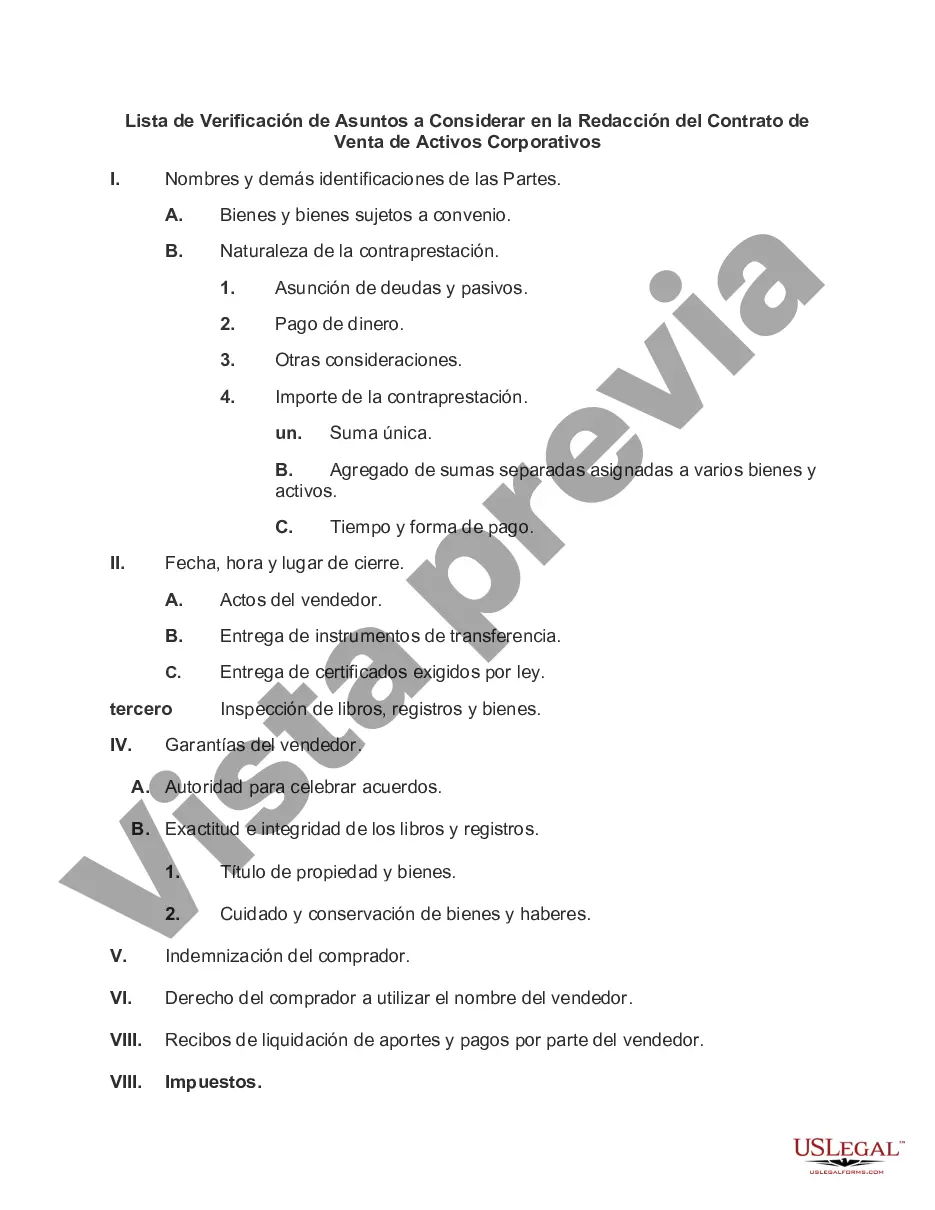

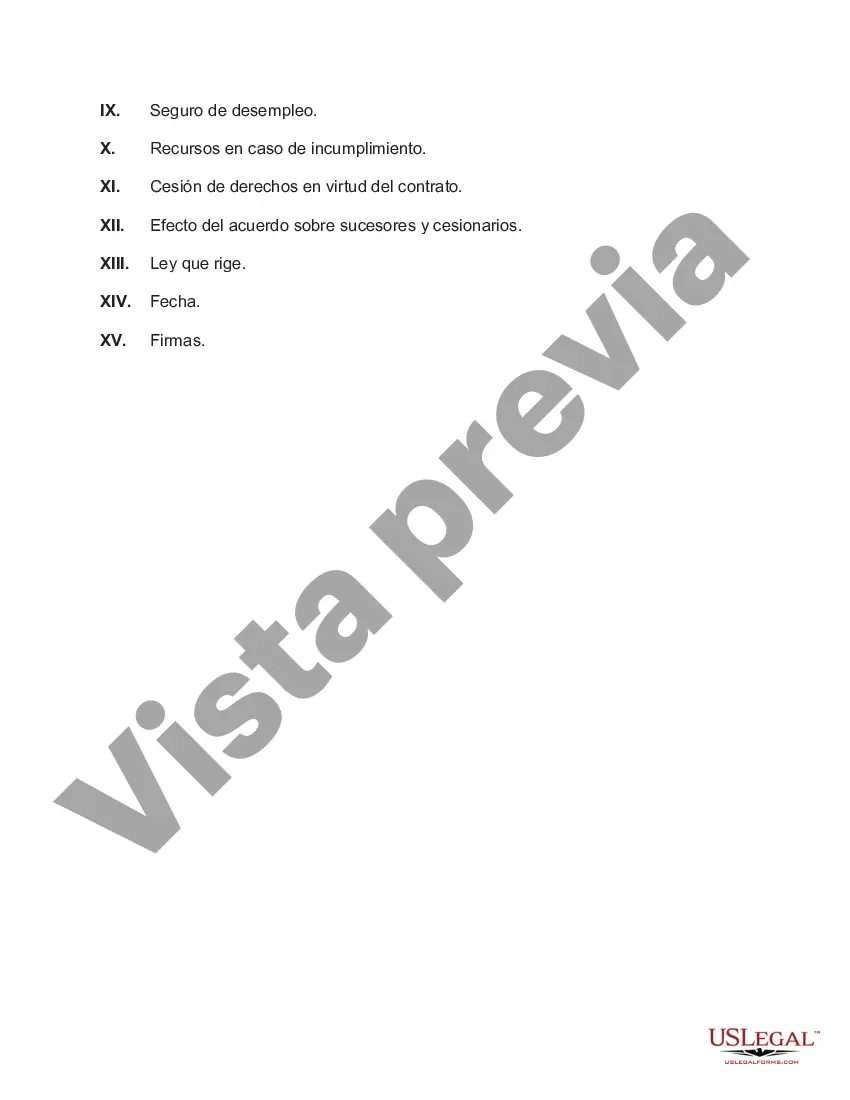

Cook Illinois Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets is a comprehensive document that provides a structured approach to ensure a successful agreement when selling corporate assets. This checklist encompasses various important considerations that should be taken into account to protect the interests of both the buyer and the seller. Below are the key areas covered in the Cook Illinois Checklist: 1. Asset Identification: This section focuses on identifying and describing the assets being sold, including a clear outline of their condition, location, and any existing liabilities or encumbrances. 2. Purchase Price and Payment Terms: It outlines the agreed-upon purchase price for the assets and the payment terms, including any installment arrangements, financing options, or contingencies. 3. Representations and Warranties: This section addresses the representations and warranties made by both the buyer and the seller. It covers aspects like the legal authority of both parties to enter the agreement, compliance with laws and regulations, and the accuracy of financial statements. 4. Due Diligence: This part delves into the due diligence processes involved in evaluating the assets being sold. It includes considerations such as inspecting physical assets, examining financial records, and verifying legal and regulatory compliance. 5. Transfer of Assets: The checklist outlines the procedural steps required to transfer ownership of the assets, including obtaining necessary approvals or consents, executing appropriate legal documents, and transferring any licenses or permits associated with the assets. 6. Employee Matters: If the assets being sold include employees, this section addresses the treatment of employees during the transition, including any requirements for severance, retention, or benefits continuation. 