Franklin Ohio Charitable Gift Annuity is a philanthropic financial tool that allows individuals to make a generous donation to a charitable organization while ensuring a lifetime income stream for themselves or a loved one. By making a charitable gift annuity, the donor can support a cause close to their heart while enjoying tax benefits and a reliable source of income. A charitable gift annuity involves transferring assets, typically cash or securities, to a charitable organization based in Franklin, Ohio, in exchange for a fixed income for life. The fixed income payments are determined by factors such as the donor's age, the value of the donated assets, and prevailing interest rates. This provides donors with the advantage of receiving a predictable income and the potential for higher returns compared to other low-risk investments. Charitable gift annuities offered by organizations in Franklin, Ohio, typically fall into two categories: 1. Immediate Payment Gift Annuity: This type of gift annuity provides immediate income payments to the donor for life, starting right after the initial donation is made. This is an ideal option for individuals seeking immediate income to supplement their retirement or meet other financial needs while supporting charitable causes. 2. Deferred Payment Gift Annuity: With a deferred gift annuity, the donor can delay the income payments for a specified period of time. This allows for the accumulation of higher income payments in the future, which can be advantageous for individuals who have longer-term charitable goals or who wish to maximize their income during retirement. Franklin, Ohio Charitable Gift Annuity brings together the dual benefits of philanthropy and financial security. Donors have the satisfaction of making a positive impact on their community while enjoying a dependable income stream. Additionally, donors may also benefit from significant tax advantages, including an income tax deduction for a portion of the donated assets, potential capital gains tax savings, and potential estate tax benefits. To explore the options and potential benefits of a Franklin Ohio Charitable Gift Annuity, individuals are encouraged to consult with a financial advisor or contact reputable charitable organizations in Franklin, Ohio that offer this service. By considering this charitable giving option, individuals can leave a lasting legacy while fulfilling their financial and philanthropic objectives.

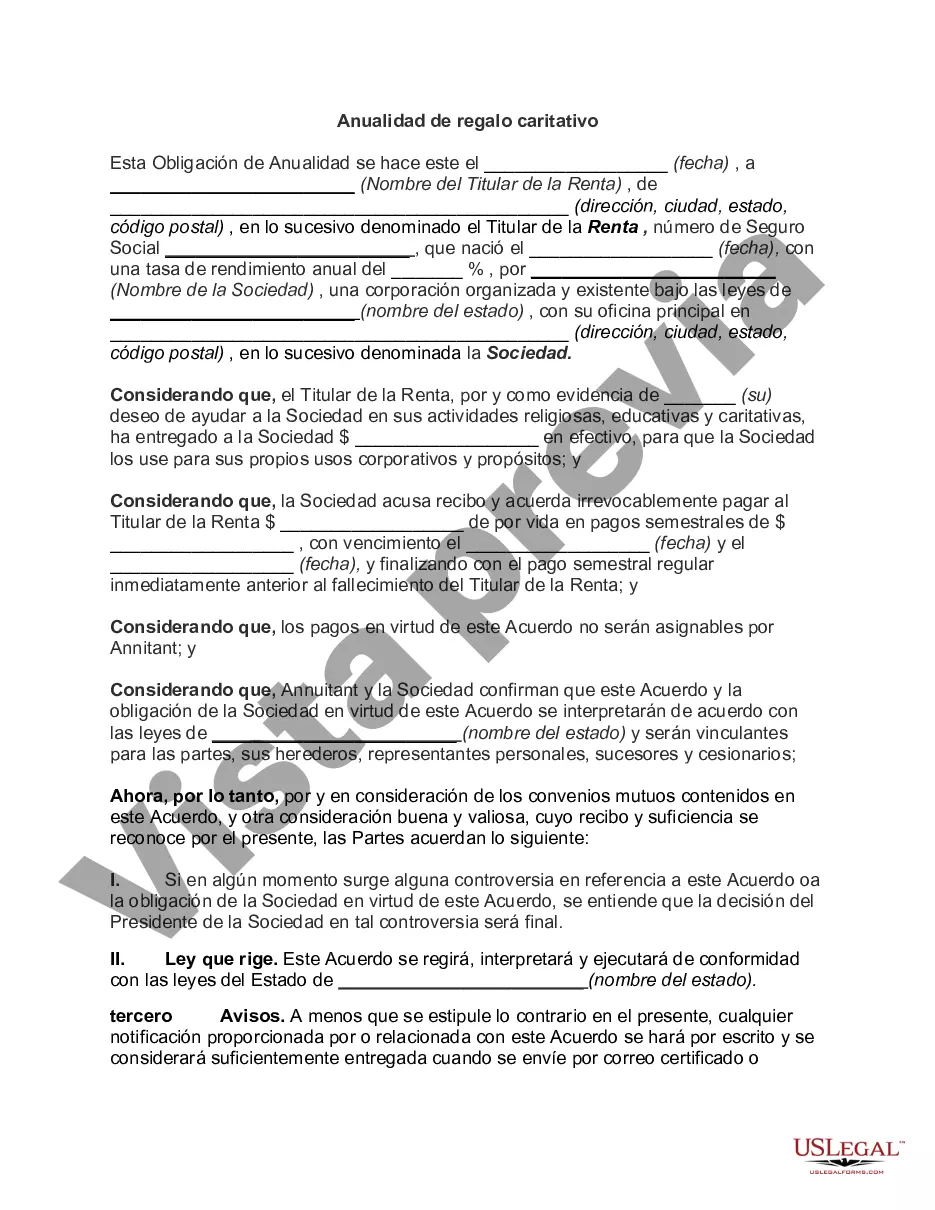

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Franklin Ohio Anualidad De Regalo Caritativo?

Creating paperwork, like Franklin Charitable Gift Annuity, to manage your legal matters is a difficult and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can take your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms created for a variety of scenarios and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Franklin Charitable Gift Annuity template. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly easy! Here’s what you need to do before downloading Franklin Charitable Gift Annuity:

- Ensure that your template is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Franklin Charitable Gift Annuity isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our service and get the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is all set. You can try and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!