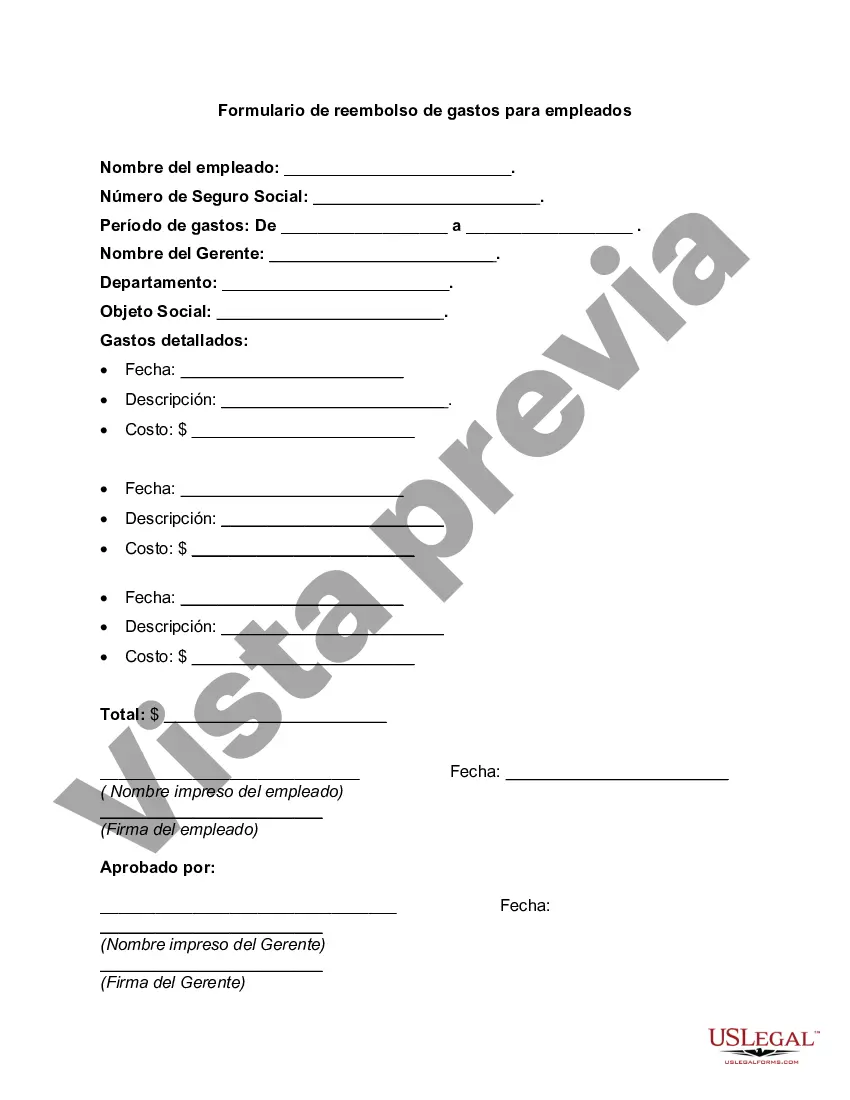

Queens New York Expense Reimbursement Form for an Employee is a document designed to facilitate the process of reimbursing employees for expenses incurred during work-related activities in Queens, New York. This form helps ensure accurate record-keeping, transparency, and adherence to company policies regarding reimbursement procedures. The Queens New York Expense Reimbursement Form typically includes the following details: 1. Employee Information: This section requires the employee's name, employee ID, job title, department, and contact information. 2. Reimbursement Date: Here, the employee needs to provide the date when the expenses were incurred and the date of submitting the reimbursement form. 3. Expense Details: This section allows the employee to itemize each expense separately. Key information includes the date, description, vendor name, and the purpose of the expense (e.g., meals, transportation, accommodation). The employee should provide the original receipts or supporting documents for each expense. 4. Expense Total: The form includes a subtotal of all the expenses listed to calculate the total amount to be reimbursed. 5. Expense Justification: The employee may need to provide justification for each expense incurred, explaining how it relates to their job responsibilities or the purpose of the business trip/meeting. 6. Approval and Signature: This section is reserved for the manager or authorized personnel to review and approve the expenses. They will sign and date the form once approval is granted. Different types of Queens New York Expense Reimbursement Forms for an Employee may include: 1. Queens New York Mileage Reimbursement Form: This form is used specifically for employees who use personal vehicles for work-related travel and need reimbursement for mileage incurred within Queens, New York. 2. Queens New York Travel Expense Reimbursement Form: When employees travel to Queens, New York, for business purposes, this form is utilized to capture all expenses related to accommodation, transportation, meals, and other eligible costs. 3. Queens New York Training Expense Reimbursement Form: Designed for employees attending training sessions, seminars, or workshops in Queens, New York, this form lets them claim expenses associated with registration fees, travel, accommodation, meals, and other relevant costs. 4. Queens New York Entertainment Expense Reimbursement Form: For employees who engage in client entertainment or business-related social events within Queens, New York, this form allows them to request reimbursement for expenses incurred during such activities (with proper documentation and managerial approval). By accurately completing and submitting the Queens New York Expense Reimbursement Form, employees can expect a prompt reimbursement process and maintain transparent financial records within their organization.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Formulario de reembolso de gastos para un empleado - Expense Reimbursement Form for an Employee

Description

How to fill out Queens New York Formulario De Reembolso De Gastos Para Un Empleado?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Queens Expense Reimbursement Form for an Employee, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how you can locate and download Queens Expense Reimbursement Form for an Employee.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the similar forms or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and buy Queens Expense Reimbursement Form for an Employee.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Queens Expense Reimbursement Form for an Employee, log in to your account, and download it. Needless to say, our website can’t replace an attorney entirely. If you need to cope with an extremely difficult case, we advise getting a lawyer to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-compliant documents with ease!