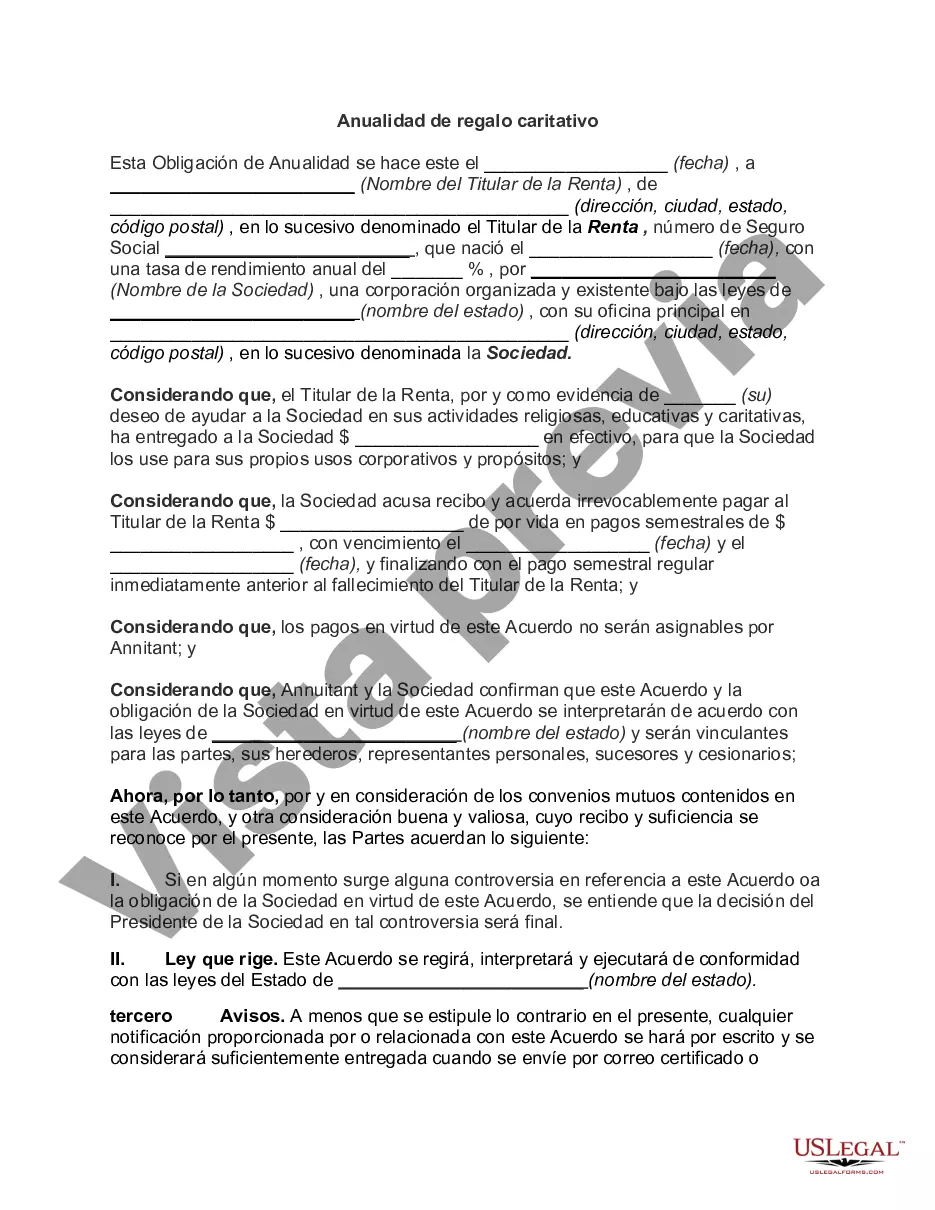

A King's New York Charitable Gift Annuity is a financial tool that allows individuals to make a charitable gift while also receiving fixed payments for life. It provides a way for individuals to support a favorite charitable cause, such as a nonprofit organization or educational institution, while enjoying financial benefits in return. Keywords: King's New York, charitable gift annuity, financial tool, individuals, charitable gift, fixed payments, life, support, nonprofit organization, educational institution, financial benefits There are two types of King's New York Charitable Gift Annuities: 1. Deferred Charitable Gift Annuity: This type of annuity allows individuals to plan for their future by deferring the start of annuity payments until a later date. By making a charitable gift now, individuals can benefit from immediate tax deductions while still ensuring a steady stream of income in the future. 2. Immediate Charitable Gift Annuity: Individuals who choose an immediate charitable gift annuity can start receiving annuity payments right away. This type of annuity is suitable for individuals who want to make an immediate impact with their charitable gift while also receiving a reliable income source. Both types of King's New York Charitable Gift Annuities offer advantages, such as tax benefits, fixed income payments, and potential reductions in estate taxes. These annuities can be tailored to meet the specific financial goals and philanthropic interests of the individual, providing a flexible and personalized giving solution. Whether an individual is looking to support a specific cause, create a lasting legacy, or benefit from fixed income payments, a King's New York Charitable Gift Annuity offers a unique opportunity to make a difference while enjoying financial security. By partnering with King's New York, individuals can ensure that their charitable giving aligns with their values and helps to create a positive impact in their community and beyond.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Kings New York Anualidad De Regalo Caritativo?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the Kings Charitable Gift Annuity.

Locating forms on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Kings Charitable Gift Annuity will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the Kings Charitable Gift Annuity:

- Ensure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Kings Charitable Gift Annuity on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!