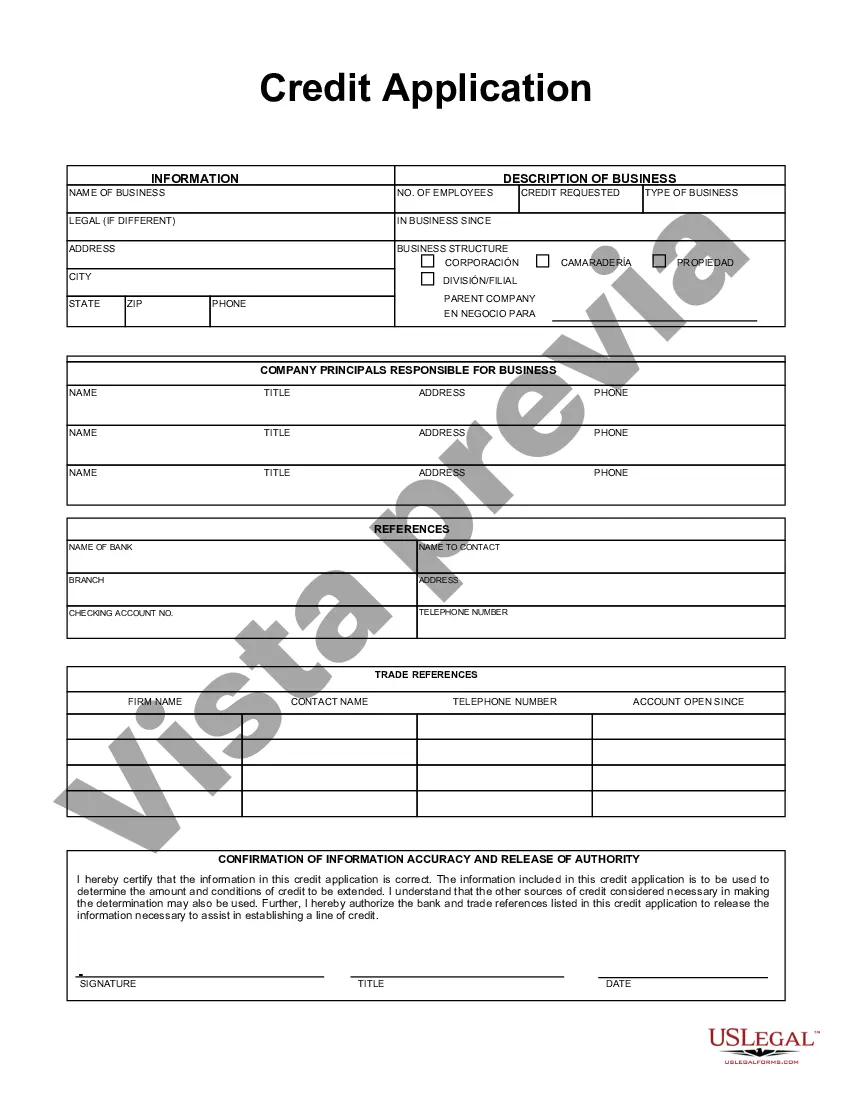

Salt Lake Utah Credit Application is a comprehensive document that allows individuals or businesses to apply for credit in the Salt Lake City area of Utah. It is a vital tool that helps borrowers apply for loans, credit cards, mortgages, and other forms of credit. This credit application gathers crucial information about the applicant, including personal details, employment history, financial standing, and credit references. The data collected in this application helps lenders evaluate the creditworthiness of potential borrowers, allowing them to make informed decisions regarding granting credit. Salt Lake Utah Credit Application typically requests the following information: 1. Personal Information: Full name, date of birth, social security number, contact details (address, phone number, and email), marital status, and number of dependents. 2. Employment Information: Current and previous employment details, including employer name, address, phone number, job title, duration of employment, and monthly salary. 3. Financial Information: Details of income sources, such as salary, dividends, rental income, or other investments. It may also require information about monthly expenses, such as rent/mortgage payments, utilities, loans, and credit card bills. 4. Credit References: The applicant is asked to provide names, addresses, and contact information for individuals or businesses that can vouch for their creditworthiness. These references may include previous lenders, landlords, or personal acquaintances. 5. Loan Details: If the application is specifically for a loan, it will also ask for the desired loan amount, purpose, and any collateral available (if applicable). By submitting a Salt Lake Utah Credit Application, individuals or businesses initiate the credit evaluation process. The application is thoroughly reviewed by lenders to assess the applicant's financial stability, credit history, and ability to repay borrowed funds. The decision to approve or decline credit is based on factors such as credit score, income-to-debt ratio, employment history, and overall creditworthiness. While there may not be different types of Salt Lake Utah Credit Application, variations can exist based on the specific financial institution or creditor. Different lenders may have slightly different application forms or additional requirements tailored to their lending policies. It is advisable to carefully review and complete the application form provided by the specific lender or financial institution where credit is being sought.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Solicitud de crédito - Credit Application

Description

How to fill out Salt Lake Utah Solicitud De Crédito?

Are you looking to quickly create a legally-binding Salt Lake Credit Application or maybe any other form to handle your personal or business affairs? You can select one of the two options: hire a professional to write a legal document for you or draft it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you get neatly written legal papers without paying unreasonable fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant form templates, including Salt Lake Credit Application and form packages. We offer documents for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, double-check if the Salt Lake Credit Application is tailored to your state's or county's laws.

- In case the form comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Salt Lake Credit Application template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Moreover, the templates we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!