Suffolk, New York Demand for a Shareholders Meeting: Understanding the Importance and Process In Suffolk, New York, the demand for a shareholders meeting holds utmost significance for shareholders in various sectors. It is a platform where shareholders come together to discuss key matters regarding the company's management, operations, and future prospects. Several types of shareholder meetings may be observed in Suffolk, including annual general meetings, special shareholder meetings, and emergency meetings. 1. Annual General Meeting (AGM): The AGM is a customary meeting held once a year, bringing together shareholders and company executives. During this meeting, shareholders receive updates on the financial performance, strategic plans, and overall operations of the company. Moreover, matters like the election of board members, appointment of auditors, and approval of financial statements are typically discussed and voted upon. 2. Special Shareholder Meeting: These are meetings called for specific purposes that cannot wait until the next AGM. Special shareholder meetings address matters such as mergers, acquisitions, stock issuance, changes in corporate structure, and other significant actions that require shareholders' approval. These meetings provide a space for shareholders to voice their opinions and vote on crucial decisions that may impact the company's future. 3. Emergency Shareholder Meeting: In cases of unforeseen circumstances or urgent matters, an emergency shareholder meeting may be demanded. This type of meeting is held at short notice to discuss immediate issues requiring shareholders' attention and decision-making. Emergency meetings often address crises, disputes, litigation, or any situation that poses a threat to the company's welfare. The demand for a shareholders meeting in Suffolk, New York is typically initiated by shareholders who believe that a meeting is necessary to address specific concerns or assert their rights as company owners. To request a shareholders meeting, the shareholder(s) must follow specific procedures outlined by the company's bylaws and local regulations. The demand for a shareholders meeting is typically communicated through a formal letter or written notice sent to the company's board of directors or corporate secretary. The document should clearly state the purpose of the meeting, include a list of proposed agenda items, and specify any resolutions or actions required. Once the demand has been served, it is the board's responsibility to comply with the request by promptly organizing and arranging the shareholders meeting. Failure to comply with a valid demand may result in legal action by the shareholders against the board for breaching their fiduciary duties. To summarize, the demand for a shareholders meeting in Suffolk, New York is a crucial avenue for shareholders to actively participate in the decision-making process of the company they have invested in. Annual general meetings, special shareholder meetings, and emergency meetings are the primary types of gatherings where shareholders can discuss, vote, and influence significant matters affecting the company's financial standing and future direction.

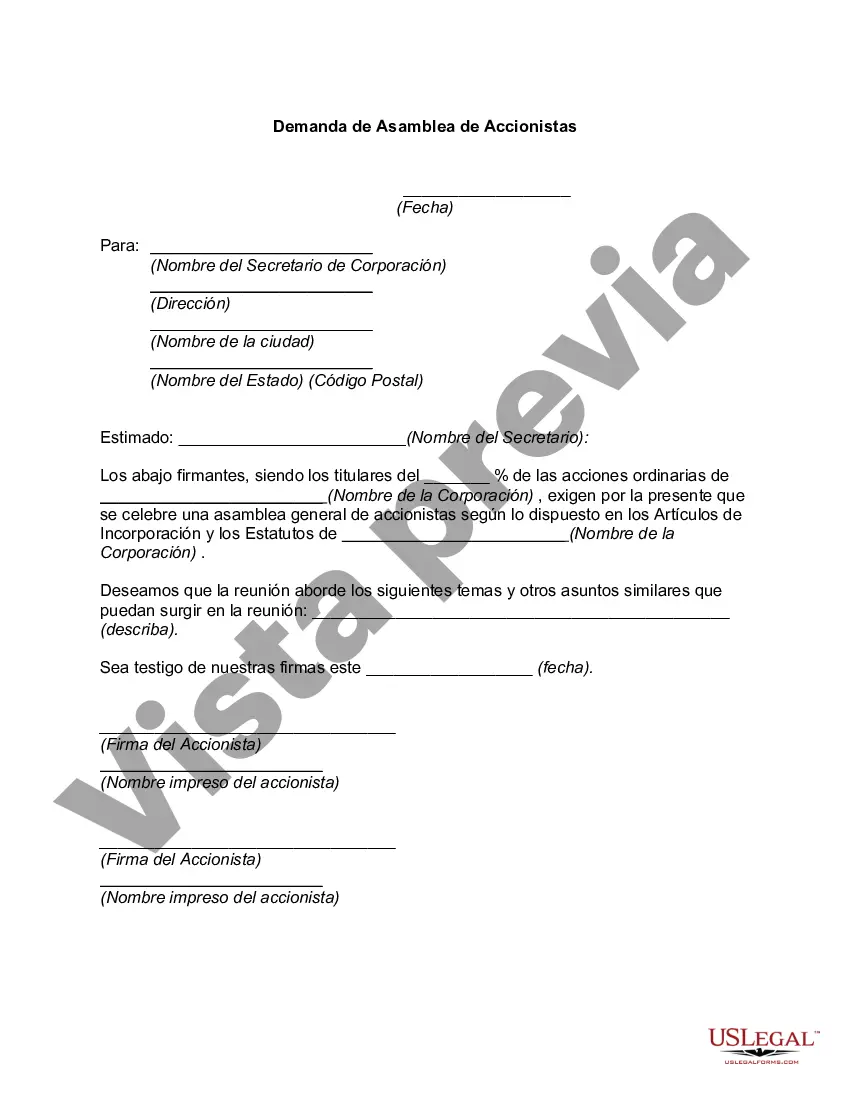

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Demanda de Asamblea de Accionistas - Demand for a Shareholders Meeting

Description

How to fill out Suffolk New York Demanda De Asamblea De Accionistas?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the Suffolk Demand for a Shareholders Meeting.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Suffolk Demand for a Shareholders Meeting will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Suffolk Demand for a Shareholders Meeting:

- Ensure you have opened the proper page with your local form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Suffolk Demand for a Shareholders Meeting on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!