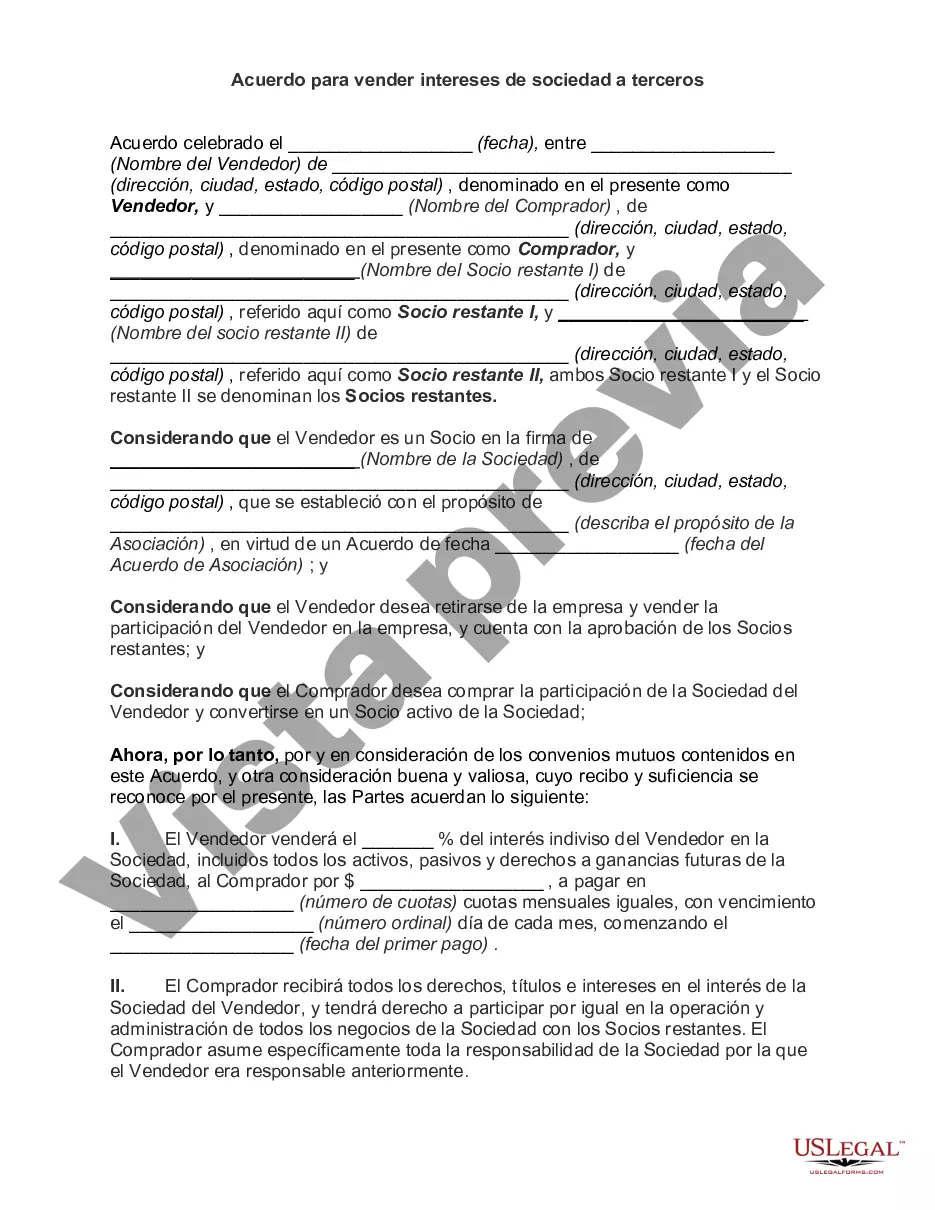

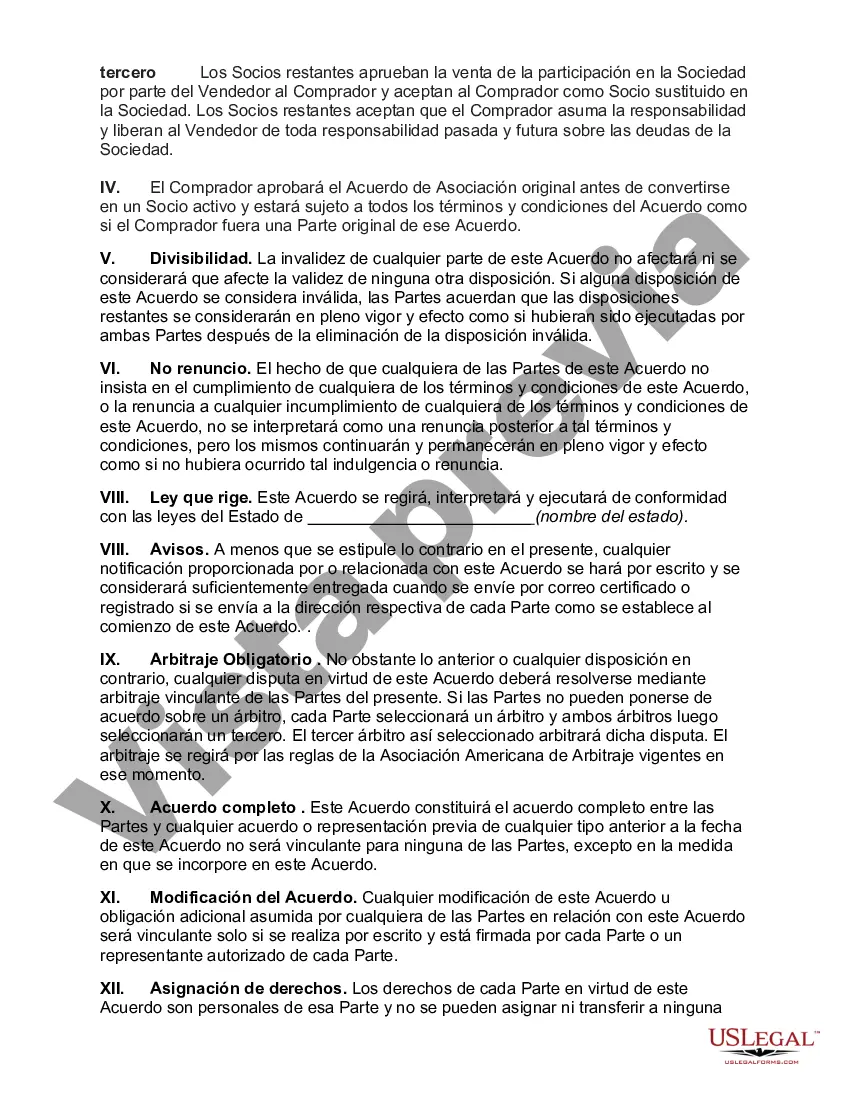

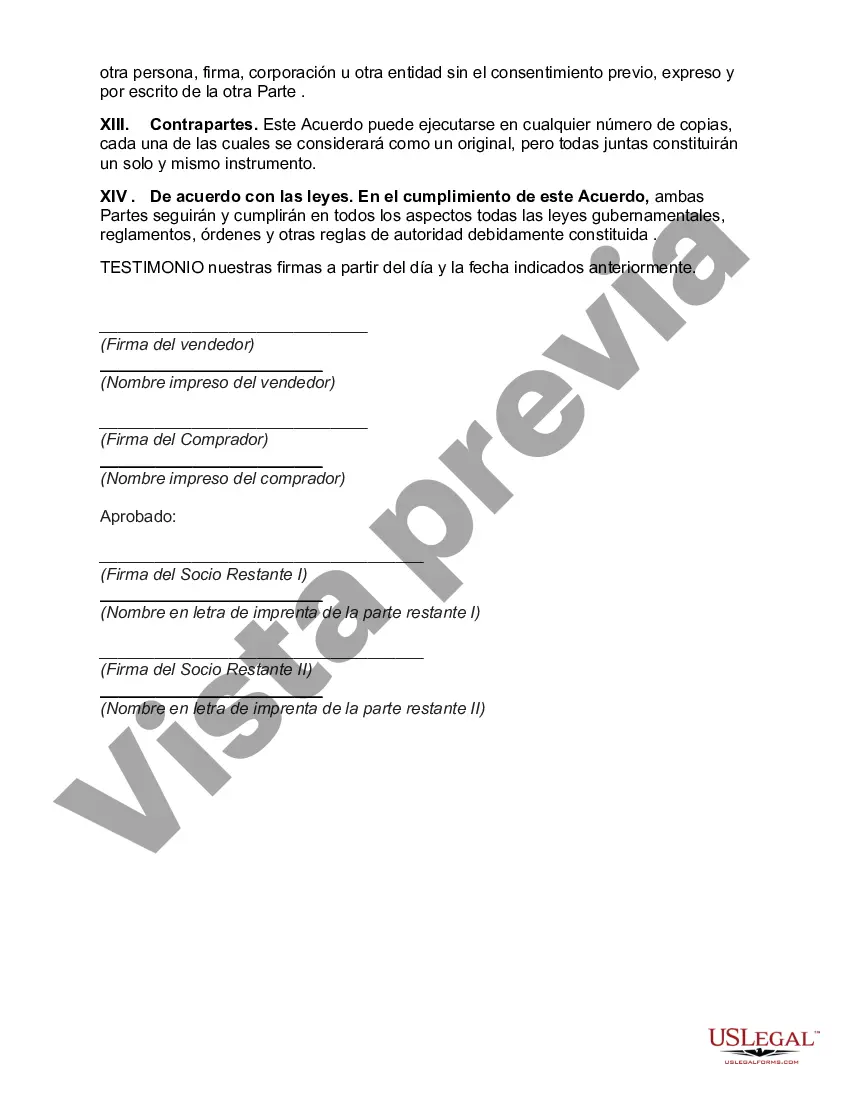

A Harris Texas Agreement to Sell Partnership Interest to a Third Party refers to a legally binding contract that outlines the terms and conditions agreed upon by the partners of a partnership in Harris County, Texas, for the sale of a partnership interest to an external party. This agreement facilitates the transfer of ownership rights and obligations to the buyer, allowing them to become a new partner in the partnership. When drafting a Harris Texas Agreement to Sell Partnership Interest to a Third Party, it is crucial to cover various aspects to ensure clarity and protect the interests of all parties involved. The agreement typically includes the following key elements: 1. Identification of Parties: Clearly identify the parties involved, ensuring accurate names, addresses, and contact information of both the selling partner(s) and the buyer(s). 2. Partnership Overview: Detail the name of the partnership, its principal place of business, and any key information necessary to establish its legal standing. 3. Purpose and Intent: Clearly state the intention of the parties to sell and buy a partnership interest, emphasizing that this agreement supersedes any prior agreements or understandings. 4. Terms of Sale: Precisely describe the partnership interest being sold, including the percentage or share of ownership being transferred. Specify whether the interest being sold encompasses management rights, voting rights, profit distributions, and any outstanding debts or liabilities. 