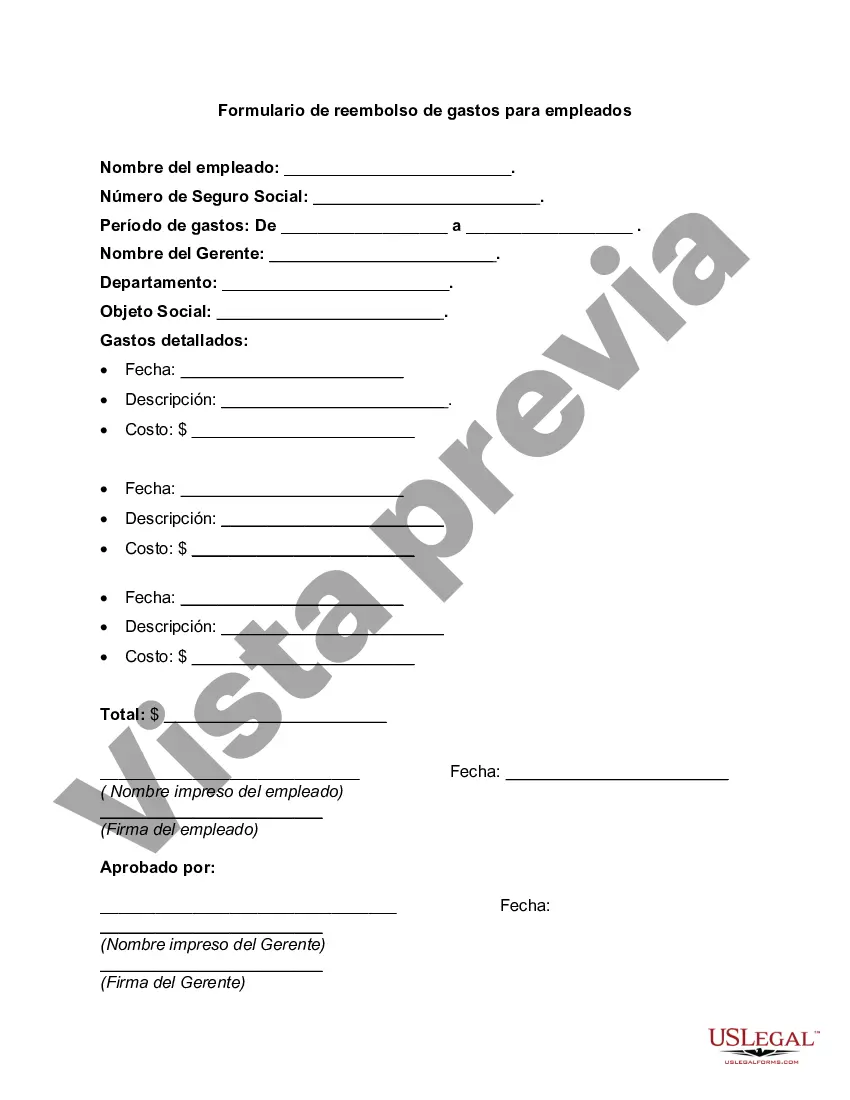

The Fairfax Virginia Expense Reimbursement Form for an Employee is a document that allows employees in Fairfax, Virginia, to request reimbursement for expenses incurred while conducting business on behalf of their employer. This form serves as a record and verification of the expenses, ensuring accurate reimbursement and financial tracking. The Fairfax Virginia Expense Reimbursement Form typically includes the following sections: 1. Employee Information: This section captures essential details such as the employee's name, department, job title, employee identification number, and contact information. It ensures that the requests are accurately associated with the respective employee. 2. Expense Details: This section enables employees to list and describe each expense incurred. It includes fields for categories like transportation, meals, lodging, office supplies, professional development, and other miscellaneous expenses. Employees need to provide specific descriptions for each expense along with the applicable date and location. 3. Receipts and Documentation: Employees are required to attach supporting documents like original receipts, invoices, and any additional paperwork relevant to the expenses claimed. These documents are vital for verification and to comply with the organization's financial policies and auditable standards. 4. Approval Section: This portion provides space for supervisors or managers to review and approve the employee's expense request. They can cross-check the expenses against the organization's travel and reimbursement policies, ensuring they conform to guidelines. 5. Reimbursement Information: In this section, employees can specify the preferred method of reimbursement, whether it is a direct deposit into their bank account or a physical check. They should include their bank account details, routing numbers, and any other necessary information for electronic transfers. 6. Signatures and Dates: The form concludes with signature fields for both the employee and the approving supervisor. It is important to include the date of submission and approval, ensuring a clear timeline for processing reimbursements. Additional variations or types of Fairfax Virginia Expense Reimbursement Forms for employees may exist depending on specific organizational requirements. These variations could cater to different departments, divisions, or funding sources within Fairfax County. They may include designation-specific expenses, project-based reimbursement forms, or travel-related forms. Overall, the Fairfax Virginia Expense Reimbursement Form for an Employee simplifies the process of reimbursing employees for their legitimate expenses, thereby promoting transparency and accountability within organizations based in Fairfax, Virginia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Formulario de reembolso de gastos para un empleado - Expense Reimbursement Form for an Employee

Description

