A Miami-Dade Florida Charitable Gift Annuity is a type of charitable giving arrangement that allows individuals to make a significant contribution to a charitable organization while receiving regular fixed payments for life. This philanthropic option provides individuals with the opportunity to support causes close to their hearts, while also benefiting from potential tax advantages and secure income. There are two primary types of Miami-Dade Florida Charitable Gift Annuities: immediate and deferred. 1. Immediate Charitable Gift Annuity: With an immediate gift annuity, contributors make a lump sum donation to a charitable organization or foundation. In return, the donor receives guaranteed fixed payments for life, which are partially tax-free. The exact amount of these payments is determined by factors such as the donor's age, the donation amount, and the prevailing interest rates. 2. Deferred Charitable Gift Annuity: Unlike the immediate annuity, a deferred gift annuity provides contributors with the option to delay the commencement of annuity payments until a future date. This can be particularly advantageous for individuals who want to generate future income for retirement. By establishing a deferred gift annuity, donors can accumulate tax-deferred savings while enjoying a charitable tax deduction in the year of the donation. Once the payout period begins, the annuitant will receive fixed payments for life. Miami-Dade Florida Charitable Gift Annuities offer several benefits to donors. Firstly, individuals can support their favorite charitable organizations and have a lasting impact on the community. Secondly, donors may experience significant tax advantages including an immediate income tax charitable deduction, avoidance of capital gains tax (for appreciated assets), and potential estate tax savings. Additionally, contributors can secure fixed payments for life, providing financial stability and peace of mind. It is important to consult with financial advisors or legal professionals in Miami-Dade Florida to ensure that the charitable gift annuity aligns with personal financial goals, tax situation, and compliance with local regulations. Through careful planning and consideration, a Miami-Dade Florida Charitable Gift Annuity can be an effective way to give back to the community while obtaining financial benefits.

