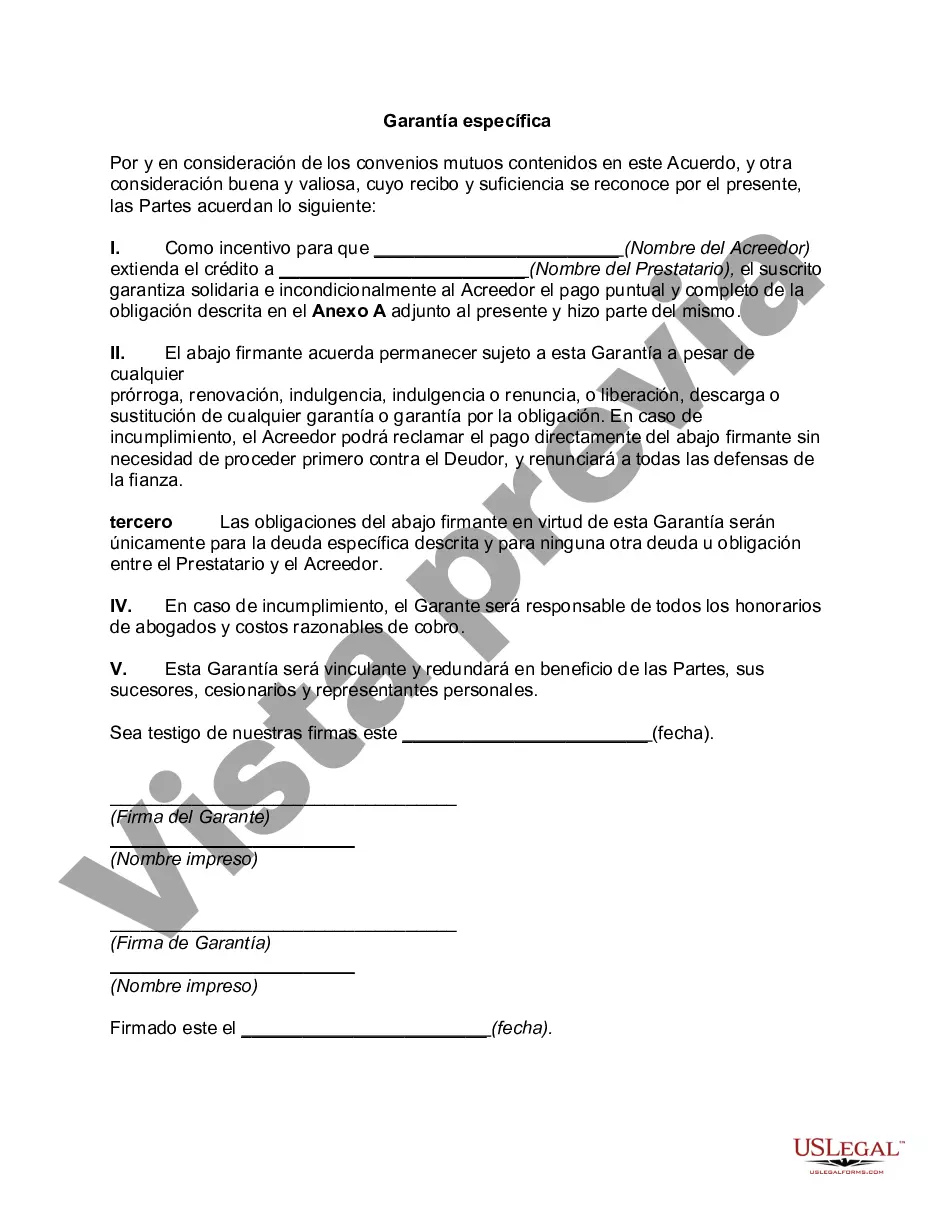

Tarrant Texas Specific Guaranty is a legal instrument used in the state of Texas to enforce financial obligations and secure future payments. It serves as a form of assurance provided by a guarantor or third party, ensuring that the obligations of the primary borrower or debtor are fulfilled. This particular type of guarantee is tailored to the Tarrant County region, which encompasses a significant portion of North Texas, including the city of Fort Worth. Tarrant Texas Specific Guaranty adheres to the local regulations and laws governing guarantees, and it is often used in various financial transactions such as loans, leases, or contracts. The purpose of Tarrant Texas Specific Guaranty is to mitigate the risk for lenders or creditors by having a secondary party take on the responsibility of repayment in case the primary borrower defaults. It provides an additional layer of security and confidence for lenders, allowing them to enter into agreements that might otherwise carry higher risks. Within Tarrant Texas, there are a few notable types of Specific Guaranty, including: 1. Commercial Guaranty: This type of guaranty is commonly used in commercial transactions, such as loans for business expansion, purchasing equipment, or leasing commercial properties. It ensures that the guarantor will be liable for the debt or obligations of the borrower in case of default. 2. Residential Guaranty: Specifically designed for residential real estate transactions, the Residential Guaranty applies to mortgages, home loans, or rental agreements. It safeguards the lender's interest and holds the guarantor accountable in case the homeowner or tenant fails to meet their financial obligations. 3. Construction Guaranty: Construction projects often involve large sums of money and significant financial risks. A Construction Guaranty ensures that the guarantor will cover any potential cost overruns, unpaid subcontractors, or delays in completing the project. This type of guaranty serves to protect contractors, developers, and lenders involved in the construction industry. It is essential to consult with legal professionals or experienced guaranty specialists when drafting or entering into Tarrant Texas Specific Guaranty agreements. Understanding the specific terms, conditions, and local laws associated with these guarantees is crucial to ensure compliance and mitigate potential risks for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Garantía específica - Specific Guaranty

Description

How to fill out Tarrant Texas Garantía Específica?

Whether you intend to open your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Tarrant Specific Guaranty is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Tarrant Specific Guaranty. Follow the guide below:

- Make sure the sample meets your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Tarrant Specific Guaranty in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!