7. Intellectual Property Considerations: If intellectual property assets are included in the sale, this part covers issues such as ownership, transferability, and the protection of trademarks, patents, copyrights, or trade secrets. 8. Tax and Accounting Considerations: This section highlights the tax implications of the asset sale, including any potential liabilities or benefits associated with the transaction. It also addresses accounting treatment and financial reporting obligations. 9. Confidentiality and Non-compete Agreements: If confidentiality or non-compete agreements are required, this part outlines the terms and conditions to be included to safeguard the interests of the parties involved. 10. Dispute Resolution: This section discusses potential methods for resolving disputes that may arise from the agreement, such as negotiation, mediation, or arbitration. Different types of Cook Illinois Checklists of Matters to be Considered in Drafting Agreements for the Sale of Corporate Assets may focus on specific industries or sectors. For example, there may be a specific checklist tailored to technology companies, manufacturing businesses, or real estate transactions. These specialized checklists would include additional considerations relevant to each respective industry.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Lista de Verificación de Asuntos a Considerar en la Redacción del Contrato de Venta de Activos Corporativos - Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Cook Illinois Lista De Verificación De Asuntos A Considerar En La Redacción Del Contrato De Venta De Activos Corporativos?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, finding a Cook Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets meeting all local requirements can be exhausting, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. In addition to the Cook Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Cook Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Cook Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!