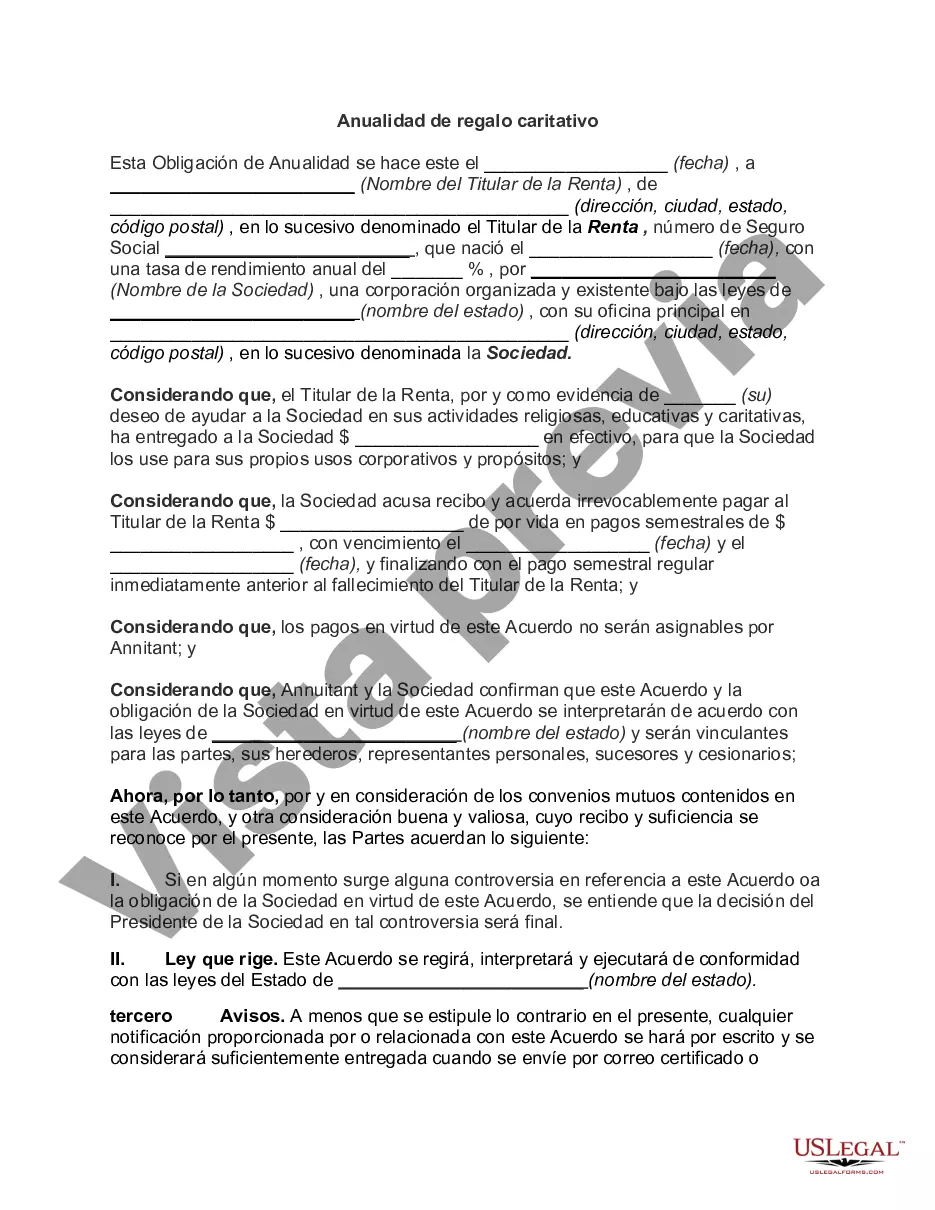

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Anualidad de regalo caritativo - Charitable Gift Annuity

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-1340742BG

Format:

Word

Instant download

Description

A charitable gift annuity is a gift vehicle that falls in the category of planned giving. It involves a contract between a donor and a charity, whereby the donor transfers cash or property to the charity in exchange for a partial tax deduction and a lifetime stream of annual income from the charity.

A Miami-Dade Florida Charitable Gift Annuity is a type of charitable giving arrangement that allows individuals to make a significant contribution to a charitable organization while receiving regular fixed payments for life. This philanthropic option provides individuals with the opportunity to support causes close to their hearts, while also benefiting from potential tax advantages and secure income. There are two primary types of Miami-Dade Florida Charitable Gift Annuities: immediate and deferred. 1. Immediate Charitable Gift Annuity: With an immediate gift annuity, contributors make a lump sum donation to a charitable organization or foundation. In return, the donor receives guaranteed fixed payments for life, which are partially tax-free. The exact amount of these payments is determined by factors such as the donor's age, the donation amount, and the prevailing interest rates. 2. Deferred Charitable Gift Annuity: Unlike the immediate annuity, a deferred gift annuity provides contributors with the option to delay the commencement of annuity payments until a future date. This can be particularly advantageous for individuals who want to generate future income for retirement. By establishing a deferred gift annuity, donors can accumulate tax-deferred savings while enjoying a charitable tax deduction in the year of the donation. Once the payout period begins, the annuitant will receive fixed payments for life. Miami-Dade Florida Charitable Gift Annuities offer several benefits to donors. Firstly, individuals can support their favorite charitable organizations and have a lasting impact on the community. Secondly, donors may experience significant tax advantages including an immediate income tax charitable deduction, avoidance of capital gains tax (for appreciated assets), and potential estate tax savings. Additionally, contributors can secure fixed payments for life, providing financial stability and peace of mind. It is important to consult with financial advisors or legal professionals in Miami-Dade Florida to ensure that the charitable gift annuity aligns with personal financial goals, tax situation, and compliance with local regulations. Through careful planning and consideration, a Miami-Dade Florida Charitable Gift Annuity can be an effective way to give back to the community while obtaining financial benefits.

Free preview