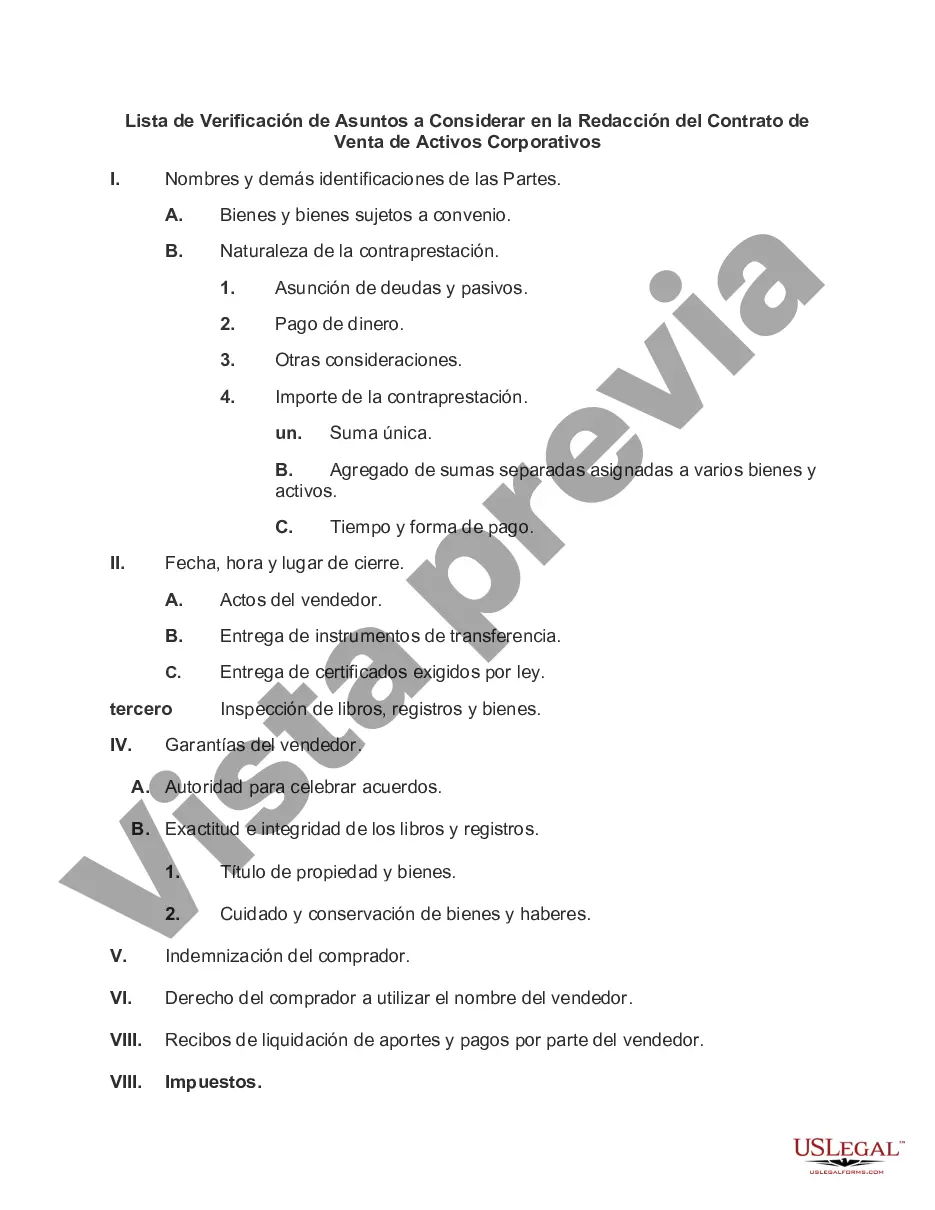

Maricopa, Arizona is a vibrant city located in Pinal County, Arizona. As a rapidly growing community, Maricopa offers a variety of amenities, attractions, and opportunities for residents and businesses alike. When considering the sale of corporate assets in Maricopa, it is crucial to have a well-drafted agreement that covers all necessary aspects, ensuring a smooth and legally binding transaction. Here is a checklist of matters to be considered in drafting such an agreement: 1. Identification of Parties: Clearly identify the parties involved in the agreement, including the buyer, seller, and any related entities. 2. Description of Assets: Provide a comprehensive description of the corporate assets being sold, including their condition, quantity, quality, and any necessary specifications. 3. Purchase Price: Clearly state the agreed-upon purchase price, including any potential adjustments or contingencies that may affect the final amount. 4. Payment Terms: Specify the payment terms, including the method and timing of payments. Determine if there will be any installment payments or financing arrangements. 5. Due Diligence: Outline the specific obligations and responsibilities of each party regarding due diligence, including access to information, financial statements, inventory inspections, and any necessary third-party assessments. 6. Representations and Warranties: Define the representations and warranties made by both the buyer and the seller regarding the assets, such as their ownership, condition, and any legal compliance requirements. 7. Intellectual Property: If applicable, address the transfer of any intellectual property rights associated with the corporate assets, including patents, trademarks, copyrights, and trade secrets. 8. Assumption of Liabilities: Determine which, if any, liabilities or obligations will be assumed by the buyer, such as outstanding debts, contracts, leases, or pending legal matters. 9. Governing Law and Jurisdiction: Specify the applicable governing law and jurisdiction that will govern any disputes arising from the agreement. 10. Confidentiality and Non-Disclosure: Include provisions to maintain the confidentiality of any sensitive information shared during the transaction process. 11. Conditions Precedent: Outline any conditions that must be met before the agreement becomes effective, such as regulatory approvals, third-party consents, or financing arrangements. 12. Closing Procedures: Detail the necessary steps to complete the sale, including the transfer of title, delivery of assets, and any other closing requirements. 13. Indemnification: Define the indemnification obligations of each party, including any post-closing liabilities or damages that may arise from the transaction. 14. Termination and Remedies: Include provisions for termination of the agreement, outlining the circumstances under which either party may terminate and the available remedies for breach. 15. Entire Agreement: Clarify that the agreement constitutes the entire understanding between the parties and supersedes any prior agreements or negotiations. While there may not be different types of Maricopa Arizona Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, these considerations provide a comprehensive overview of key elements that should be incorporated into such agreements to protect the interests of both parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Lista de Verificación de Asuntos a Considerar en la Redacción del Contrato de Venta de Activos Corporativos - Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Maricopa Arizona Lista De Verificación De Asuntos A Considerar En La Redacción Del Contrato De Venta De Activos Corporativos?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including Maricopa Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any tasks associated with paperwork completion straightforward.

Here's how to purchase and download Maricopa Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets.

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the validity of some records.

- Examine the related document templates or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and purchase Maricopa Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Maricopa Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, log in to your account, and download it. Of course, our website can’t replace an attorney entirely. If you need to deal with an extremely complicated case, we advise using the services of a lawyer to review your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-compliant paperwork with ease!