Riverside California Charitable Gift Annuity is a philanthropic giving tool that allows individuals to make a significant impact on charitable organizations while enjoying financial benefits. This innovative financial arrangement involves a contract between a donor and a charitable organization, most commonly a non-profit, where the donor transfers assets to the organization in exchange for regular fixed income payments. One type of Riverside California Charitable Gift Annuity is the Immediate Gift Annuity. With this option, the donor transfers assets, such as cash or securities, to the charitable organization and immediately begins to receive fixed income payments. These payments are typically guaranteed for life and provide the donor with a steady stream of income, even in retirement. Another type is the Deferred Gift Annuity. This option allows the donor to make a charitable contribution now and defer the income payments until a later date, usually aligning with the donor's retirement. This strategy can provide individuals with a charitable deduction and potential tax advantages while ensuring future income in retirement years. The Riverside California Charitable Gift Annuity offers several advantages for donors. Firstly, it allows individuals to support causes they care about deeply, such as education, healthcare, or the environment, while receiving financial benefits in return. The fixed income payments provided by the annuity ensure a stable income source, while the donor also benefits from potential tax deductions and the personal satisfaction of making a difference in their community. Moreover, Riverside California Charitable Gift Annuities often offer attractive fixed rates of return, providing donors with greater financial security compared to other investment options in today's unpredictable market. Additionally, because these annuities are structured with a charitable organization, the remaining assets in the annuity at the donor's passing can be left as a charitable legacy, benefiting the chosen organization and its mission. By utilizing a Riverside California Charitable Gift Annuity, individuals can create a lasting impact on the community while enjoying stable lifetime income and potential tax advantages. It's crucial for donors to consult with financial advisors or experts in charitable giving to understand the specific terms, rates, and legalities associated with Riverside California Charitable Gift Annuities and how they can align with their philanthropic goals.

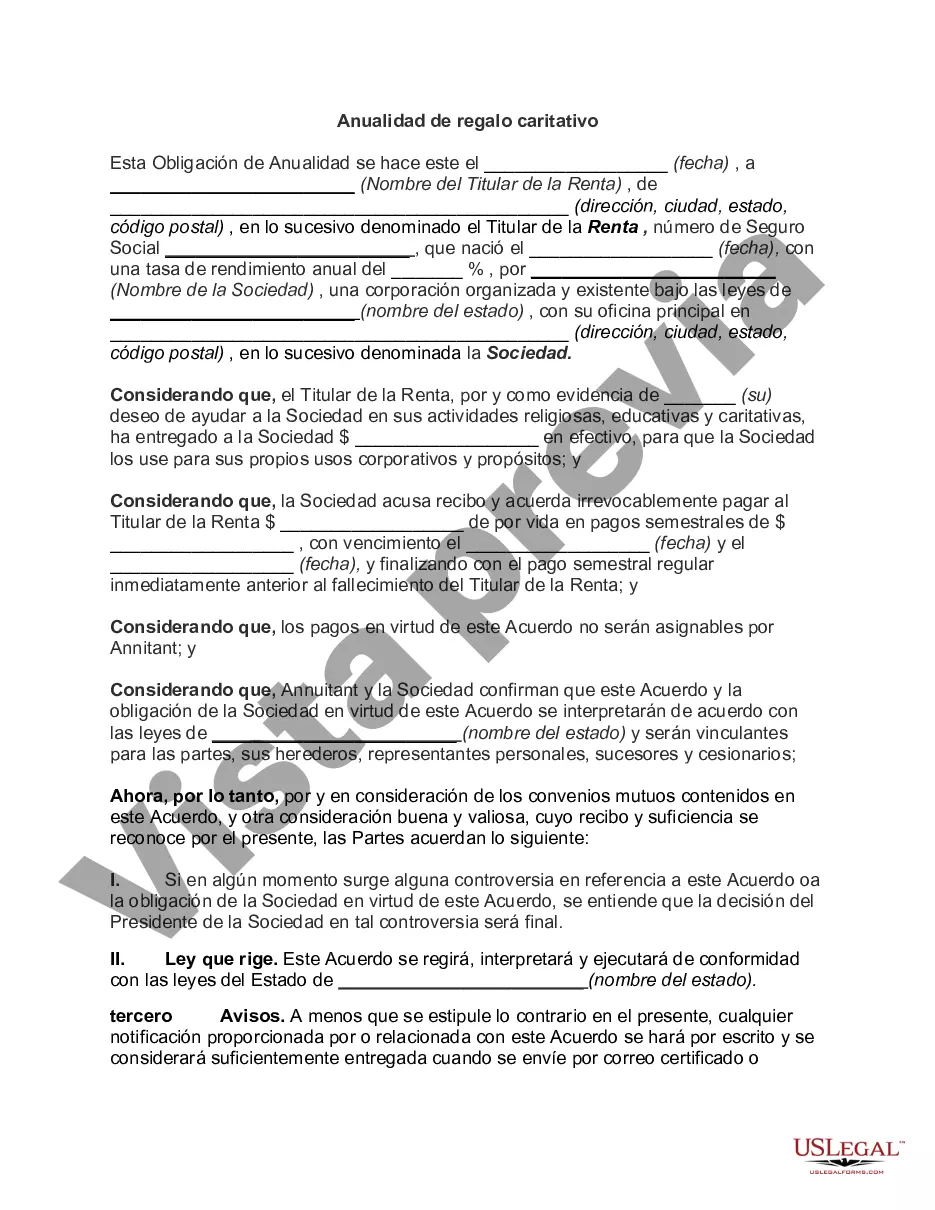

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Riverside California Anualidad De Regalo Caritativo?

If you need to find a trustworthy legal document supplier to get the Riverside Charitable Gift Annuity, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of supporting materials, and dedicated support make it easy to locate and complete various documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to search or browse Riverside Charitable Gift Annuity, either by a keyword or by the state/county the form is created for. After finding the required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Riverside Charitable Gift Annuity template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less pricey and more affordable. Set up your first company, organize your advance care planning, create a real estate contract, or execute the Riverside Charitable Gift Annuity - all from the comfort of your home.

Join US Legal Forms now!