Bexar Texas Charitable Gift Annuity is a financial tool offered by charitable organizations in Bexar County, Texas, that allows individuals to make a charitable donation while also receiving fixed income payments for life. This type of annuity serves as a win-win situation, offering both philanthropic support and financial security to the donor. A Bexar Texas Charitable Gift Annuity involves an agreement between the donor and the charitable organization, where the donor transfers assets such as cash, stocks, or real estate to the organization. In return, the organization guarantees a fixed income stream to the donor for the rest of their life, and sometimes even to a surviving spouse or other beneficiaries. The income payments are typically made on a regular basis, such as monthly, quarterly, or annually. One of the key benefits of a Bexar Texas Charitable Gift Annuity is that it provides donors with a reliable income source, especially in retirement. The fixed payments offer stability and can supplement other sources of income, such as pensions or Social Security benefits. Furthermore, the income from the annuity is often partially tax-free, as a portion of the payments may be considered a return of principal rather than taxable income. Moreover, Bexar Texas Charitable Gift Annuities have the added advantage of providing donors with substantial tax benefits. Upon making the initial donation, the donor can typically claim an income tax deduction for the charitable contribution. Additionally, if the donor contributes appreciated assets like stocks or real estate, they can potentially avoid capital gains taxes on the appreciation. Different types of Bexar Texas Charitable Gift Annuities may include single-life annuities, where only the donor receives income payments, and joint-life annuities, which provide income for the donor and their spouse or another beneficiary. The annuity rates and payment amounts may vary based on factors such as the donor's age, the chosen payout period, and the current interest rate environment. In summary, Bexar Texas Charitable Gift Annuities offer a unique opportunity for individuals to support charitable causes while enjoying financial benefits during their lifetimes. These annuities provide a reliable income stream, tax advantages, and the satisfaction of making a meaningful contribution to the Bexar County community.

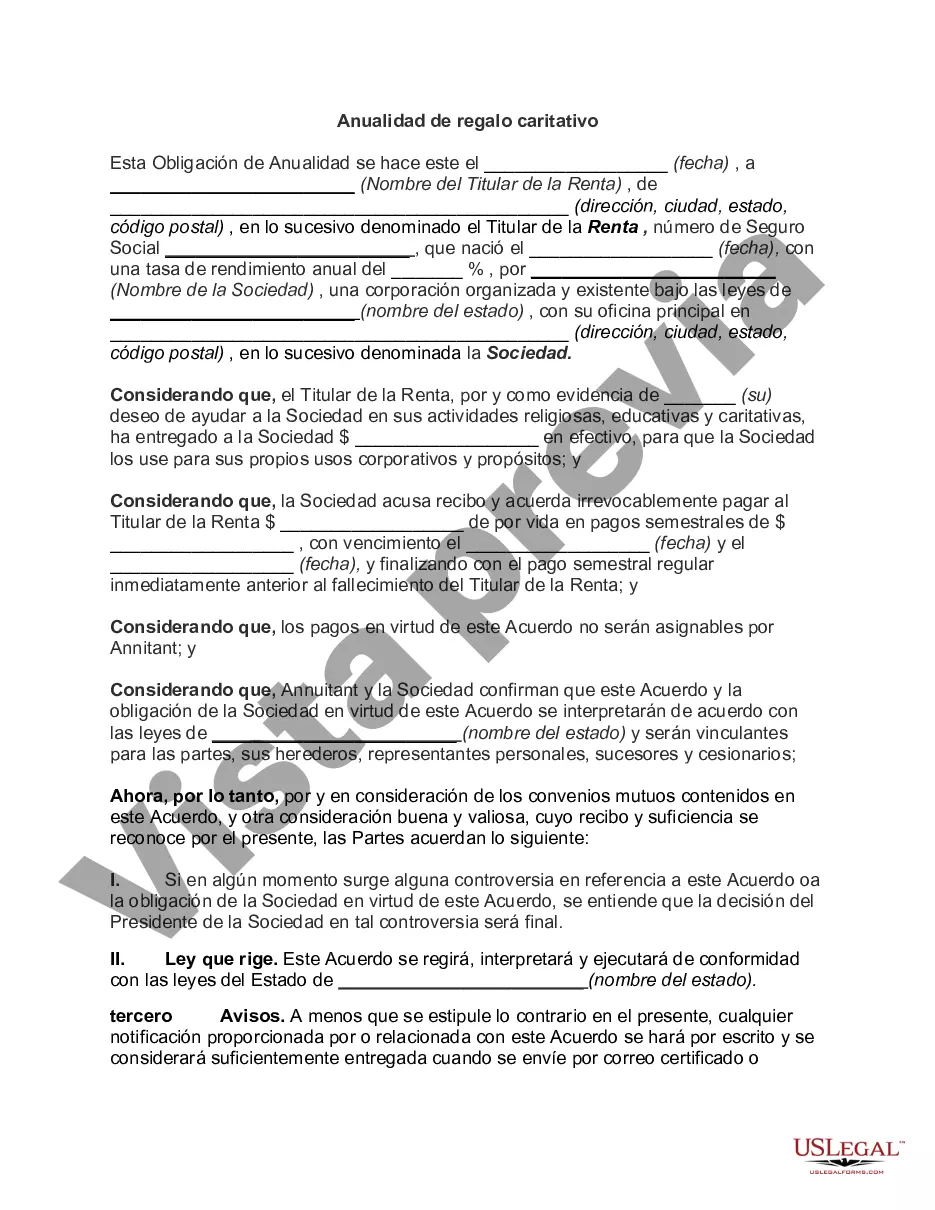

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Bexar Texas Anualidad De Regalo Caritativo?

If you need to find a trustworthy legal paperwork provider to find the Bexar Charitable Gift Annuity, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning resources, and dedicated support make it easy to locate and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply select to look for or browse Bexar Charitable Gift Annuity, either by a keyword or by the state/county the form is created for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Bexar Charitable Gift Annuity template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and select a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less costly and more affordable. Create your first company, arrange your advance care planning, create a real estate agreement, or complete the Bexar Charitable Gift Annuity - all from the convenience of your home.

Sign up for US Legal Forms now!