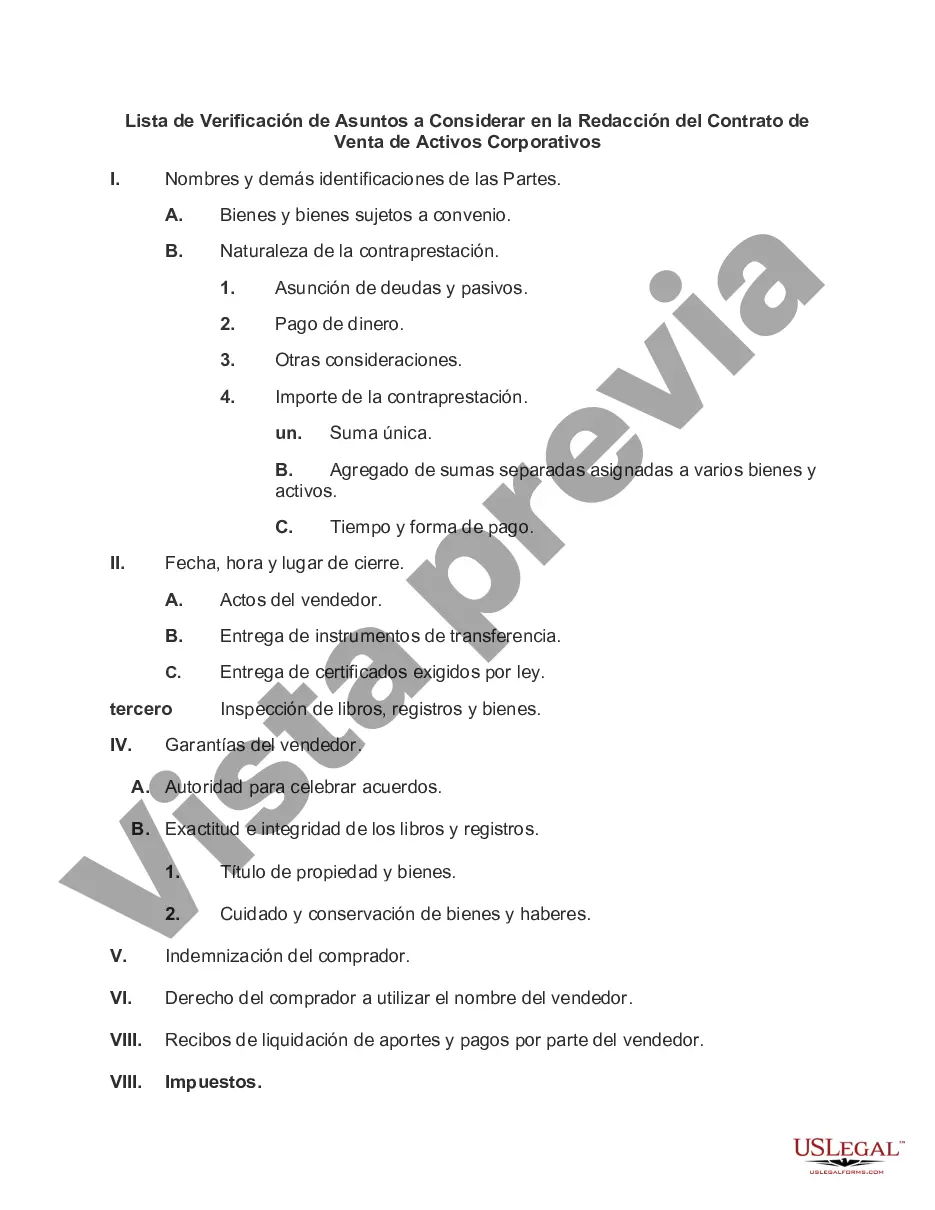

Mecklenburg County, North Carolina, has a specific checklist of matters that should be taken into account when drafting an agreement for the sale of corporate assets. These considerations are crucial to ensure a smooth transaction and protect the interests of all parties involved. Here is a detailed description of what this checklist entails and the key points to be considered: 1. Identification of Parties: The agreement should clearly identify both the buyer and the seller, including their legal names, contact details, and any relevant corporate information. 2. Description of Assets: A comprehensive description of the assets being sold should be included, along with their quantity, quality, and condition. This may involve detailed information about real estate properties, equipment, inventory, and intellectual property rights. 3. Purchase Price and Payment Terms: The agreement must outline the agreed-upon purchase price for the assets and specify the payment terms, including the timeframe for payment and any installment plans or conditions. 4. Due Diligence: Both parties must conduct a thorough due diligence process to assess the assets' value, legal status, and any potential liabilities. This includes reviewing financial records, contracts, permits, and any other relevant documents. 5. Representations and Warranties: The seller should provide accurate representations and warranties regarding the assets being sold. These statements ensure that the seller has legal ownership of the assets, that they are free from any encumbrances or litigation, and that they are in compliance with all applicable laws and regulations. 6. Allocation of Assets: If the sale involves various types of assets, it is important to specify how the purchase price will be allocated among them. This allocation may have tax implications for both the buyer and the seller. 7. Transfer of Liabilities: Determine which, if any, liabilities will be assumed by the buyer as part of the asset sale. This may include outstanding debts, pending legal actions, or contractual obligations. 8. Approvals and Consents: Identify any necessary approvals or consents required for the sale of corporate assets, such as board approvals, regulatory clearances, or shareholder consent. 9. Closing Conditions: Outline the conditions that need to be fulfilled before the sale can be finalized. These may include obtaining necessary permits, clearances, or consents, as well as confirming the accuracy of the representations and warranties. 10. Confidentiality and Non-Compete Agreements: If the sale involves sensitive business information or intellectual property, it is important to include confidentiality provisions to protect trade secrets. Additionally, non-compete clauses may be necessary to prevent the seller from competing with the buyer post-transaction. It is worth noting that while these considerations form a general checklist for drafting an agreement for the sale of corporate assets in Mecklenburg County, North Carolina, specific agreements may vary depending on the nature of the assets, parties involved, and the complexity of the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Lista de Verificación de Asuntos a Considerar en la Redacción del Contrato de Venta de Activos Corporativos - Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Mecklenburg North Carolina Lista De Verificación De Asuntos A Considerar En La Redacción Del Contrato De Venta De Activos Corporativos?

Draftwing documents, like Mecklenburg Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, to manage your legal matters is a difficult and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for various scenarios and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Mecklenburg Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets form. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading Mecklenburg Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets:

- Ensure that your template is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the Mecklenburg Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start utilizing our service and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!