Harris Texas Charitable Gift Annuity is a financial tool that allows individuals to make a charitable contribution while securing a fixed income for themselves or a beneficiary. This type of annuity is popular among individuals who wish to support charities or organizations in Harris County, Texas, while also benefiting from the financial stability it offers. A Charitable Gift Annuity involves making a donation to a qualified charitable organization in exchange for a guaranteed lifetime income stream. The amount of income received is based on various factors such as the donated amount, the age of the annuitant, and prevailing interest rates. The annuity payments can be structured to begin immediately or deferred to a future date. One of the key benefits of a Harris Texas Charitable Gift Annuity is the tax advantages it offers. Donors can enjoy an immediate income tax deduction for the charitable gift portion of their contribution and potentially reduce their estate taxes. Additionally, a portion of the annuity payments may be tax-free, depending on the donated amount and the age of the annuitant. There are no specific types of Harris Texas Charitable Gift Annuities. However, the annuity terms and conditions can vary depending on the charitable organization and the donor's preferences. Some organizations offer flexible options, such as joint-life annuities, which provide income for multiple beneficiaries. Others may provide the option to establish a charitable remainder trust, allowing the donor to name additional beneficiaries who will receive income after the donor's lifetime. Individuals considering a Harris Texas Charitable Gift Annuity should consult with their financial advisor and the specific charitable organization to understand the terms, benefits, and requirements. It is important to choose a reputable and well-established organization that aligns with the donor's philanthropic goals. By exploring this annuity option, residents of Harris County, Texas, can make a lasting impact on their community while enjoying financial security.

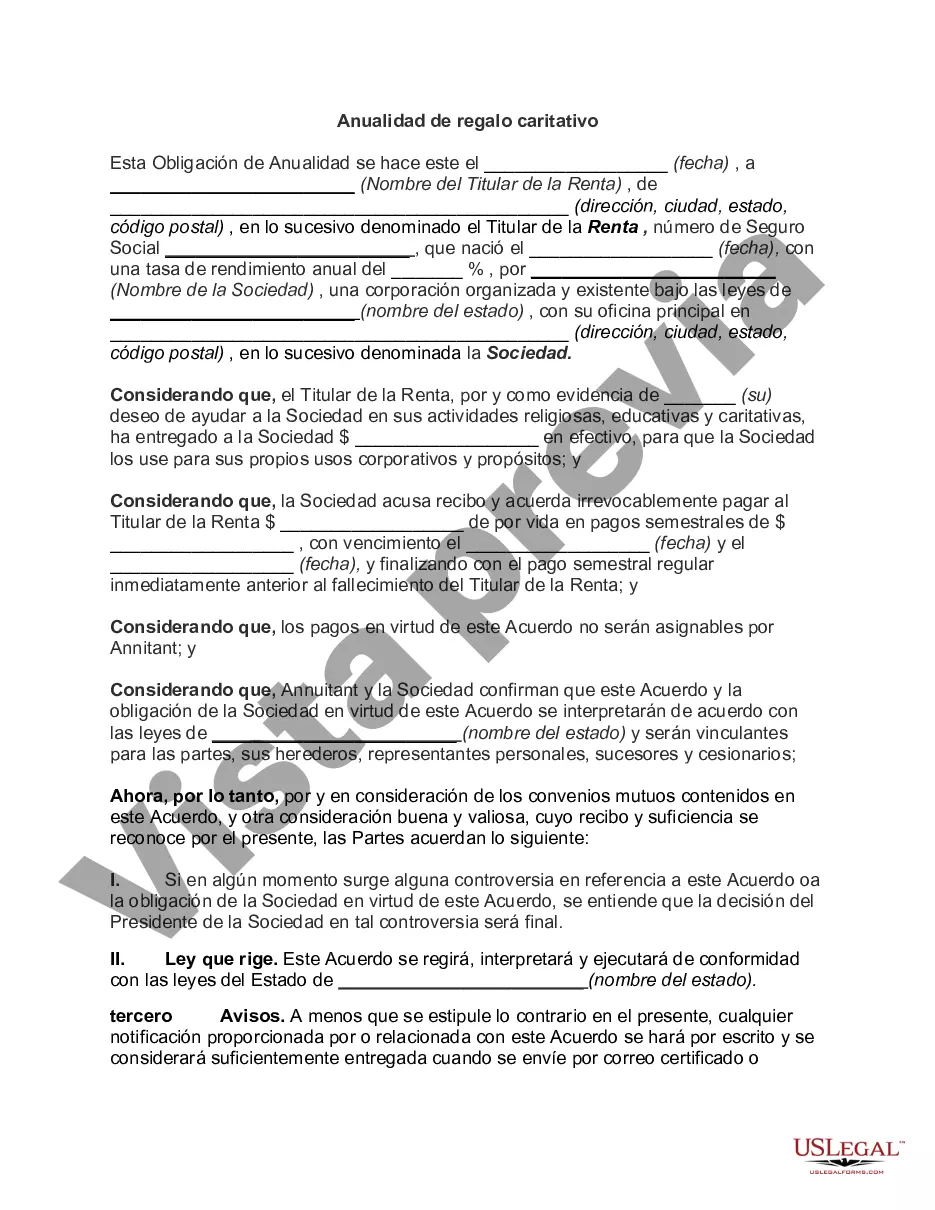

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Harris Texas Anualidad De Regalo Caritativo?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a Harris Charitable Gift Annuity suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Aside from the Harris Charitable Gift Annuity, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Harris Charitable Gift Annuity:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Harris Charitable Gift Annuity.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!