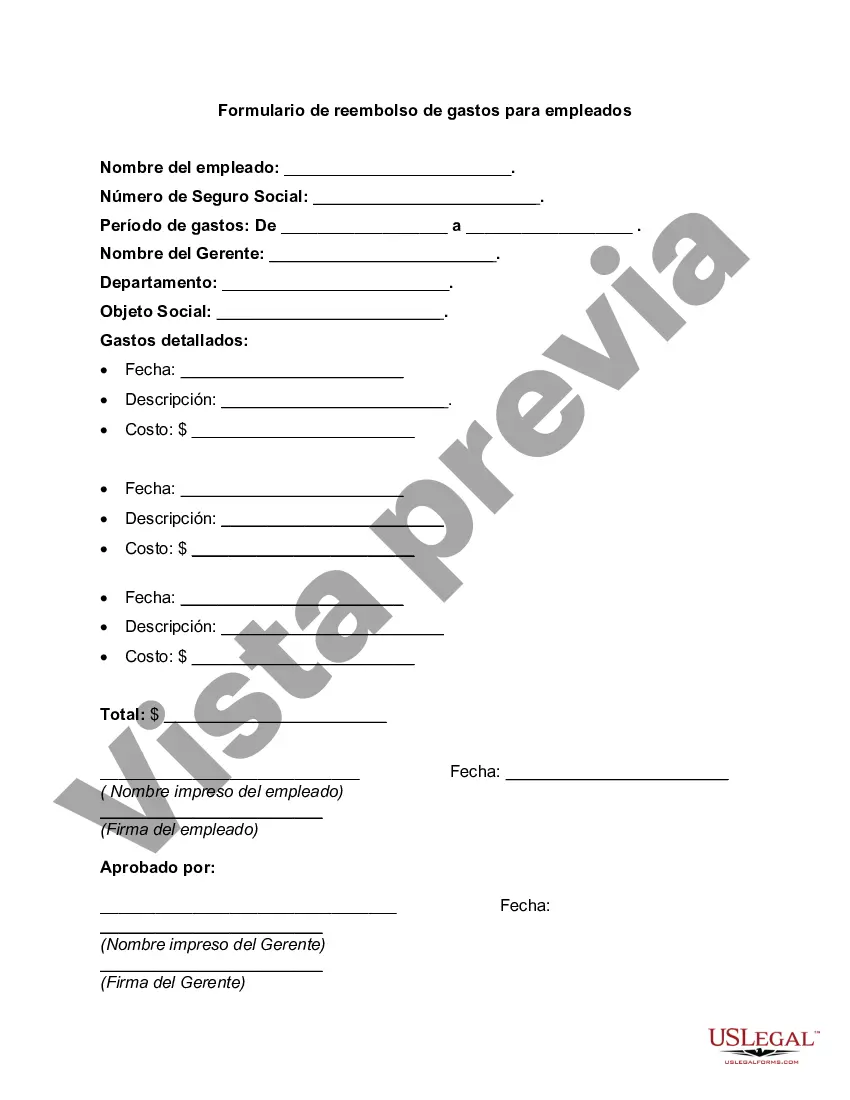

The Franklin Ohio Expense Reimbursement Form for an Employee is a crucial document that enables employees to claim reimbursements for business-related expenses incurred during their course of work. This form is designed to accurately capture all necessary details and ensure that employees are reimbursed appropriately for their expenses. The form typically includes the following information: 1. Employee Information: This section requires the employee to provide their name, employee ID, department, and contact information, ensuring proper identification and communication. 2. Expense Details: Employees are required to provide a comprehensive breakdown of each expense incurred, including the date, description, and purpose of the expense. This section also allows employees to specify the amount spent and the currency used. 3. Supporting Documentation: To validate the expenses, employees are often asked to attach relevant receipts or invoices that clearly show the nature of the expense and the amount paid. 4. Authorization: The form usually requires the employee's supervisor or authorized personnel to review and approve the reimbursement request. The reviewer may assess the accuracy, authenticity, and conformity of the expense in relation to company policy. 5. Account Information: Employees are asked to provide the necessary bank account details, such as account number and routing information, to facilitate the electronic transfer of reimbursed funds. 6. Signature and Date: To confirm the accuracy of the information provided, the employee is required to sign and date the form, acknowledging the responsibility associated with the expense reimbursement request. In addition to the general Franklin Ohio Expense Reimbursement Form for an Employee, there could be specific types of forms for various categories of expenses, such as: 1. Travel Expense Reimbursement Form: Used when employees have incurred expenses for travel-related purposes, including airfare, accommodation, meals, transportation, and any other necessary expenses during business trips. 2. Meal and Entertainment Expense Reimbursement Form: Specifically designed for employees to claim reimbursement for meals and entertainment expenses, usually incurred during client meetings, conferences, or business events. 3. Mileage Reimbursement Form: Used when employees use their personal vehicles for business-related travel, allowing them to claim reimbursement for mileage, fuel, and other vehicle-related expenses. Proper utilization of the Franklin Ohio Expense Reimbursement Form for an Employee ensures transparency, accuracy, and fairness in reimbursing employees for their business-related expenses while adhering to company policies and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Formulario de reembolso de gastos para un empleado - Expense Reimbursement Form for an Employee

Description

How to fill out Franklin Ohio Formulario De Reembolso De Gastos Para Un Empleado?

Are you looking to quickly draft a legally-binding Franklin Expense Reimbursement Form for an Employee or maybe any other document to manage your own or business matters? You can select one of the two options: hire a legal advisor to write a valid document for you or create it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get professionally written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific document templates, including Franklin Expense Reimbursement Form for an Employee and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra hassles.

- To start with, double-check if the Franklin Expense Reimbursement Form for an Employee is tailored to your state's or county's regulations.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the search again if the template isn’t what you were looking for by using the search bar in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Franklin Expense Reimbursement Form for an Employee template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the documents we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!