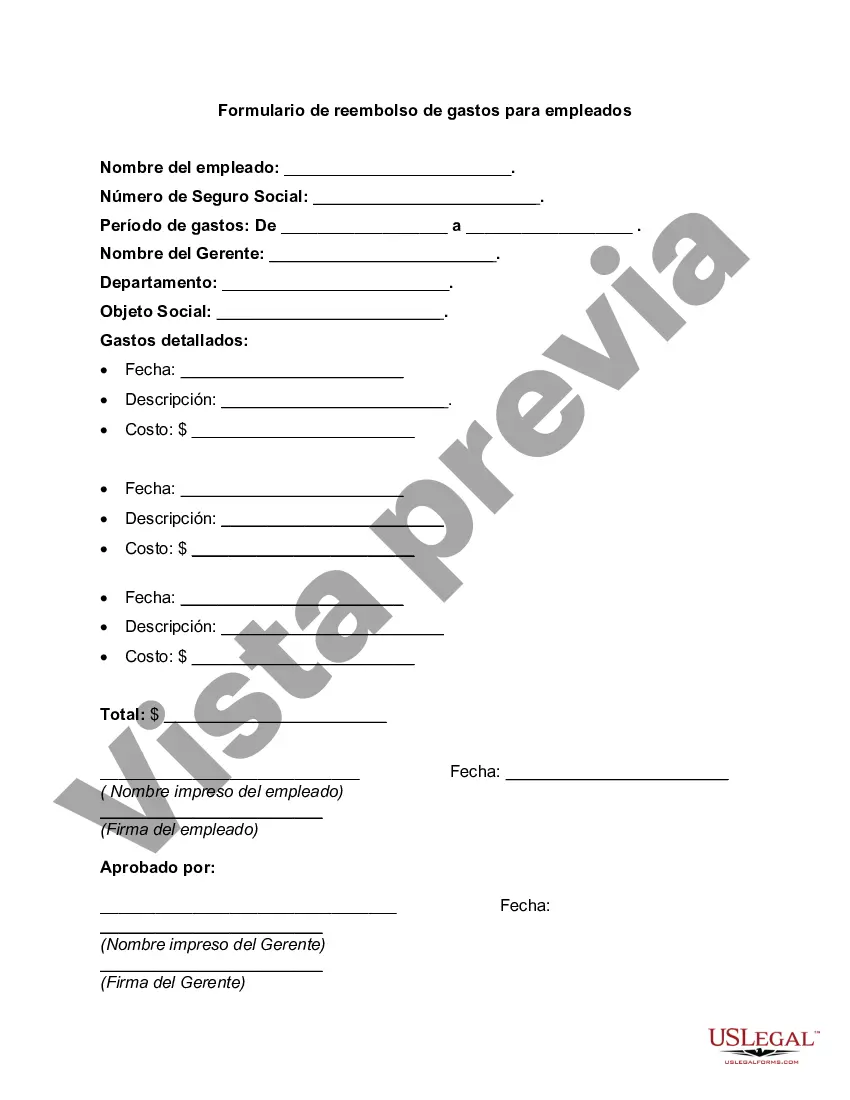

Los Angeles California Expense Reimbursement Form is a document that allows employees to request reimbursement for business-related expenses incurred in the course of their work. This form is designed to ensure that employees are properly reimbursed and that the expenses are within the company's policies and guidelines. The form captures essential details such as the employee's name, department, date of the expense, purpose of the expense, and the total amount incurred. The Los Angeles California Expense Reimbursement Form for an Employee includes various sections, each serving a specific purpose. These may include: 1. Employee Details: This section requires the employee to provide their name, employee identification number, department, and contact information. It helps identify who is requesting the reimbursement and enables efficient processing. 2. Expense Details: Here, the employee needs to describe each incurred expense separately. This may include transportation costs, meals, lodging, parking, conference fees, or other relevant business-related expenditures. The employee must provide a detailed explanation, date of expenditure, and attach original receipts as supporting documentation. 3. Approval Section: This area is designated for the employee's immediate supervisor or manager to review and approve the reimbursement request. They need to verify the expenses and ensure they comply with the company's reimbursement policy, budget restrictions, and any applicable legal regulations. 4. Accounting Section: In this section, the form is usually sent to the accounting department for review and final processing. Accountants verify the accuracy of the reimbursement request, match it with the attached receipts, and reconcile it with the company's budgetary allocations. 5. Signatures and Dates: At the end of the form, designated spaces are provided for the employee, supervisor, and accounting personnel to sign and date, ensuring proper authorization and record-keeping. The Los Angeles California Expense Reimbursement Form might have additional variations depending on the company's specific requirements and policies. Some common variants may include: 1. Travel Expense Reimbursement Form: This form is specifically used for employees seeking reimbursement for travel-related expenses, such as airfare, lodging, rental cars, and meals during business trips. 2. Mileage Reimbursement Form: Primarily used by employees who use personal vehicles for business purposes, this form allows them to report their mileage and request reimbursement based on the company's predetermined mileage rate. 3. Conference/Event Expense Reimbursement Form: Companies often use this form for employees attending conferences, seminars, or industry-related events. It typically includes additional fields specific to event registration fees, training materials, and other expenses associated with attending such gatherings. In conclusion, the Los Angeles California Expense Reimbursement Form for an Employee is a crucial document that ensures employees are appropriately reimbursed for business-related expenses while adhering to the company's reimbursement policies. These forms can vary depending on the type of expenses incurred, ranging from general reimbursement forms to more specific variants like travel, mileage, or conference expense reimbursement forms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Formulario de reembolso de gastos para un empleado - Expense Reimbursement Form for an Employee

Description

How to fill out Los Angeles California Formulario De Reembolso De Gastos Para Un Empleado?

If you need to get a reliable legal form provider to find the Los Angeles Expense Reimbursement Form for an Employee, consider US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of supporting materials, and dedicated support make it easy to find and execute various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to look for or browse Los Angeles Expense Reimbursement Form for an Employee, either by a keyword or by the state/county the document is intended for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Los Angeles Expense Reimbursement Form for an Employee template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive collection of legal forms makes these tasks less expensive and more reasonably priced. Set up your first business, arrange your advance care planning, draft a real estate agreement, or complete the Los Angeles Expense Reimbursement Form for an Employee - all from the convenience of your sofa.

Sign up for US Legal Forms now!