Wayne Michigan Gift of Stock to Spouse for Life with Remainder to Children is a type of estate planning strategy that allows individuals residing in Wayne, Michigan to transfer ownership of stocks to their spouse during their lifetime, while ensuring that upon the spouse's death, the remaining stock assets are passed down to their children. This gifting strategy provides tax advantages and allows individuals to pass on their wealth and assets to their loved ones in a structured manner. By designating a spouse as the primary beneficiary, individuals can ensure that their partner has ownership and control over the stock assets during their lifetime. This allows the spouse to benefit from any potential income generated from the stocks, including dividends and capital gains. It also provides financial security and flexibility to the surviving spouse in case of unforeseen circumstances. Upon the death of the spouse, the remaining stock assets are automatically transferred to the children as predetermined beneficiaries. This aspect of the strategy ensures that the children receive the remaining value of the stocks, while also minimizing potential estate taxes. By transferring the assets through this gifting strategy, individuals can potentially reduce the value of their estate subject to taxation. The Wayne Michigan Gift of Stock to Spouse for Life with Remainder to Children is a flexible estate planning tool that can be customized to meet the specific needs and wishes of individuals. It is important to consult with a qualified estate planning attorney or financial advisor to ensure that the strategy is tailored to individual circumstances and complies with the relevant legal requirements. Additional keywords: Stock gifting strategy, estate planning, spouse as beneficiary, tax advantages, wealth transfer, stock assets, financial security, income generation, capital gains, predetermined beneficiaries, estate taxes, estate planning attorney, financial advisor.

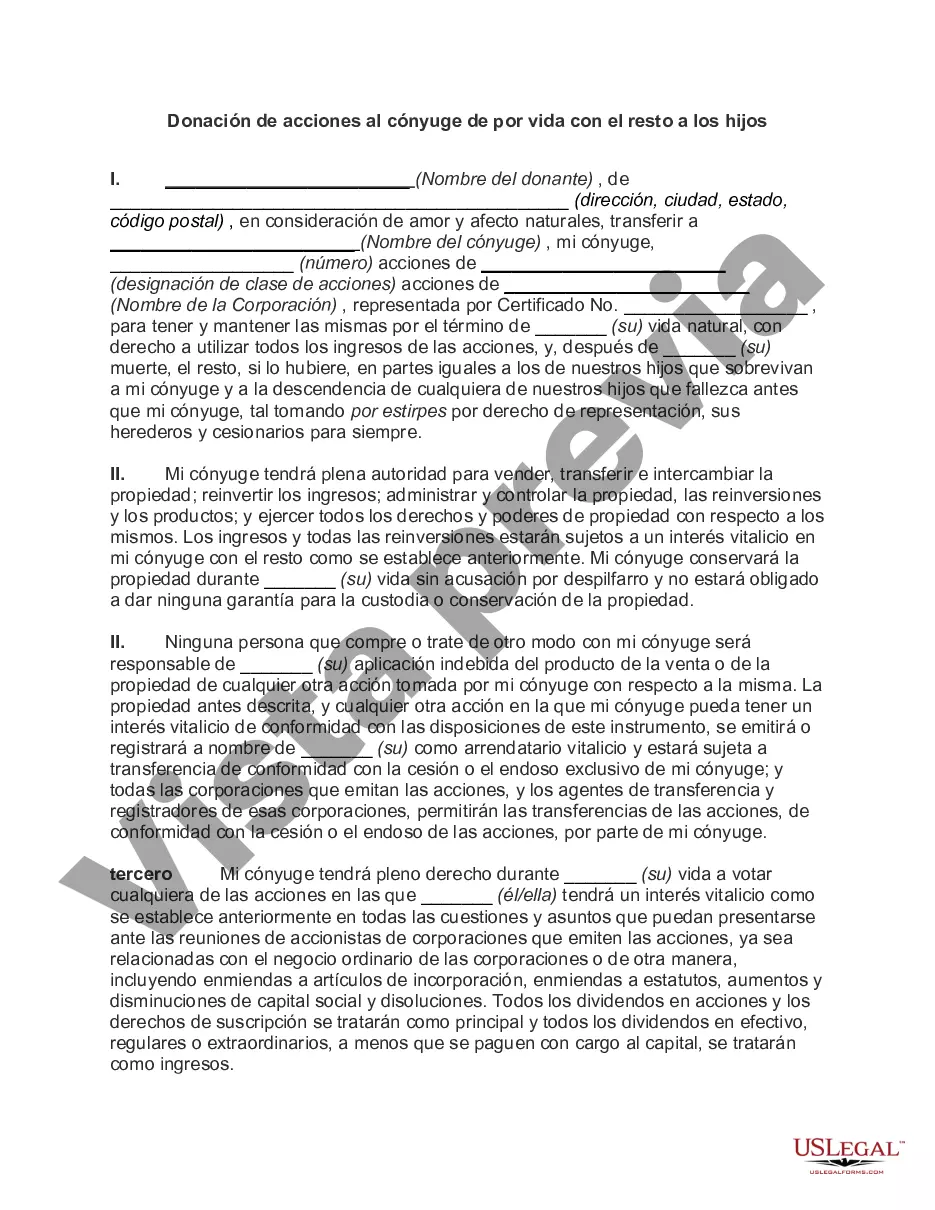

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Donación de acciones al cónyuge de por vida con el resto a los hijos - Gift of Stock to Spouse for Life with Remainder to Children

Description

How to fill out Wayne Michigan Donación De Acciones Al Cónyuge De Por Vida Con El Resto A Los Hijos?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including Wayne Gift of Stock to Spouse for Life with Remainder to Children, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find detailed resources and tutorials on the website to make any activities associated with document execution straightforward.

Here's how you can locate and download Wayne Gift of Stock to Spouse for Life with Remainder to Children.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the legality of some documents.

- Examine the similar document templates or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Wayne Gift of Stock to Spouse for Life with Remainder to Children.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Wayne Gift of Stock to Spouse for Life with Remainder to Children, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney completely. If you have to cope with an extremely difficult case, we advise getting a lawyer to review your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and get your state-specific documents effortlessly!