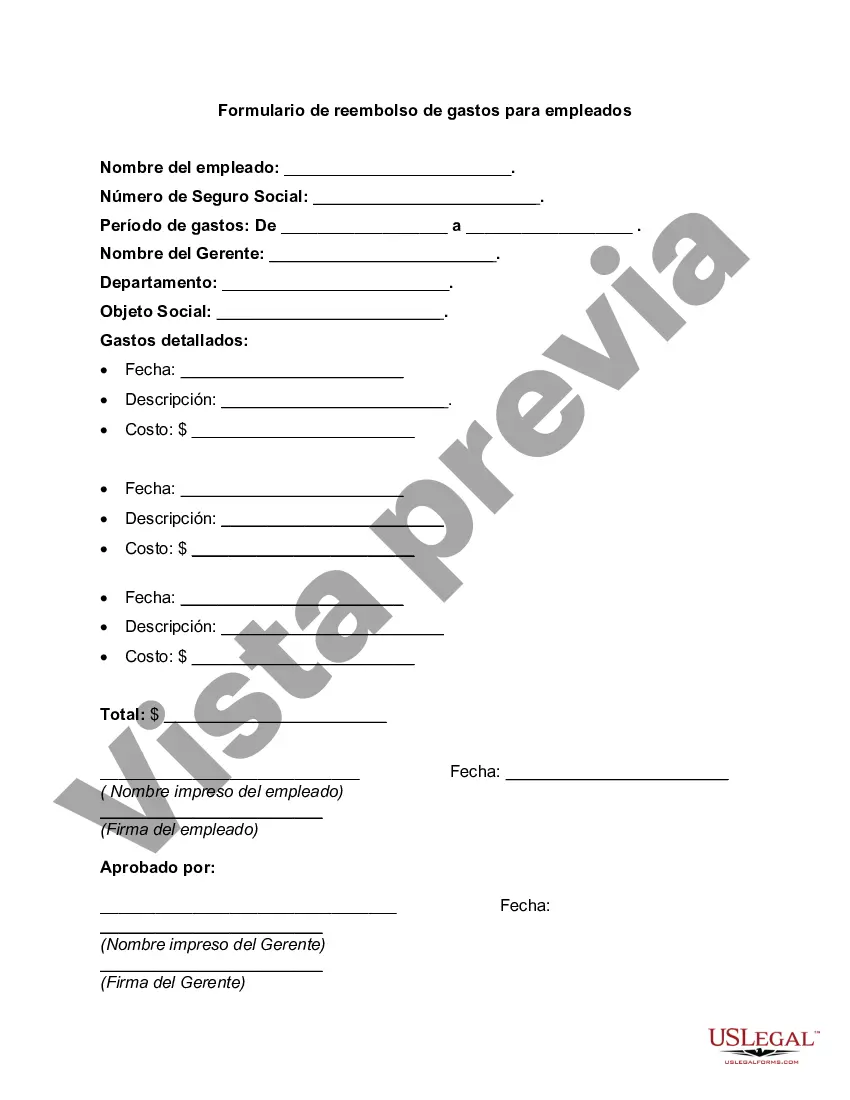

Cook Illinois Expense Reimbursement Form for an Employee is a document provided by Cook Illinois Corporation, a transportation company, to their employees to facilitate the reimbursement process for any expenses incurred during work-related activities. This form ensures that employees are reimbursed for valid expenses while adhering to the company's reimbursement policy. The Cook Illinois Expense Reimbursement Form for an Employee requires detailed information to ensure accuracy and efficient processing. The form typically includes the following sections: 1. Employee Information: This section captures the employee's name, employee identification number, department, and contact information. It serves to identify the employee making the reimbursement request. 2. Expense Details: Here, employees need to specify the nature of the expense, such as travel expenses, meal expenses, lodging expenses, or other eligible expenses. They should provide a clear description of the incurred expense, including the date(s) of the expense, purpose, and any supporting documentation attached. 3. Receipts and Supporting Documentation: Employees are required to attach original receipts, bills, invoices, or any relevant supporting documentation that provides evidence of the expense incurred. This ensures transparency and allows the company to verify the validity of the expense. 4. Amount Requested: In this section, employees need to specify the total amount being requested for reimbursement. They should calculate the expenses accurately, ensuring they include taxes, tips, or any other applicable charges associated with the expense. 5. Approval and Signature: The form provides space for the employee to obtain the necessary approvals from their supervisor, department head, or designated personnel. The approver's signature ensures that the expenses are authorized and comply with the company's policies. Depending on the type of expenses incurred, Cook Illinois Corporation may have specific reimbursement forms tailored to different categories, such as: 1. Travel Expense Reimbursement Form: This form is used when an employee incurs expenses related to business travel, such as airfare, accommodation, rental cars, and fuel expenses. 2. Meal Expense Reimbursement Form: This form is used for employees seeking reimbursement for meals consumed during work-related activities, such as client meetings or training sessions. 3. Vehicle Expense Reimbursement Form: This form is applicable when an employee uses their personal vehicle for work-related purposes, such as mileage reimbursement and fuel expenses. By utilizing the Cook Illinois Expense Reimbursement Form(s) for an Employee and accurately providing all the requested information, employees can ensure a smooth and prompt reimbursement process while complying with the company's policies and procedures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Formulario de reembolso de gastos para un empleado - Expense Reimbursement Form for an Employee

Description

How to fill out Cook Illinois Formulario De Reembolso De Gastos Para Un Empleado?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Cook Expense Reimbursement Form for an Employee is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to get the Cook Expense Reimbursement Form for an Employee. Adhere to the guide below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Cook Expense Reimbursement Form for an Employee in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!