5. Purchase Consideration: Outline the purchase price of the partnership interest, including the agreed-upon payment method and timeline for making the payment. Specify any conditions or adjustments to the price, such as debt obligations or future profit-sharing arrangements. 6. Regulatory Compliance: Ensure that the sale complies with federal, state, and local laws, including any required approvals, permits, or licenses. 7. Seller's Representations: The selling partner(s) must provide representations and warranties regarding the partnership's affairs, assets, liabilities, contracts, and legal compliance. This helps protect the buyer from undisclosed risks or liabilities. 8. Buyer's Representations: The buying party must also provide representations and warranties, such as confirming their legal capacity to enter into the agreement, ability to fund the purchase, and compliance with any relevant laws or regulations. 9. Closing Process: Define the closing process, including the location, date, and time of the transaction. Outline the necessary documents to be exchanged, and provide instructions on the transfer of ownership and partnership books and records. 10. Dispute Resolution and Governing Law: Specify the process for resolving any disputes arising from the agreement and the governing law under which the agreement will be interpreted. Common variations of a Harris Texas Agreement to Sell Partnership Interest to Third Party may include agreements specific to different types of partnerships, such as: 1. General Partnership: An agreement for the sale of partnership interest in a general partnership, where all partners have unlimited liability. 2. Limited Partnership: An agreement for the sale of partnership interest in a limited partnership, where there are general partners with unlimited liability and limited partners with liability limited to their investment. 3. Limited Liability Partnership (LLP): An agreement for the sale of partnership interest in an LLP, where all partners have limited liability. In conclusion, a Harris Texas Agreement to Sell Partnership Interest to Third Party is a crucial legal document that governs the sale of a partnership interest and protects the rights and obligations of all parties involved. By ensuring comprehensive coverage of the necessary elements, this agreement ensures a smooth transfer of ownership and minimizes potential disputes or liabilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo para vender intereses de sociedad a terceros - Agreement to Sell Partnership Interest to Third Party

Description

How to fill out Harris Texas Acuerdo Para Vender Intereses De Sociedad A Terceros?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life sphere, locating a Harris Agreement to Sell Partnership Interest to Third Party suiting all local requirements can be exhausting, and ordering it from a professional attorney is often pricey. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the Harris Agreement to Sell Partnership Interest to Third Party, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Harris Agreement to Sell Partnership Interest to Third Party:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Agreement to Sell Partnership Interest to Third Party.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!