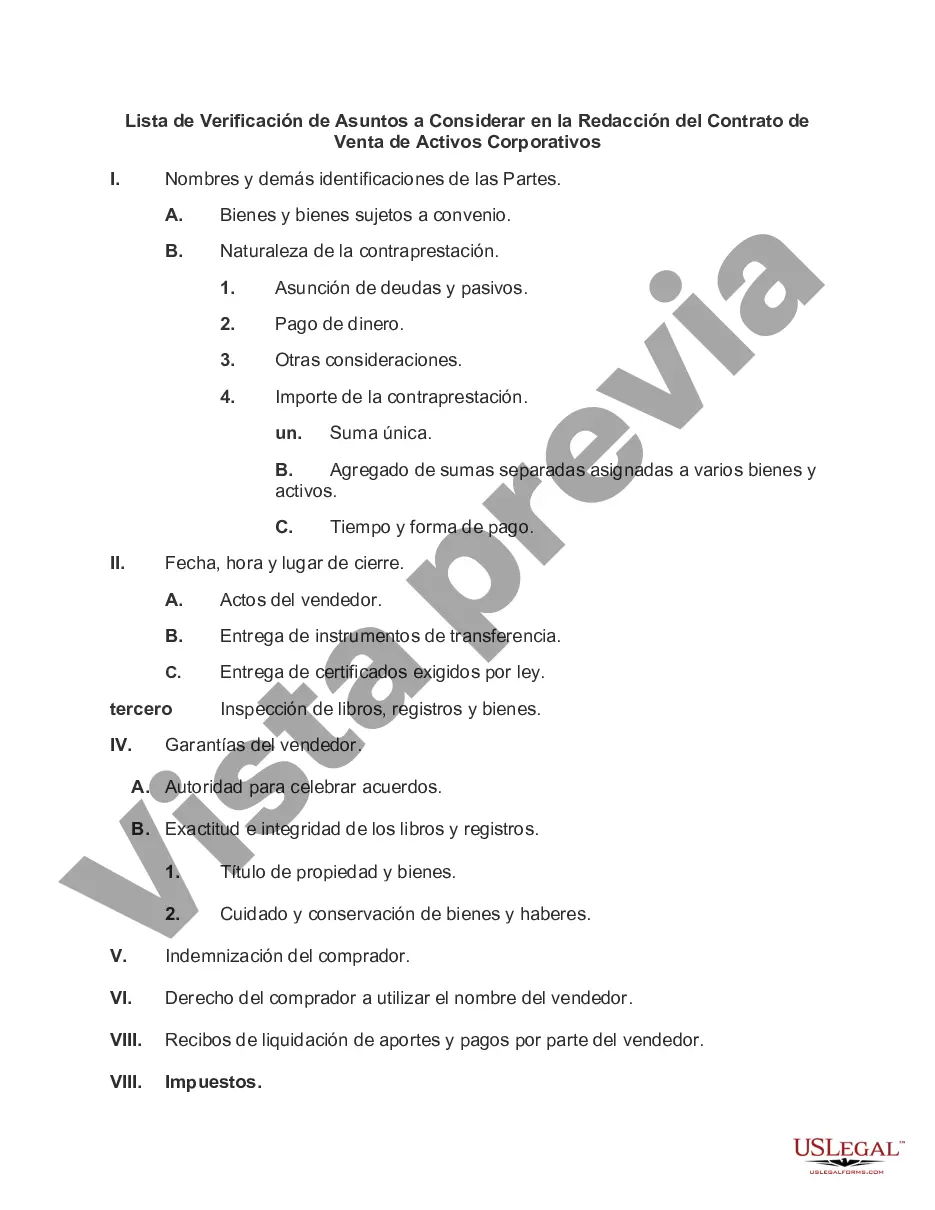

Montgomery, Maryland is a vibrant county located in the Washington Metropolitan Area. Renowned for its rich history, diverse community, and excellent quality of life, Montgomery County offers a plethora of attractions and opportunities for both residents and visitors alike. Whether you are considering moving to Montgomery County or planning a visit, here is a comprehensive checklist of matters to be considered when drafting an agreement for the sale of corporate assets: 1. Asset Identification: Clearly identify and describe the assets to be sold, including real property, intellectual property, equipment, inventory, and any other relevant assets. 2. Purchase Price: Determine the agreed-upon purchase price for the corporate assets and specify whether it is a lump sum or if it will be paid in installments. 3. Payment Terms: Outline the payment terms, including the timeline for payment, method of payment, and any applicable interest or penalties for late payments. 4. Representations and Warranties: Ensure that the agreement includes representations and warranties from both the buyer and the seller, such as the legal authority to enter into the agreement, the ownership of the assets, and the absence of any encumbrances, liens, or legal disputes. 5. Due Diligence: Specify the due diligence period for the buyer to investigate the assets, request additional information, and perform any necessary inspections or appraisals. 6. Transfer of Title: Discuss the process for transferring ownership of the assets, including any necessary documents, registrations, or permits required by the relevant authorities. 7. Assumption of Liabilities: Determine if the buyer will assume any existing liabilities or debts associated with the assets and clearly outline any indemnification provisions. 8. Employee Matters: Address the treatment of employees associated with the sold assets, including whether they will be retained, terminated, or transferred to another entity. 9. Governing Law and Dispute Resolution: Determine the governing law of the agreement and establish a mechanism for resolving any potential disputes, such as arbitration or litigation processes. 10. Confidentiality: Include provisions to protect the confidentiality of any sensitive or proprietary information exchanged during the transaction. 11. Termination Provisions: Define the circumstances under which the agreement can be terminated by either party and the consequences of such termination. 12. Conditions Precedent: Specify any conditions that must be satisfied before the sale of assets can be consummated, such as obtaining regulatory approvals or third-party consents. Different types of Montgomery, Maryland checklists for drafting agreements for the sale of corporate assets may be tailored to specific industries or sectors. For example, there could be separate checklists for technology companies, manufacturing businesses, or real estate transactions. Each checklist may emphasize unique considerations relevant to the specific assets being sold and the associated legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Lista de Verificación de Asuntos a Considerar en la Redacción del Contrato de Venta de Activos Corporativos - Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Montgomery Maryland Lista De Verificación De Asuntos A Considerar En La Redacción Del Contrato De Venta De Activos Corporativos?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Montgomery Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Montgomery Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Montgomery Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets:

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!