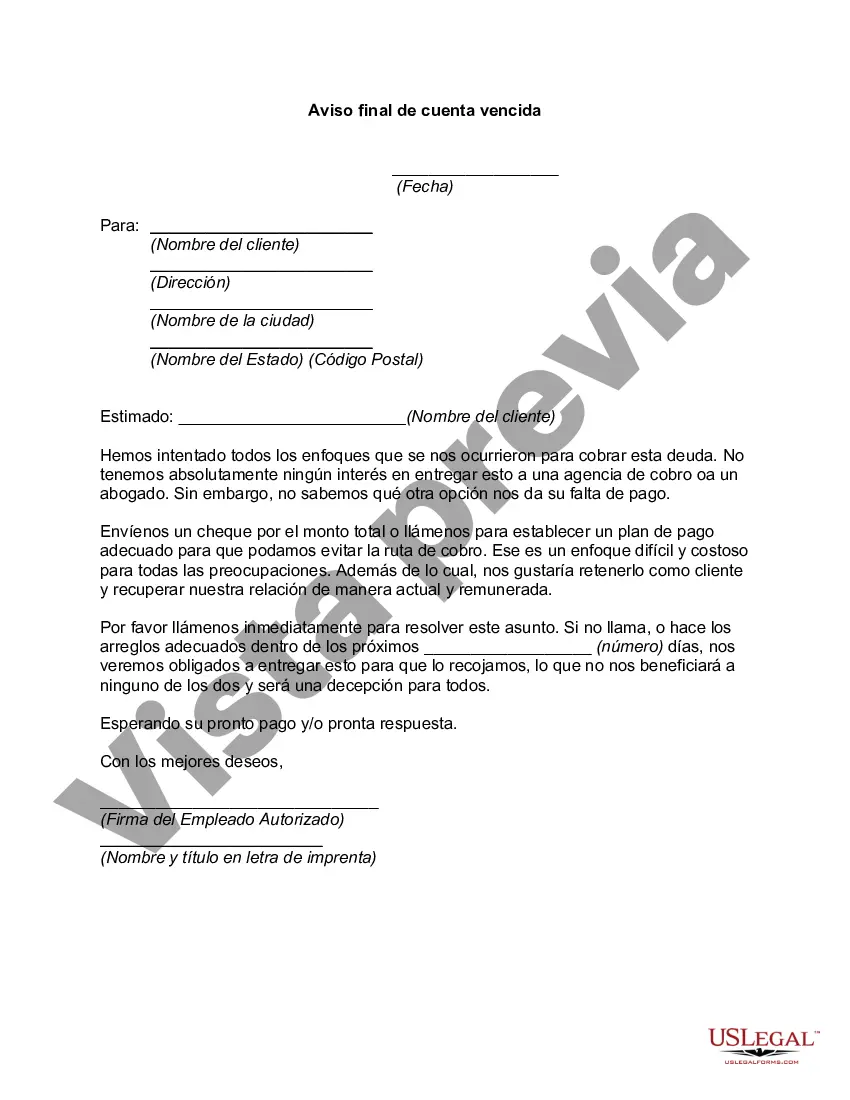

Chicago Illinois Final Notice of Past Due Account is a legal document issued by a creditor or collection agency in Chicago, Illinois, notifying an individual or business that they have an unpaid debt that is overdue. It serves as an official communication to inform the debtor of their outstanding balance and the urgent need for payment. The purpose of the Chicago Illinois Final Notice of Past Due Account is to urge the debtor to settle their dues promptly and avoid further consequences such as legal action or credit damage. It constitutes an essential step in the debt collection process and signifies the creditor's intent to pursue the balance owed. Keywords: Chicago, Illinois, final notice, past due account, legal document, creditor, collection agency, unpaid debt, overdue, outstanding balance, payment, communication, debtor, settlement, consequences, legal action, credit damage, debt collection process. Types of Chicago Illinois Final Notice of Past Due Account: 1. Personal Final Notice of Past Due Account: This type of notice is issued to an individual who has an outstanding personal debt owed to a creditor or collection agency in Chicago, Illinois. It can be related to various debts such as credit card bills, medical bills, personal loans, or utility payments. 2. Business Final Notice of Past Due Account: This notice is specifically designed for businesses that have failed to pay their invoices or maintain timely payments with their suppliers, vendors, or service providers in Chicago, Illinois. It emphasizes the urgency of settling outstanding balances to maintain healthy business relationships and avoid potential disruptions. 3. Legal Final Notice of Past Due Account: In some cases, the creditor or collection agency in Chicago, Illinois may escalate the debt collection process by sending a legal final notice. This type of notice typically signifies the creditor's intent to initiate legal actions to recover the unpaid debt. It is crucial for the debtor to respond promptly to this notice to mitigate legal consequences. 4. Mortgage Final Notice of Past Due Account: This type of notice is specific to individuals who have fallen behind on their mortgage payments in Chicago, Illinois. It serves as a reminder that immediate action must be taken to address the overdue payments and prevent potential foreclosure proceedings. 5. Tax Final Notice of Past Due Account: In cases of unpaid taxes owed to the state or federal government, Chicago, Illinois may issue a final notice to the taxpayer. This notice alerts the recipient about the outstanding tax balance, penalties, and possible legal actions if the debt remains unpaid. Overall, the Chicago Illinois Final Notice of Past Due Account is a critical communication tool used to inform debtors about their unpaid debts and the impending consequences of non-payment. It emphasizes the importance of settling the outstanding balance promptly to avoid further legal actions and protect one's creditworthiness.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Aviso final de cuenta vencida - Final Notice of Past Due Account

Description

How to fill out Chicago Illinois Aviso Final De Cuenta Vencida?

