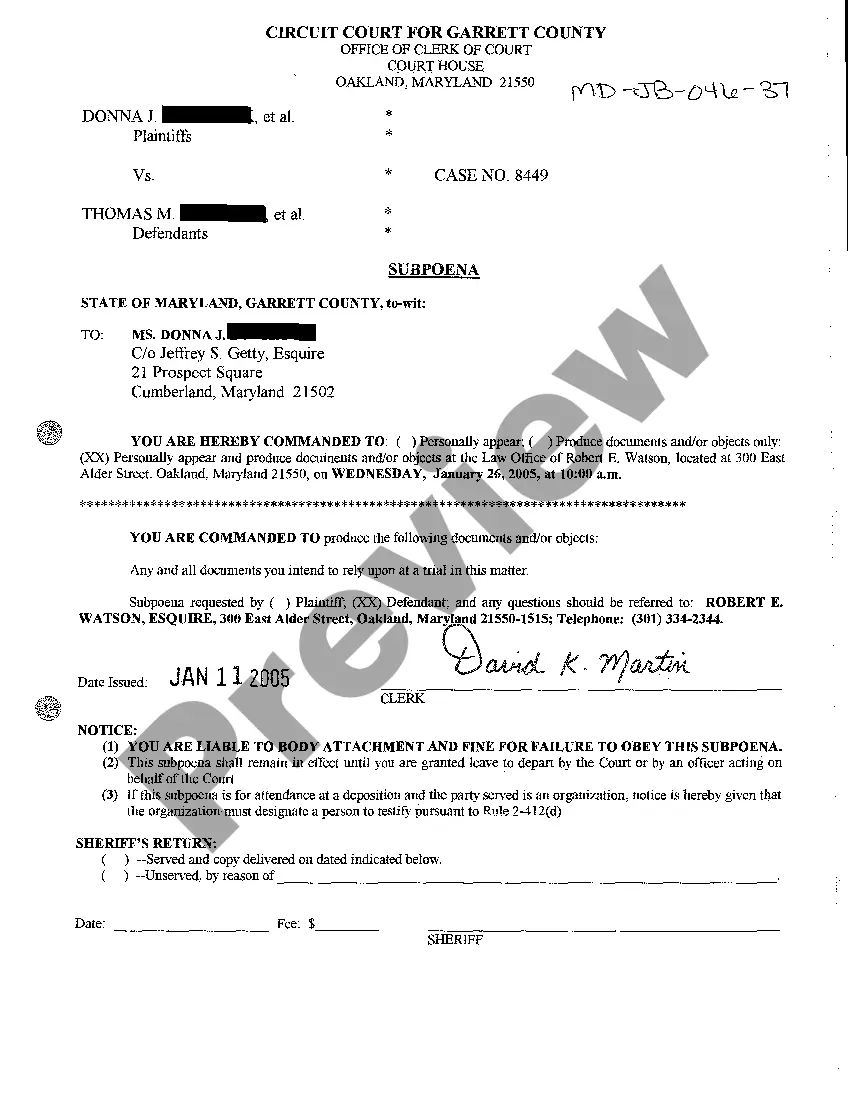

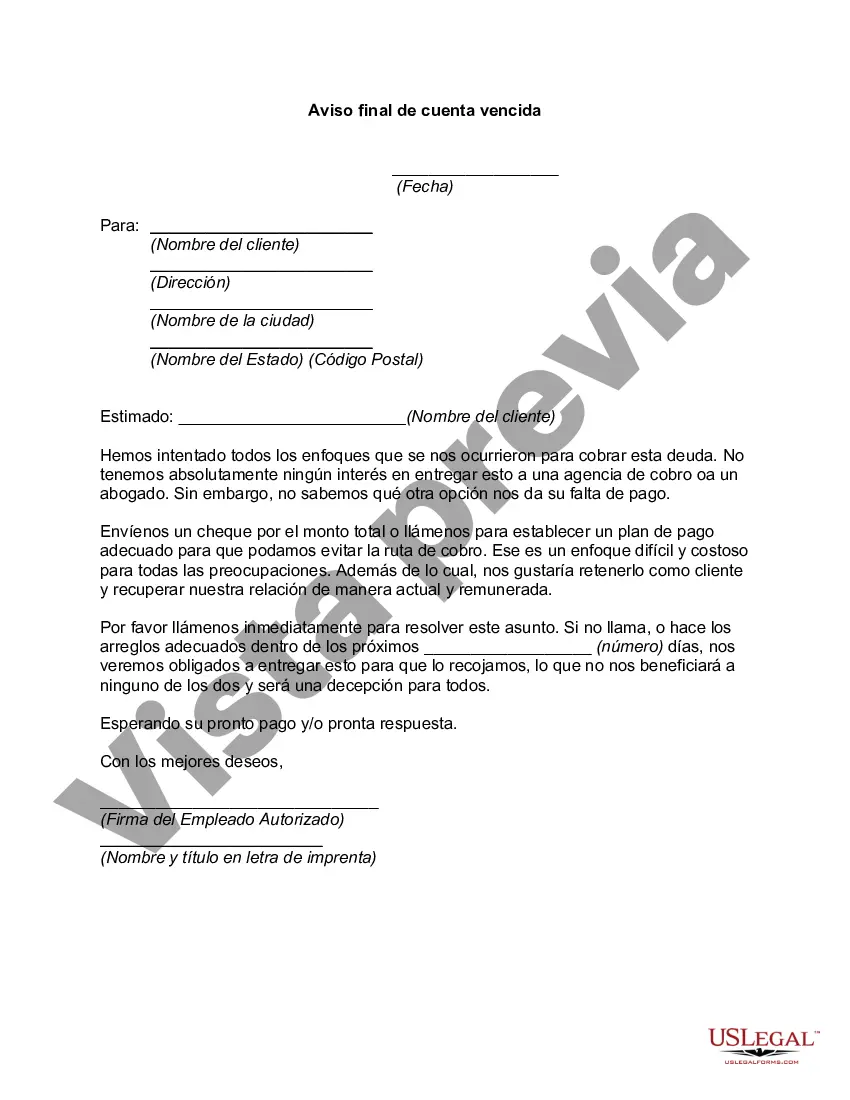

The Harris Texas Final Notice of Past Due Account is a crucial communication from the Harris Texas authorities informing individuals or businesses about their outstanding debts that have not been settled within the given time frame. This notice serves as a reminder and an urgent call for immediate action, highlighting the consequences that may arise if the outstanding balance is not paid promptly. The Harris Texas Final Notice of Past Due Account is sent to individuals or organizations who have failed to fulfill their financial obligations, such as taxes, fines, fees, or any other outstanding payments owed to the government agencies, departments, or other entities within Harris Texas. It is a legally binding document aiming to escalate the collection process and recover the unpaid debts. The key purpose of this notice is to outline the exact details of the past due account, including the amount owed, the date of the original payment deadline, and any accrued penalties or interest, leaving no room for misunderstandings. It emphasizes the importance of settling the debt promptly to avoid further penalties, such as legal actions, collections agencies involvement, or potential tax liens on assets. Different types or variations of the Harris Texas Final Notice of Past Due Account may include: 1. Harris County Texas Final Notice of Past Due Property Taxes: This particular notice is sent to property owners who have failed to pay their property taxes by the specified due date. It contains information on the outstanding amount, the assessed property, and the potential consequences of foreclosure or auction of the property. 2. Harris Texas Final Notice of Delinquent Vehicle Registration: This notice is sent to individuals who have not renewed their vehicle registration within the required period. It notifies the owner about the outstanding fees and informs them about the potential penalties, such as fines, vehicle impoundment, or suspended driving privileges if immediate action is not taken. 3. Harris Texas Final Notice of Overdue Business Taxes: This variation of the notice is directed towards businesses or self-employed individuals who have failed to pay their business taxes on time. It outlines the outstanding amount, the tax period, and the potential penalties if the debts are not settled immediately. This may include heavy fines, asset seizure, or legal actions against the business entity. In conclusion, the Harris Texas Final Notice of Past Due Account is a critical document sent by the authorities, emphasizing the urgency to settle outstanding debts and avoid significant repercussions. It is crucial for recipients to review the notice thoroughly, understand the implications of non-payment, and take immediate action to resolve their past due accounts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Aviso final de cuenta vencida - Final Notice of Past Due Account

Description

How to fill out Harris Texas Aviso Final De Cuenta Vencida?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Harris Final Notice of Past Due Account, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Harris Final Notice of Past Due Account from the My Forms tab.

For new users, it's necessary to make several more steps to get the Harris Final Notice of Past Due Account:

- Take a look at the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!