How to fill out Fairfax Virginia Formulario De Reembolso De Gastos Para Un Empleado?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Fairfax Expense Reimbursement Form for an Employee, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Fairfax Expense Reimbursement Form for an Employee from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fairfax Expense Reimbursement Form for an Employee:

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Un formulario reembolso se compone de una serie de preguntas frecuentes en diferentes casillas relativas a: Datos personales del empleado. Datos de facturacion. Documentos aportados. Datos bancarios para el ingreso. Firma y fecha.

¿Como facturar y que puedo deducir? Nombre y RFC del emisor y receptor. Fecha, lugar y hora de emision. Tipo de CFDI. Uso del CFDI. Datos del producto o servicio. Desglose de Impuestos. Forma y Metodo de pago. Cadenas y certificaciones del SAT.

La figura del reembolso de gastos se origina en una intermediacion en la realizacion de la respectiva transaccion, es decir, cuando un sujeto realiza pagos por cuenta y a nombre de un tercero los efectos de la transaccion se radican en cabeza de la persona a cuyo nombre se realizaron.

Dos circunstancias del uso del reembolso Puede utilizarse como mejora de la calidad y servicio: En el caso de recibir un articulo en mal estado, defectuoso o simplemente por error. En estos casos, el vendedor ofrece la posibilidad de devolver el producto y restituir el dinero.

Para obtener el reembolso el intermediario debera emitir una factura por el reembolso de gastos, en la cual se detallaran los comprobantes de venta motivo del reembolso, con la especificacion del RUC del emisor, numero de la factura, valor neto e IVA y ademas se adjuntaran los originales de tales comprobantes.

Cuando existe un gasto reembolsable tiene que existir una factura o documento justificativo del gasto y dicha factura debe ser emitida al nombre de la empresa o autonomo, de tal manera que, a efectos fiscales, sea para dicha empresa o autonomo un gasto deducible.

El reembolso de gastos es el reembolso que se da a un empleado por los gastos incurridos durante un viaje de trabajo.

Registrar un reembolso de cliente desde Cuentas bancarias Cliente. Introduce la referencia o el nombre del negocio.Pagado de cuenta bancaria. Comprueba que aparece la cuenta bancaria correcta.Forma de pago. Especifica el metodo de pago. Fecha de reembolso.Referencia (opcional).Importe reembolsado.

Puedes administrar las devoluciones, los cambios y mucho mas en la pagina Historial de pedidos....Para solicitar una devolucion o un cambio: Inicia sesion en Historial de pedidos y selecciona Solicitar una devolucion.Sigue las instrucciones en pantalla para obtener una etiqueta de envio prepago para la devolucion.

Cuando existe un gasto reembolsable tiene que existir una factura o documento justificativo del gasto y dicha factura debe ser emitida al nombre de la empresa o autonomo, de tal manera que, a efectos fiscales, sea para dicha empresa o autonomo un gasto deducible.