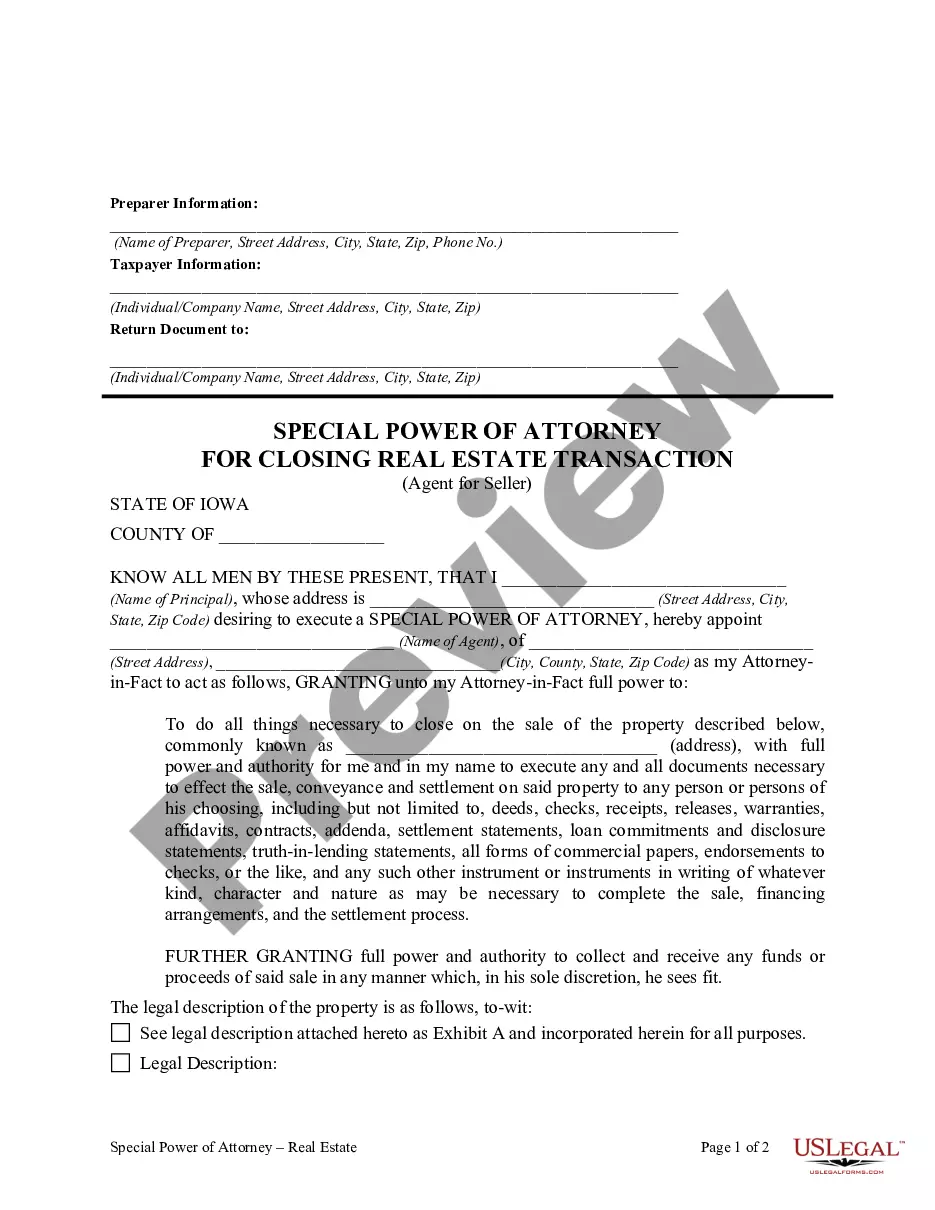

Do you need to quickly create a legally-binding Chicago Final Notice of Past Due Account or probably any other document to manage your personal or business matters? You can go with two options: hire a legal advisor to draft a legal document for you or draft it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get professionally written legal documents without paying sky-high prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific document templates, including Chicago Final Notice of Past Due Account and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- First and foremost, carefully verify if the Chicago Final Notice of Past Due Account is tailored to your state's or county's regulations.

- If the document has a desciption, make sure to check what it's intended for.

- Start the search again if the document isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Chicago Final Notice of Past Due Account template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the paperwork we offer are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!