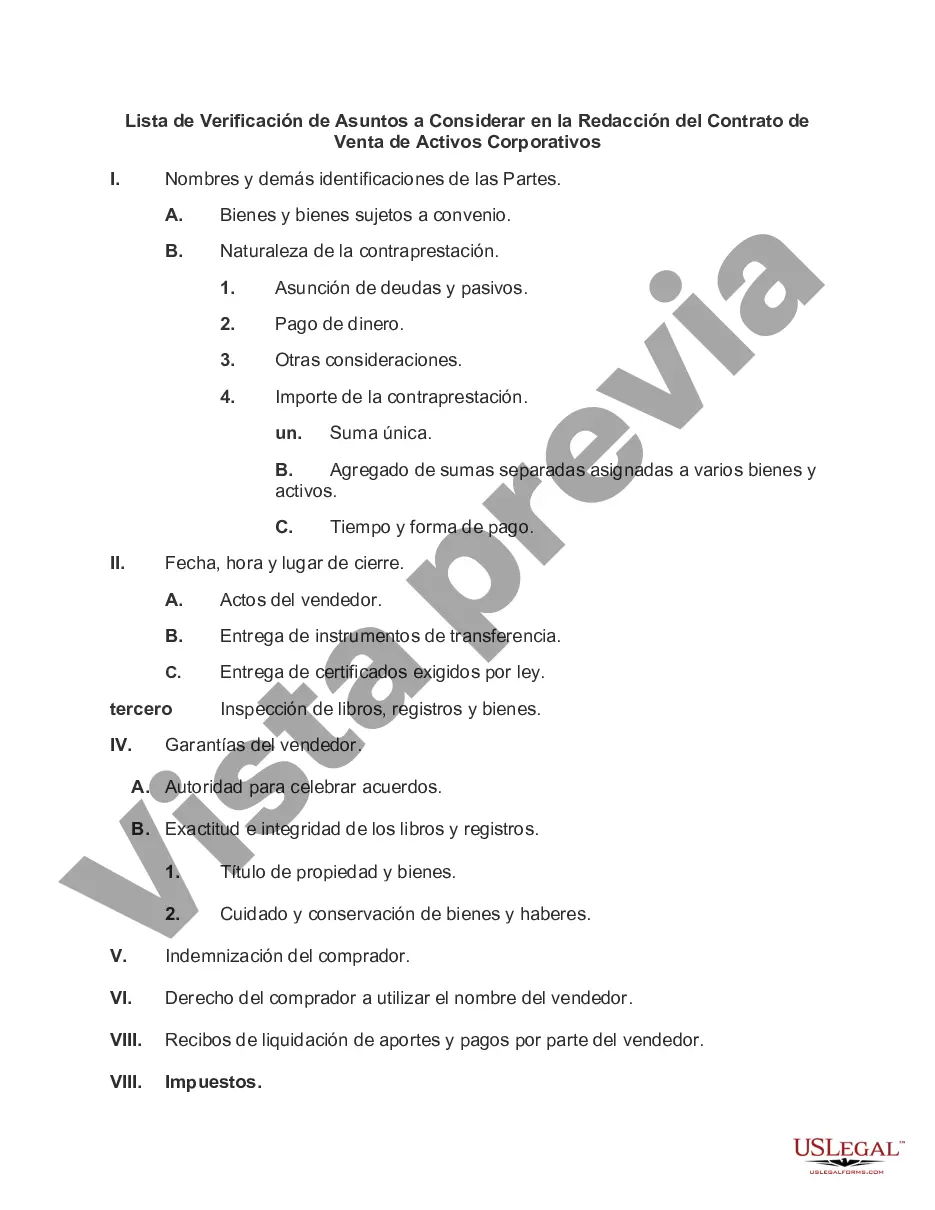

A Houston Texas Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets is an essential tool for ensuring a smooth and successful transaction. Whether you are a buyer or a seller, this checklist provides a comprehensive overview of the key considerations that need to be addressed in the agreement for the sale of corporate assets. Here are some important aspects that should be included: 1. Description of Assets: Clearly define the assets being sold, including any intellectual property rights, real estate, equipment, inventory, contracts, customer lists, or any other items included in the transaction. 2. Purchase Price and Payment Terms: Determine the agreed-upon purchase price and the structure of payments, whether it will be made in a lump sum, through installment payments, or through any other agreed-upon method. 3. Representations and Warranties: Specify the representations and warranties that the seller makes regarding the assets being sold, such as title to the assets, absence of encumbrances, compliance with laws, and accuracy of financial statements. 4. Due Diligence: Define the scope and timeframe for conducting due diligence on the assets to provide the buyer with an opportunity to review and investigate the assets' condition, financial records, contracts, and any legal issues associated with them. 5. Transfer of Assets: Outline the necessary steps and requirements for transferring ownership of the assets, including any consents or approvals required from third parties or government authorities. 6. Liabilities and Indemnification: Address how the liabilities and obligations related to the assets will be allocated between the buyer and seller and establish a framework for indemnification or compensation in the event of any claims, breaches, or damages arising from the sale. 7. Closing Conditions: Identify the conditions that must be satisfied before the sale can close, such as obtaining necessary consents, approvals, permits, or licenses, as well as completing any required filings or registrations. 8. Employee Matters: Consider how the sale will impact employees, including any necessary transfers, terminations, or obligations towards employee benefits, pension plans, or severance packages. 9. Confidentiality and Non-Compete: Include provisions to protect sensitive information and trade secrets, as well as any restrictions on competing with the business being sold. 10. Governing Law and Dispute Resolution: Specify the governing law for the agreement and outline the procedures for resolving any disputes that may arise. Different types of Houston Texas Checklists of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets can be tailored to specific industries or sectors. For example, there may be specific considerations for technology companies, manufacturing businesses, or service-oriented organizations. It is important to customize the checklist to address the unique aspects of the assets being sold and the industry in which the transaction is taking place.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Lista de Verificación de Asuntos a Considerar en la Redacción del Contrato de Venta de Activos Corporativos - Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Houston Texas Lista De Verificación De Asuntos A Considerar En La Redacción Del Contrato De Venta De Activos Corporativos?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Houston Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the latest version of the Houston Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Houston Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Houston Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!