Cook County, located in Illinois, offers an appealing charitable giving option known as the Cook Illinois Charitable Gift Annuity (CGA). This philanthropic tool allows individuals to make a generous gift to a non-profit organization while receiving ongoing fixed payments for the remainder of their lives. Let us dive into the details and explore the various types of Cook Illinois Charitable Gift Annuities available. A Cook Illinois Charitable Gift Annuity is an agreement between a donor and a charitable organization, commonly referred to as the annuity issuer. The donor transfers cash or appreciated assets, such as stocks or real estate, to the issuer. In return, the issuer promises to pay the donor a fixed income stream for life, which is usually based on the donor's age at the time of the gift. This annuity arrangement offers several benefits for both the donor and the chosen charity. Firstly, donors can experience the joy of giving back to their community by supporting causes that align with their values and passions. Secondly, the donor receives a secure and predictable income stream, which can be especially beneficial for those looking for stable retirement income or wishing to diversify their investment portfolio. It is important to note that there are different types of Cook Illinois Charitable Gift Annuities, allowing individuals to select the one that best suits their financial and philanthropic goals. These options typically include: 1. Single-Life Gift Annuity: This annuity provides a steady income for the donor's lifetime. It is ideal for individuals who do not have a dependent or wish to make a gift solely in their name. 2. Two-Life/ Joint Gift Annuity: As the name suggests, this annuity covers two individuals, typically spouses. Payments continue until the second individual passes away, ensuring financial security for both beneficiaries. 3. Deferred Charitable Gift Annuity: With this type, donors make a gift now but delay the start of the annuity payments until a later date. By deferring the payments, donors may receive a higher income stream in the future while enjoying a current charitable tax deduction. To determine the specific benefits and individual circumstances of each type of Cook Illinois Charitable Gift Annuity, potential donors are encouraged to consult with financial advisors or representatives from the charitable organization they wish to support. In conclusion, Cook Illinois Charitable Gift Annuities offer a unique philanthropic opportunity for individuals looking to support their community while securing a stable income stream for themselves or their loved ones. The different types of annuities available allow for flexibility and customization to meet the needs and preferences of donors. By considering a Cook Illinois Charitable Gift Annuity, individuals can leave a lasting impact on the causes they hold dear while enjoying the financial benefits associated with this charitable giving vehicle.

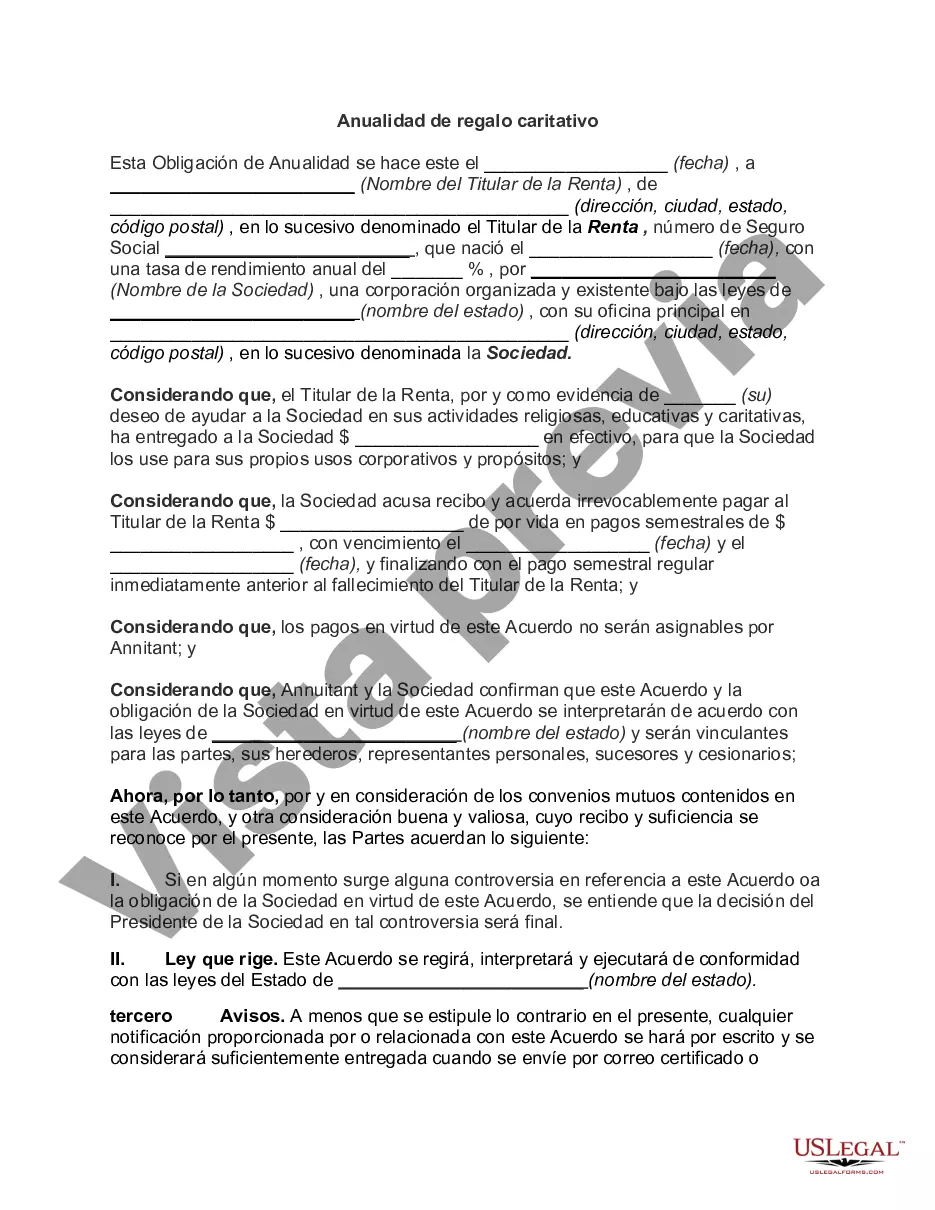

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Cook Illinois Anualidad De Regalo Caritativo?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Cook Charitable Gift Annuity meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. In addition to the Cook Charitable Gift Annuity, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Cook Charitable Gift Annuity:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Cook Charitable Gift Annuity.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!