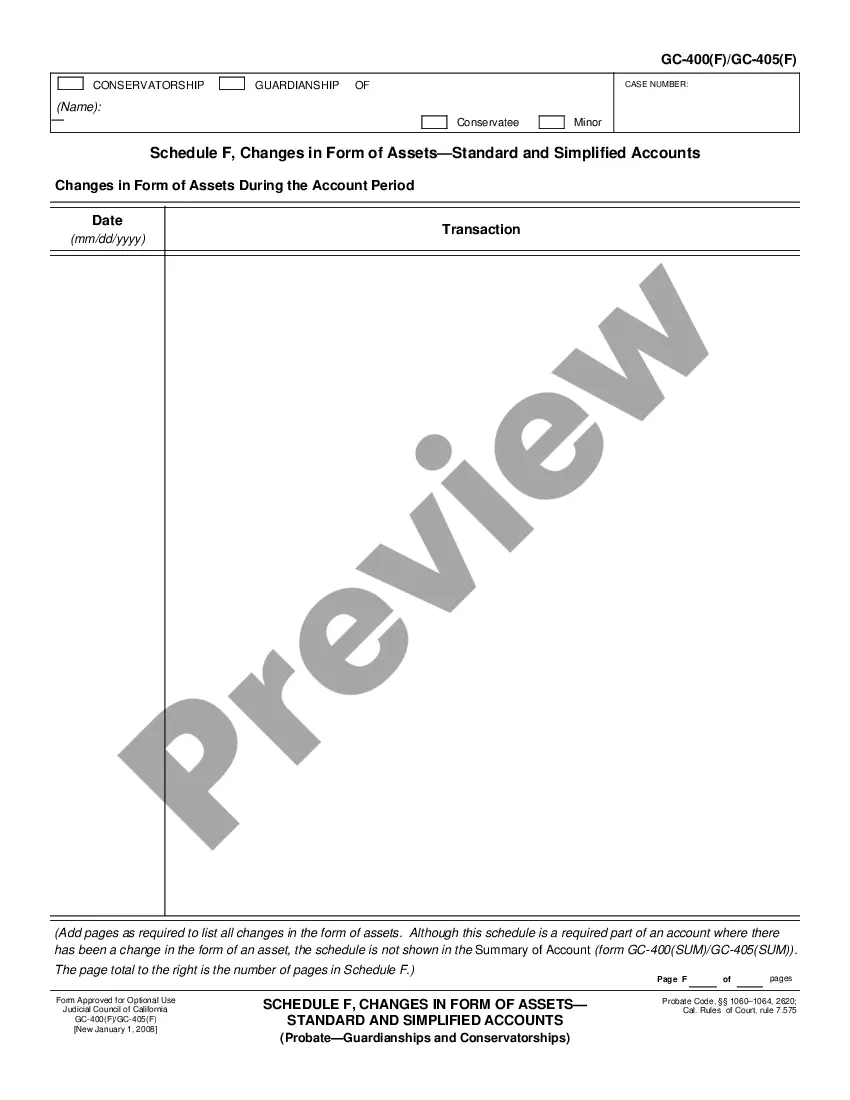

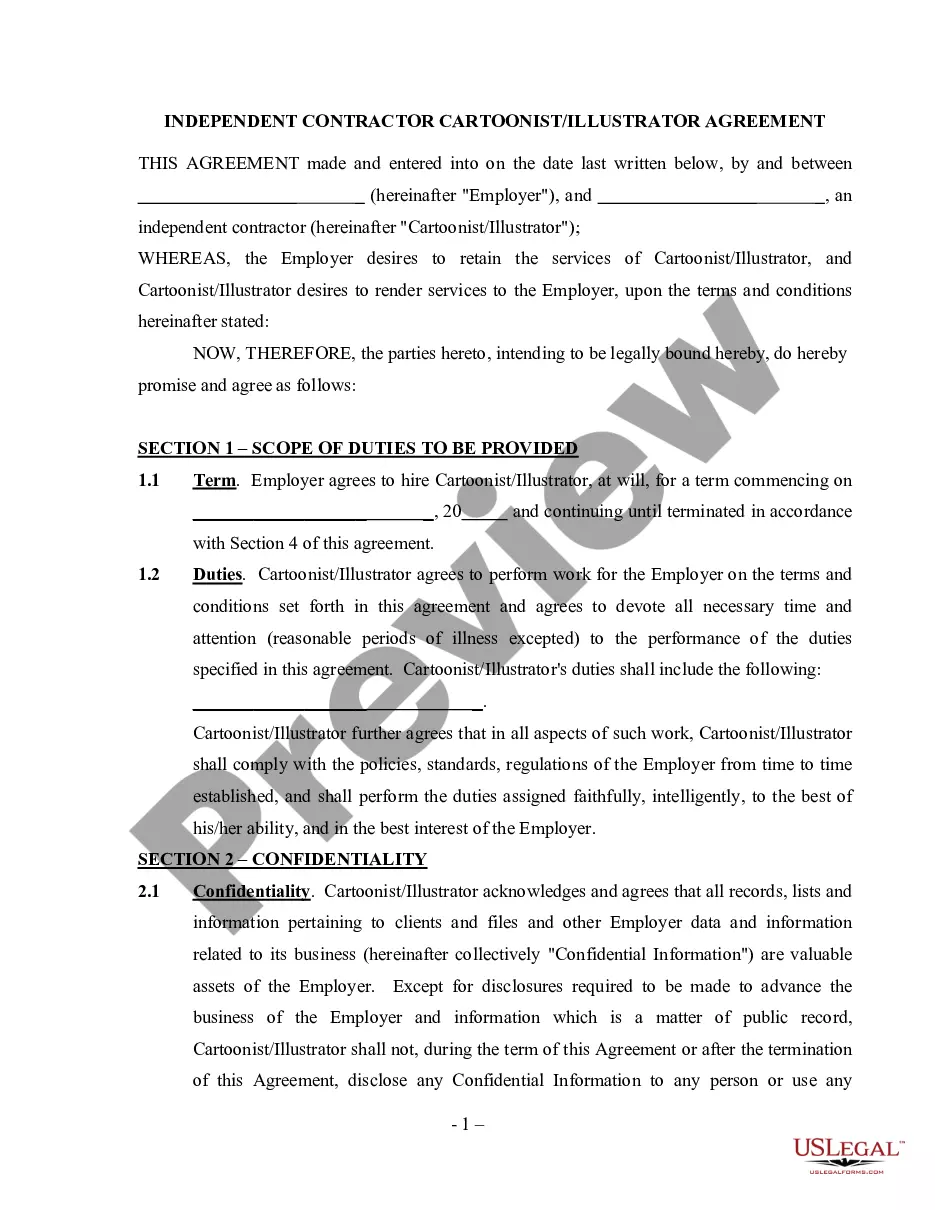

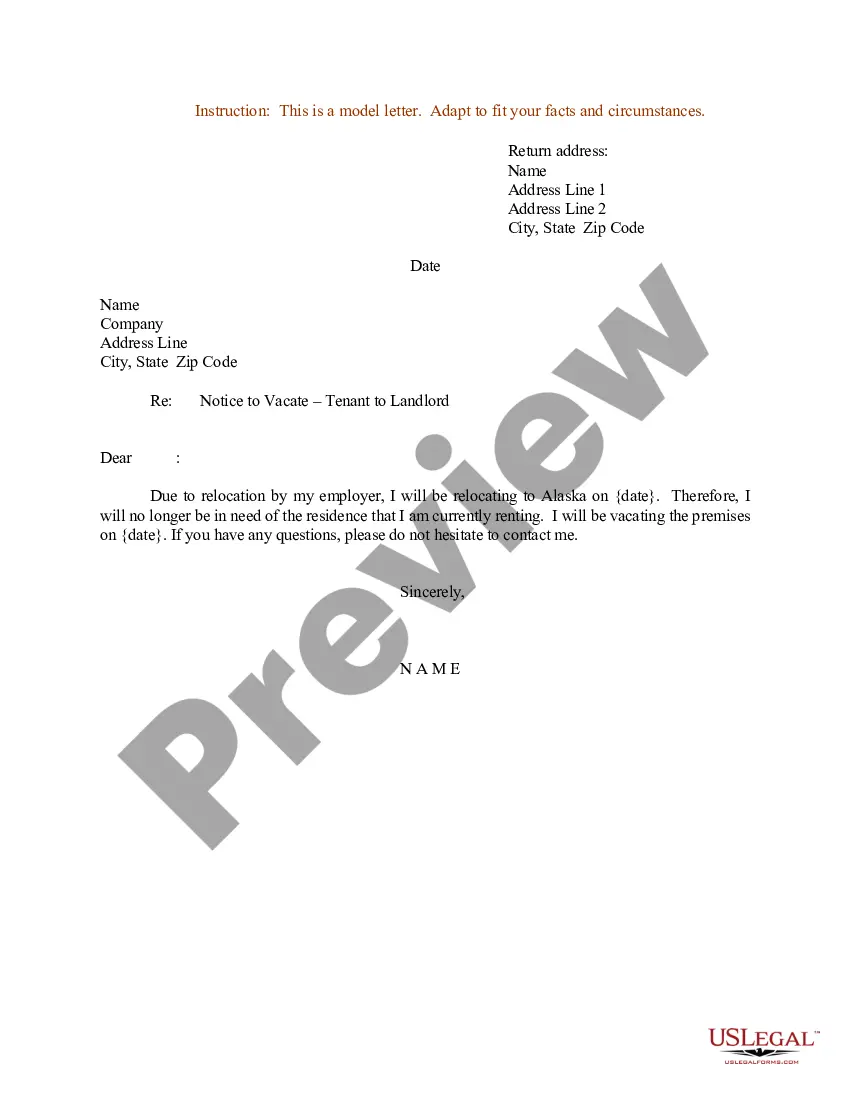

How to fill out Salt Lake Utah Donación De Acciones Al Cónyuge De Por Vida Con El Resto A Los Hijos?

Do you need to quickly draft a legally-binding Salt Lake Gift of Stock to Spouse for Life with Remainder to Children or maybe any other document to take control of your own or business affairs? You can select one of the two options: contact a legal advisor to write a valid document for you or create it completely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you get neatly written legal papers without having to pay sky-high fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Salt Lake Gift of Stock to Spouse for Life with Remainder to Children and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra troubles.

- First and foremost, carefully verify if the Salt Lake Gift of Stock to Spouse for Life with Remainder to Children is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to verify what it's intended for.

- Start the searching process over if the document isn’t what you were seeking by utilizing the search bar in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Salt Lake Gift of Stock to Spouse for Life with Remainder to Children template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. In addition, the templates we offer are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!